10 Best Dividend Stocks For Reducing Risk

Image Source: Pixabay

One of the big advantages of dividend growth investing is that it reduces risk and investment mistakes by focusing solely on stocks that pay rising dividends.

Investing in quality stocks – and in particular dividend growth stocks – offers risk reduction based on the nature of the investment.

Buying a portfolio of quality dividend stocks leads to diversification. Diversification reduces risk mathematically; if you have only 5% of your portfolio in a stock, you can’t lose more than 5% in that stock.

Dividend growth stocks represent proven businesses. The longer a company’s dividend streak, the more it demonstrates its ability to generate actual cash and return it to shareholders.

This is why we recommend stocks with at least 10+ consecutive years of dividend increases, which we call ‘blue chip’ stocks.

Blue-chip stocks are established, financially strong, and consistently profitable publicly traded companies.

By focusing on quality businesses that return cash to shareholder through dividends, you can reduce mistakes and benefit from compounding dividend income over time.

The following 10 blue chip stocks have increase their dividends for at least 10 years, have Dividend Risk Scores of ‘A’ or ‘B’ in the Sure Analysis Research Database, and have current yields above 3%.

The 10 blue chip stocks are sorted by dividend yield, from lowest to highest.

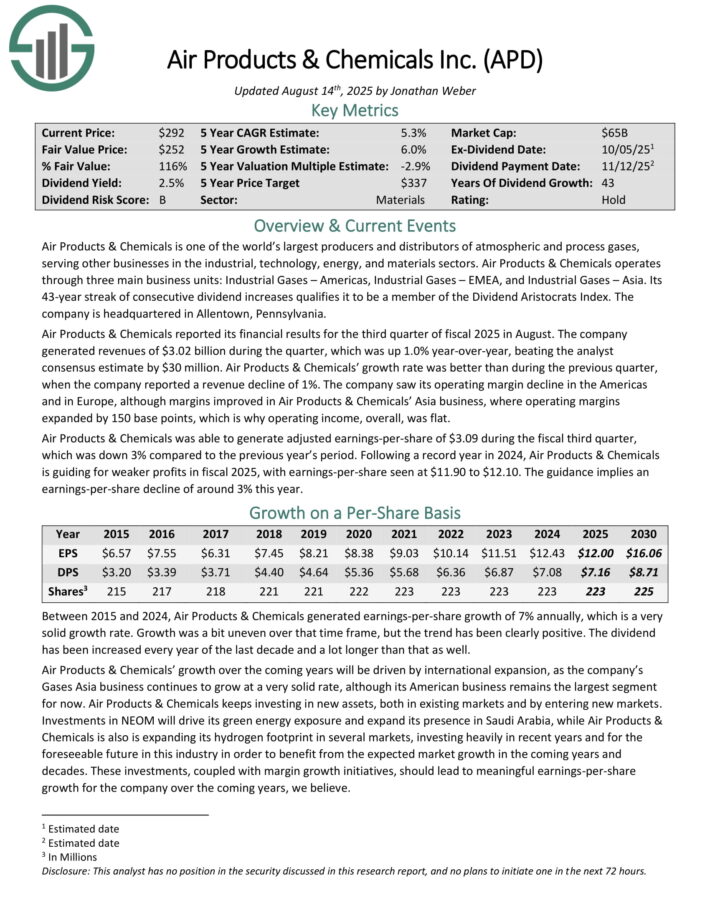

Dividend Stock To Reduce Risk: Air Products & Chemicals (APD)

- Dividend Yield: 3.0%

Air Products & Chemicals is one of the world’s largest producers and distributors of atmospheric and process gases, serving other businesses in the industrial, technology, energy, and materials sectors.

Air Products & Chemicals operates through three main business units: Industrial Gases – Americas, Industrial Gases – EMEA, and Industrial Gases – Asia.

Its 43-year streak of consecutive dividend increases qualifies it to be a member of the Dividend Aristocrats Index.

Air Products & Chemicals reported its financial results for the third quarter of fiscal 2025 in August. The company generated revenues of $3.02 billion during the quarter, which was up 1.0% year-over-year, beating the analyst consensus estimate by $30 million.

The company saw its operating margin decline in the Americas and in Europe, although margins improved in Air Products & Chemicals’ Asia business, where operating margins expanded by 150 base points, which is why operating income, overall, was flat.

Air Products & Chemicals was able to generate adjusted earnings-per-share of $3.09 during the fiscal third quarter, which was down 3% compared to the previous year’s period.

Click here to download our most recent Sure Analysis report on APD (preview of page 1 of 3 shown below):

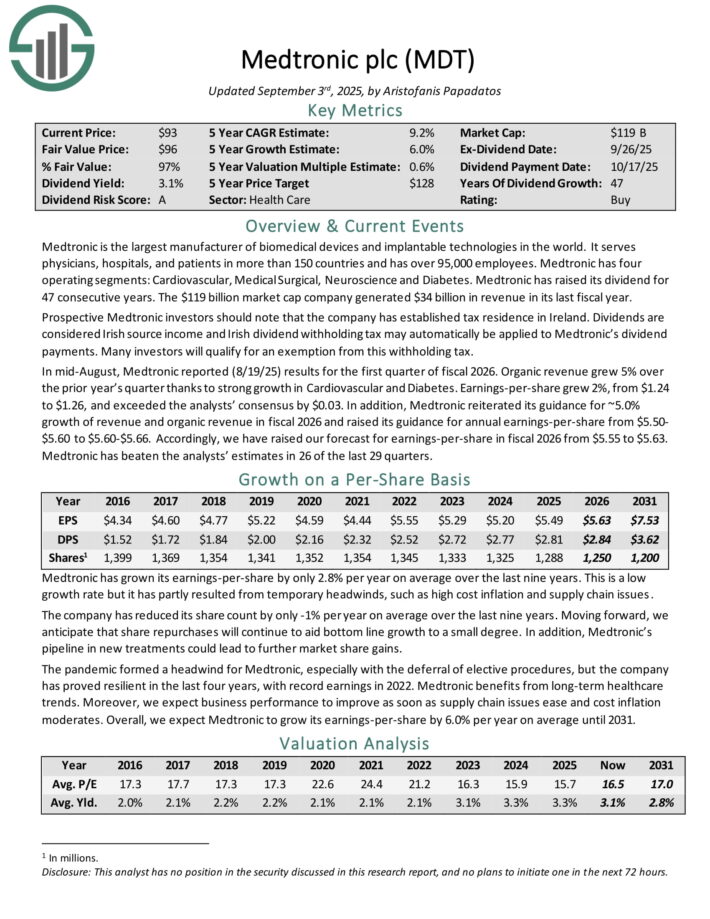

Dividend Stock To Reduce Risk: Medtronic plc (MDT)

- Dividend Yield: 3.2%

Medtronic is the largest manufacturer of biomedical devices and implantable technologies in the world. It serves physicians, hospitals, and patients in more than 150 countries and has over 95,000 employees.

Medtronic has four operating segments: Cardiovascular, Medical Surgical, Neuroscience and Diabetes. Medtronic has raised its dividend for 47 consecutive years. The company generated $34 billion in revenue in its last fiscal year.

In mid-August, Medtronic reported (8/19/25) results for the first quarter of fiscal 2026. Organic revenue grew 5% over the prior year’s quarter thanks to strong growth in Cardiovascular and Diabetes. Earnings-per-share grew 2%, from $1.24 to $1.26, and exceeded the analysts’ consensus by $0.03.

In addition, Medtronic reiterated its guidance for ~5.0% growth of revenue and organic revenue in fiscal 2026 and raised its guidance for annual earnings-per-share from $5.50-$5.60 to $5.60-$5.66.

Click here to download our most recent Sure Analysis report on MDT (preview of page 1 of 3 shown below):

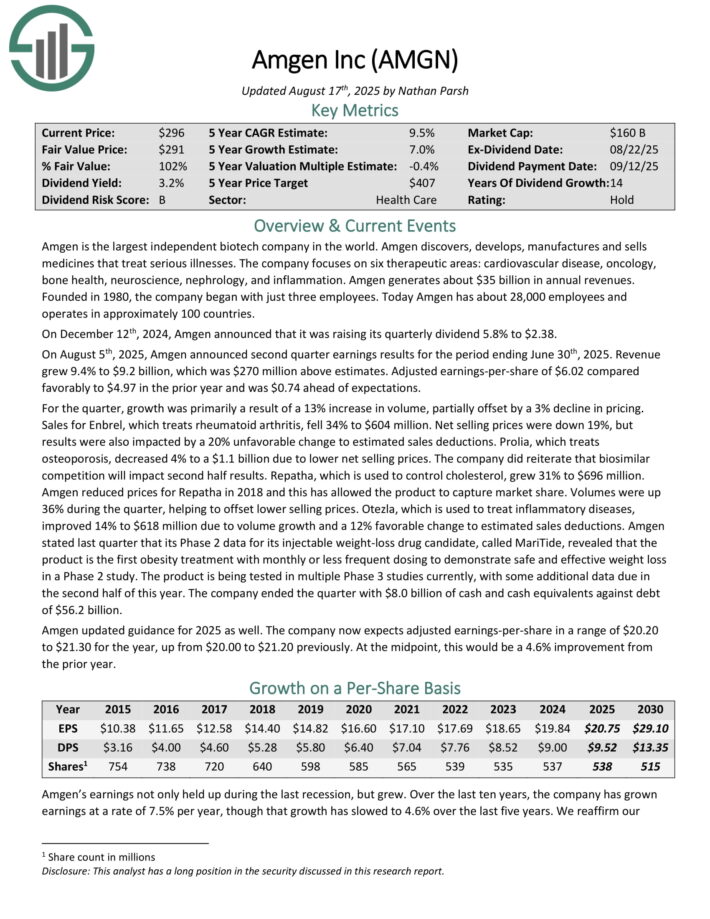

Dividend Stock To Reduce Risk: AMGEN Inc. (AMGN)

- Dividend Yield: 3.2%

Amgen is the largest independent biotech company in the world. Amgen discovers, develops, manufactures and sells medicines that treat serious illnesses. The company focuses on six therapeutic areas: cardiovascular disease, oncology, bone health, neuroscience, nephrology, and inflammation. Amgen generates about $35 billion in annual revenues.

On August 5th, 2025, Amgen announced second quarter earnings results for the period ending June 30th, 2025. Revenue grew 9.4% to $9.2 billion, which was $270 million above estimates. Adjusted earnings-per-share of $6.02 compared favorably to $4.97 in the prior year and was $0.74 ahead of expectations.

For the quarter, growth was primarily a result of a 13% increase in volume, partially offset by a 3% decline in pricing. Sales for Enbrel, which treats rheumatoid arthritis, fell 34% to $604 million. Net selling prices were down 19%, but results were also impacted by a 20% unfavorable change to estimated sales deductions.

Prolia, which treats osteoporosis, decreased 4% to a $1.1 billion due to lower net selling prices. The company did reiterate that biosimilar competition will impact second half results. Repatha, which is used to control cholesterol, grew 31% to $696 million.

Amgen stated last quarter that its Phase 2 data for its injectable weight-loss drug candidate, called MariTide, revealed that the product is the first obesity treatment with monthly or less frequent dosing to demonstrate safe and effective weight loss in a Phase 2 study.

The product is being tested in multiple Phase 3 studies currently, with some additional data due in the second half of this year. The company ended the quarter with $8.0 billion of cash and cash equivalents against debt of $56.2 billion.

Amgen updated guidance for 2025 as well. The company now expects adjusted earnings-per-share in a range of $20.20 to $21.30 for the year, up from $20.00 to $21.20 previously. At the midpoint, this would be a 4.6% improvement from the prior year.

Click here to download our most recent Sure Analysis report on AMGN (preview of page 1 of 3 shown below):

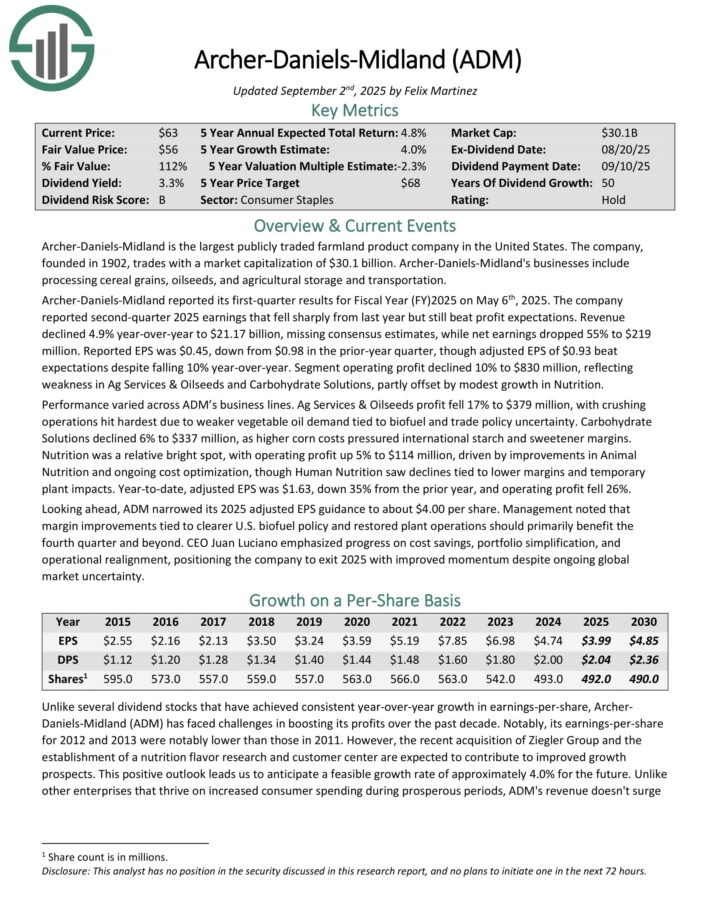

Dividend Stock To Reduce Risk: Archer Daniels Midland (ADM)

- Dividend Yield: 3.7%

Archer-Daniels-Midland is the largest publicly traded farmland product company in the United States. Its businesses include processing cereal grains, oilseeds, and agricultural storage and transportation.

Archer-Daniels-Midland reported its first-quarter results for Fiscal Year (FY)2025 on May 6th, 2025. The company reported second-quarter 2025 earnings that fell sharply from last year but still beat profit expectations. Revenue declined 4.9% year-over-year to $21.17 billion, missing consensus estimates, while net earnings dropped 55% to $219 million.

Reported EPS was $0.45, down from $0.98 in the prior-year quarter, though adjusted EPS of $0.93 beat expectations despite falling 10% year-over-year. Segment operating profit declined 10% to $830 million, reflecting weakness in Ag Services & Oilseeds and Carbohydrate Solutions, partly offset by modest growth in Nutrition.

Performance varied across ADM’s business lines. Ag Services & Oilseeds profit fell 17% to $379 million, with crushing operations hit hardest due to weaker vegetable oil demand tied to biofuel and trade policy uncertainty. Carbohydrate Solutions declined 6% to $337 million, as higher corn costs pressured international starch and sweetener margins.

Nutrition was a relative bright spot, with operating profit up 5% to $114 million, driven by improvements in Animal

Nutrition and ongoing cost optimization, though Human Nutrition saw declines tied to lower margins and temporary

plant impacts. Year-to-date, adjusted EPS was $1.63, down 35% from the prior year, and operating profit fell 26%.

Click here to download our most recent Sure Analysis report on ADM (preview of page 1 of 3 shown below):

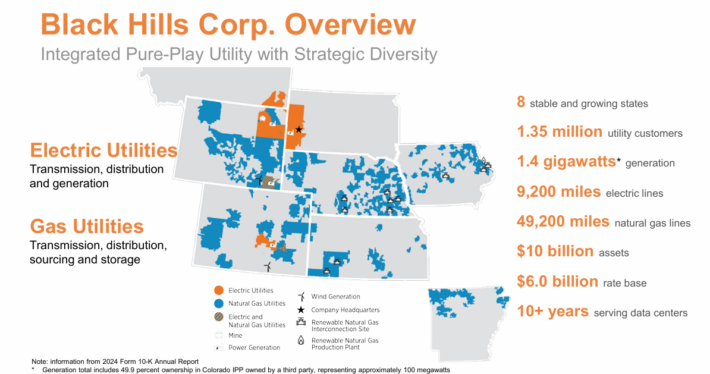

Dividend Stock To Reduce Risk: PepsiCo Inc. (PEP)

- Dividend Yield: 3.9%

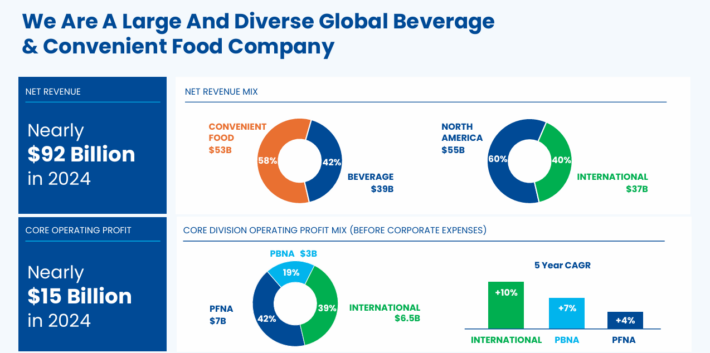

PepsiCo is a global food and beverage company. Its products include Pepsi, Mountain Dew, Frito-Lay chips, Gatorade, Tropicana orange juice and Quaker foods.

Its business is split roughly 60-40 in terms of food and beverage revenue. It is also balanced geographically between the U.S. and the rest of the world.

Source: Investor Presentation

On July 18th, 2025, PepsiCo announced second quarter earnings results for the period ending June 30th, 2025. For the quarter, revenue grew 1.0% to $22.7 billion, which topped estimates by $430 million.

Adjusted earnings-per-share of $2.12 compared unfavorably to $2.28 the prior year, but this was $0.09 ahead of expectations. Currency exchange reduced revenue by 1.5% and adjusted earnings-per-share by 5%.

Organic sales grew 2.1% for the second quarter. For the period, volume for beverages was once again unchanged while food fell 1.5%.

Click here to download our most recent Sure Analysis report on PEP (preview of page 1 of 3 shown below):

Dividend Stock To Reduce Risk: Bank OZK (OZK)

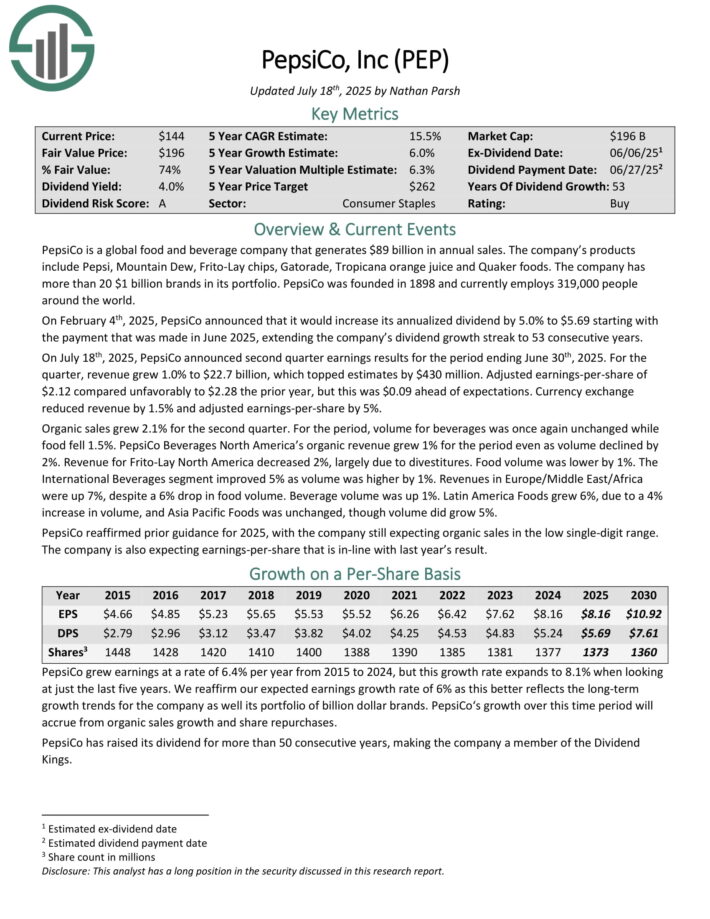

- Dividend Yield: 4.0%

Bank OZK, previously Bank of the Ozarks, is a regional bank that offers services such as checking, business banking, commercial loans and mortgages to its customers in Arkansas, Florida, North Carolina, Texas, Alabama, South Carolina, New York and California.

On October 1st, 2025, Bank OZK announced a $0.45 quarterly dividend, representing a 2.3% raise over the last quarter’s payment and a 9.8% raise year-over-year. This marks the company’s 61st consecutive quarter of raising its dividend.

In mid-October, Bank OZK reported (10/16/25) results for the third quarter of 2025. Total loans and deposits grew 10% and 1%, respectively, over the end of last year. Net interest income grew 6% over the prior year’s quarter thanks to lower deposit costs. Provisions for credit losses increased 4%.

Earnings-per-share grew 3%, from $1.55 to a new all-time high of $1.59, but missed the analysts’ consensus by $0.10. Bank OZK has exceeded the analysts’ consensus in 19 of the last 22 quarters. The bank has posted record earnings-per-share in 11 of the last 12 quarters.

Moreover, management remains confident in achieving all-time high net interest income in 2025.

Click here to download our most recent Sure Analysis report on OZK (preview of page 1 of 3 shown below):

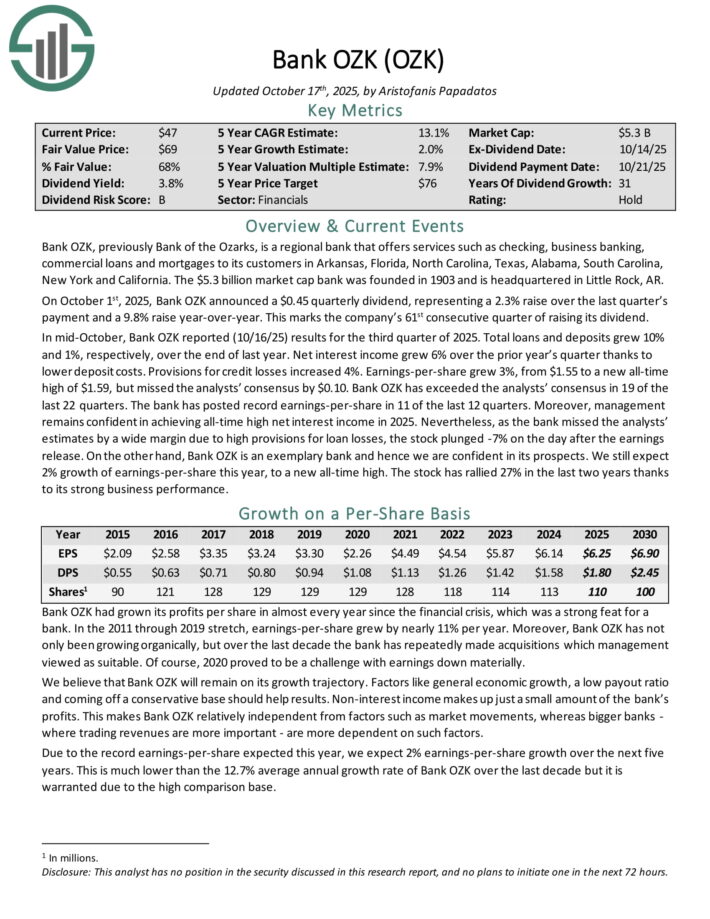

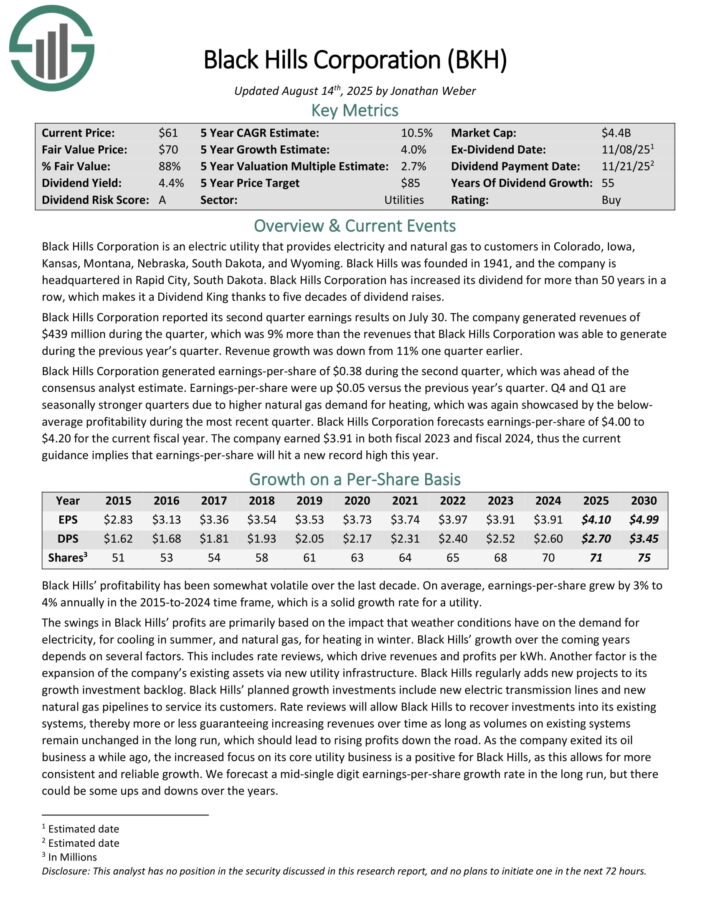

Dividend Stock To Reduce Risk: Black Hills Corporation (BKH)

- Dividend Yield: 4.2%

Black Hills Corporation is an electric utility that provides electricity and natural gas to customers in Colorado, Iowa, Kansas, Montana, Nebraska, South Dakota, and Wyoming.

The company has 1.35 million utility customers in eight states. Its natural gas assets include 49,200 miles of natural gas lines. Separately, it has ~9,200 miles of electric lines and 1.4 gigawatts of electric generation capacity.

Source: Investor Presentation

Black Hills Corporation reported its second quarter earnings results on July 30. The company generated revenues of $439 million during the quarter, up 9% year-over-year.

Black Hills Corporation generated earnings-per-share of $0.38 during the second quarter, which was ahead of the consensus analyst estimate.

Earnings-per-share were up $0.05 versus the previous year’s quarter. Q4 and Q1 are seasonally stronger quarters due to higher natural gas demand for heating.

Black Hills Corporation forecasts earnings-per-share of $4.00 to $4.20 for the current fiscal year.

Click here to download our most recent Sure Analysis report on BKH (preview of page 1 of 3 shown below):

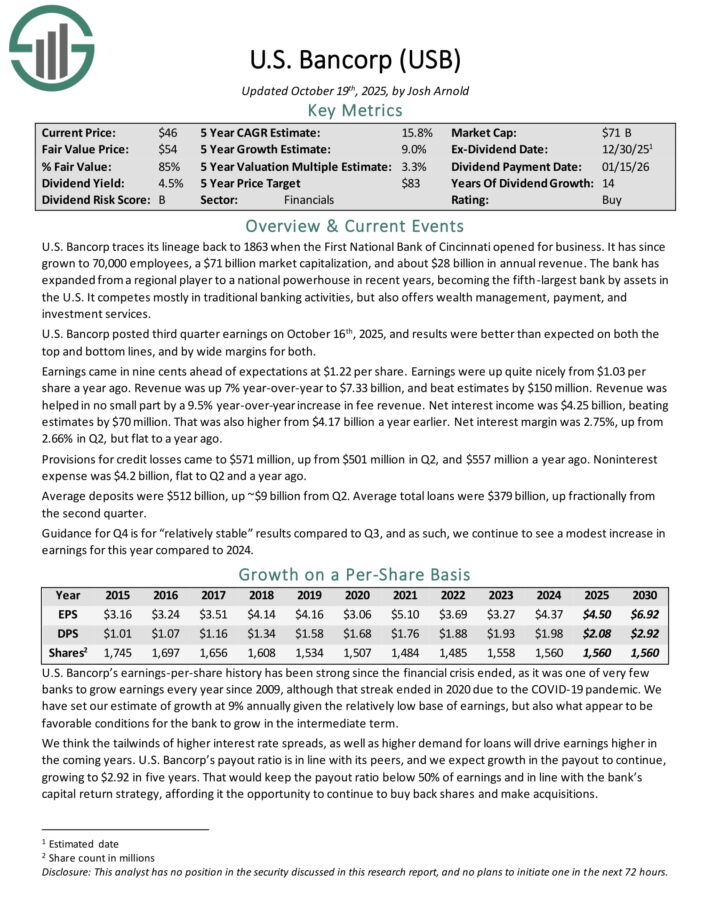

Dividend Stock To Reduce Risk: U.S. Bancorp (USB)

- Dividend Yield: 4.5%

U.S. Bancorp traces its lineage back to 1863 when the First National Bank of Cincinnati opened for business. It has since grown to 70,000 employees, and about $28 billion in annual revenue.

The bank has expanded from a regional player to a national powerhouse in recent years, becoming the fifth-largest bank by assets in the U.S. It competes mostly in traditional banking activities, but also offers wealth management, payment, and investment services.

U.S. Bancorp posted third quarter earnings on October 16th, 2025, and results were better than expected on both the top and bottom lines, and by wide margins for both.

Earnings came in nine cents ahead of expectations at $1.22 per share. Earnings were up quite nicely from $1.03 per share a year ago. Revenue was up 7% year-over-year to $7.33 billion, and beat estimates by $150 million. Revenue was helped in no small part by a 9.5% year-over-year increase in fee revenue.

Net interest income was $4.25 billion, beating estimates by $70 million. That was also higher from $4.17 billion a year earlier. Net interest margin was 2.75%, up from 2.66% in Q2, but flat to a year ago.

Provisions for credit losses came to $571 million, up from $501 million in Q2, and $557 million a year ago. Noninterest expense was $4.2 billion, flat to Q2 and a year ago.

Average deposits were $512 billion, up ~$9 billion from Q2. Average total loans were $379 billion, up fractionally from the second quarter.

Click here to download our most recent Sure Analysis report on USB (preview of page 1 of 3 shown below):

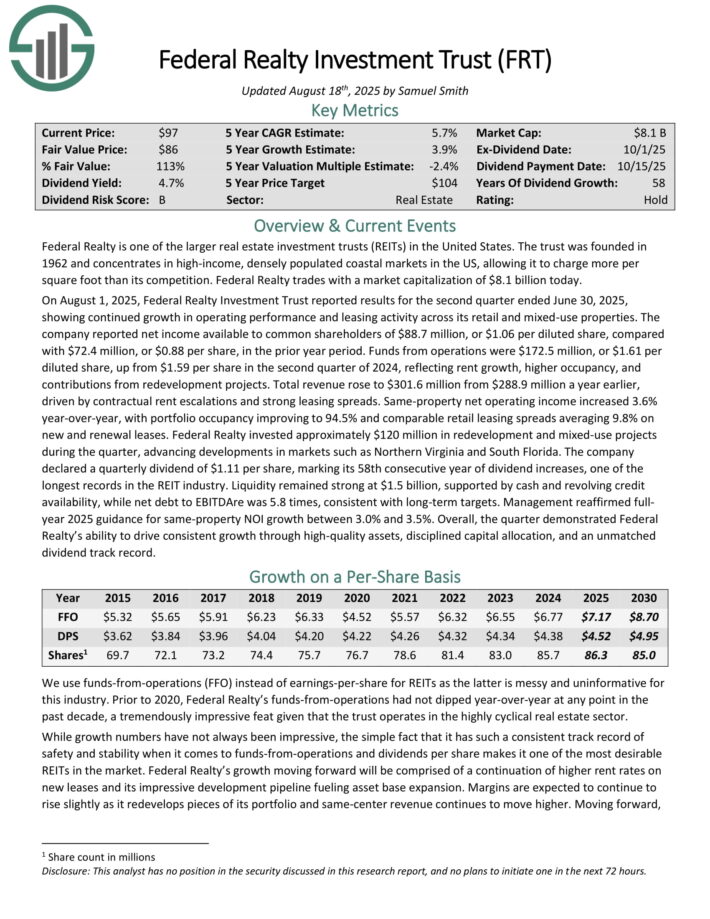

Dividend Stock To Reduce Risk: Federal Realty Investment Trust (FRT)

- Dividend Yield: 4.7%

Federal Realty was founded in 1962. As a Real Estate Investment Trust, Federal Realty’s business model is to own and rent out real estate properties.

It uses a significant portion of its rental income, as well as external financing, to acquire new properties.

On August 1, 2025, Federal Realty Investment Trust reported results for the second quarter. The company reported net income available to common shareholders of $88.7 million, or $1.06 per diluted share, compared with $72.4 million, or $0.88 per share, in the prior year period.

Funds from operations were $172.5 million, or $1.61 per diluted share, up from $1.59 per share in the second quarter of 2024, reflecting rent growth, higher occupancy, and contributions from redevelopment projects.

Total revenue rose to $301.6 million from $288.9 million a year earlier, driven by contractual rent escalations and strong leasing spreads.

Same-property net operating income increased 3.6% year-over-year, with portfolio occupancy improving to 94.5% and comparable retail leasing spreads averaging 9.8% on new and renewal leases.

Click here to download our most recent Sure Analysis report on Federal Realty (preview of page 1 of 3 shown below):

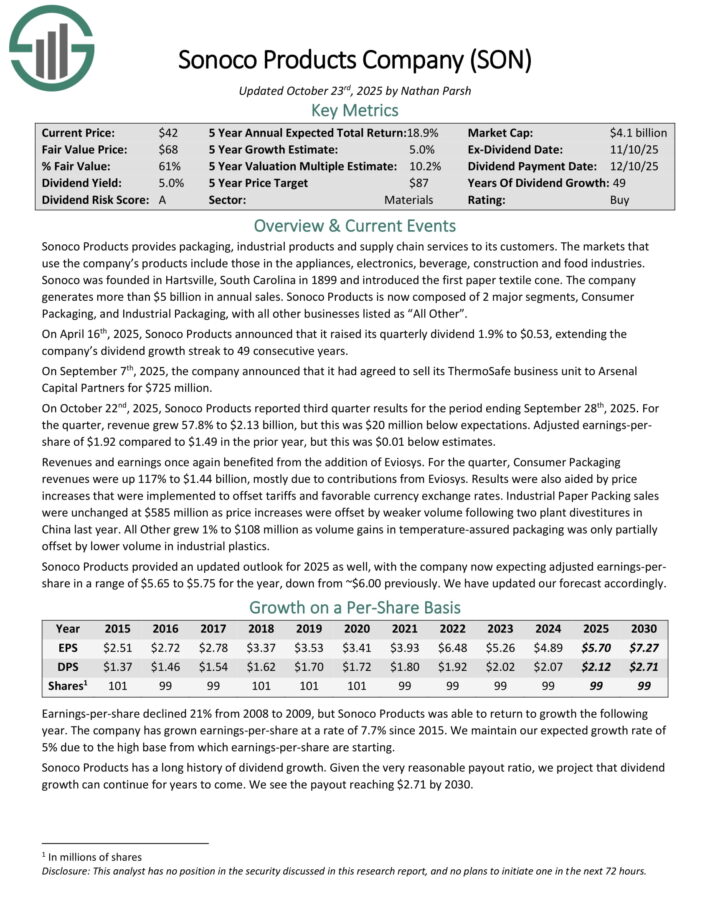

Dividend Stock To Reduce Risk: Sonoco Products (SON)

- Dividend Yield: 5.3%

Sonoco Products provides packaging, industrial products and supply chain services to its customers. The markets that use the company’s products include those in the appliances, electronics, beverage, construction and food industries.

The company generates more than $5 billion in annual sales. Sonoco Products is now composed of 2 major segments, Consumer Packaging, and Industrial Packaging, with all other businesses listed as “All Other”.

On October 22nd, 2025, Sonoco Products reported third quarter results for the period ending September 28th, 2025. For the quarter, revenue grew 57.8% to $2.13 billion, but this was $20 million below expectations. Adjusted earnings-per-share of $1.92 compared to $1.49 in the prior year, but this was $0.01 below estimates.

Revenues and earnings once again benefited from the addition of Eviosys. For the quarter, Consumer Packaging revenues were up 117% to $1.44 billion, mostly due to contributions from Eviosys. Results were also aided by price increases that were implemented to offset tariffs and favorable currency exchange rates.

Industrial Paper Packing sales were unchanged at $585 million as price increases were offset by weaker volume following two plant divestitures in China last year. All Other grew 1% to $108 million as volume gains in temperature-assured packaging was only partially offset by lower volume in industrial plastics.

Sonoco Products provided an updated outlook for 2025 as well, with the company now expecting adjusted earnings-per-share in a range of $5.65 to $5.75 for the year, down from ~$6.00 previously.

Click here to download our most recent Sure Analysis report on SON (preview of page 1 of 3 shown below):

More By This Author:

High Dividend 50: Cardinal Energy

3 Stocks Yielding Over 3% To Help Reduce Portfolio Risk

High Dividend 50: Hess Midstream LP

Disclaimer: SureDividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more