1-800-Flowers In Full Bloom

1-800-FLOWERS.COM, Inc. (FLWS) is a leading e-commerce provider of floral products and gifts, in terms of number of customers and revenue. With the development of the company's online business and a strategic acquisition, they have continuously expanded their product offerings, most recently to include gourmet foods and home and garden merchandise. As a result, the company has developed relationships with customers who purchase products not only for gifting occasions but also for everyday consumption.

1-800-Flowers is currently leading our newsletter portfolios with a big gain of 41% for our Small Cap Stock Strategy subscribers. The stock has been on quite a tear recently, and it isn't all due to the Valentine's Day rush. The company has expanded in recent years via good acquisitions such as last year's --cash--purchase of Harry and David and strategic relationships with big shippers for their diverse line of gifts. In addition, the company is not bound by phone numbers anymore, and they garner a lot of orders from the various mobile apps they have developed. These innovations helped the company book revenues of @ $750 billion in 2014.

The stock's recent climb has been fueled by some huge earnings gains. Earlier this month, the company reported total net revenues of $534.3 million for its fiscal 2015 second quarter compared with revenues of $266.3 million in the prior year period. Notably, earnings were up across all three of the company's business segments and were not just a result of the Harry and David acquisition.

Company CEO Jim McCann noted that "during the fiscal second quarter, [FLWS] more than doubled our revenues and tripled our bottom line results year-over-year." He went on to note that these stunning results occurred despite a fire at the company's Cleveland-area warehouse facility and distribution center. Guidance from the company calls for a 2015 with total net revenues in excess of $1.1 billion.

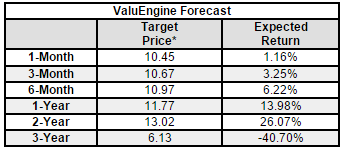

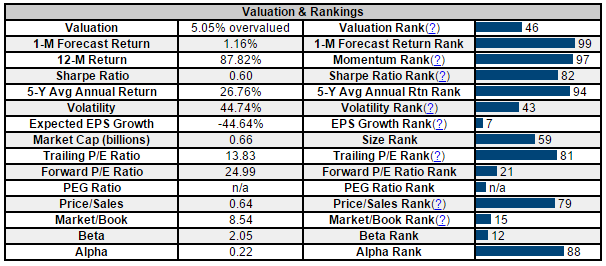

RECOMMENDATION: ValuEngine continues its STRONG BUY recommendation on 1800FLOWERS.COM for 2015-02-13. Based on the information we have gathered and our resulting research, we feel that 1800FLOWERS.COM has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Momentum and Sharpe Ratio.

Below is today's data on FLWS:

Disclosure: None

Hopefully they don't continue their horrible Valentine's day trend. Company can't seem to handle it's biggest day of the year.