Stocks & Bond Yields Surge On "Resumption Of Trade-Talks", Silver Slammed

Trade-Talks are on again... on like Donkey Kong if markets are to be believed.

So to explain what happened today, the following chart should help (trade accordingly):

(Click on image to enlarge)

Which brings to mind...

Chinese stocks opened dramatically higher but faded into the close of the afternoon session...

(Click on image to enlarge)

Source: Bloomberg

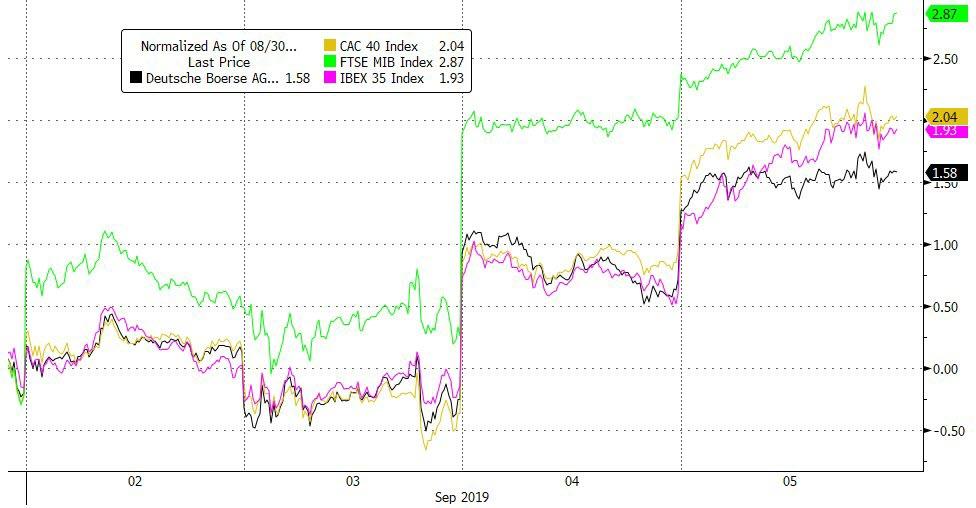

European stocks soared also, led by Germany (trade hopes) on the day...

(Click on image to enlarge)

Source: Bloomberg

German 30Y Yields broke back above 0.00% for the first time in over a month...

(Click on image to enlarge)

Source: Bloomberg

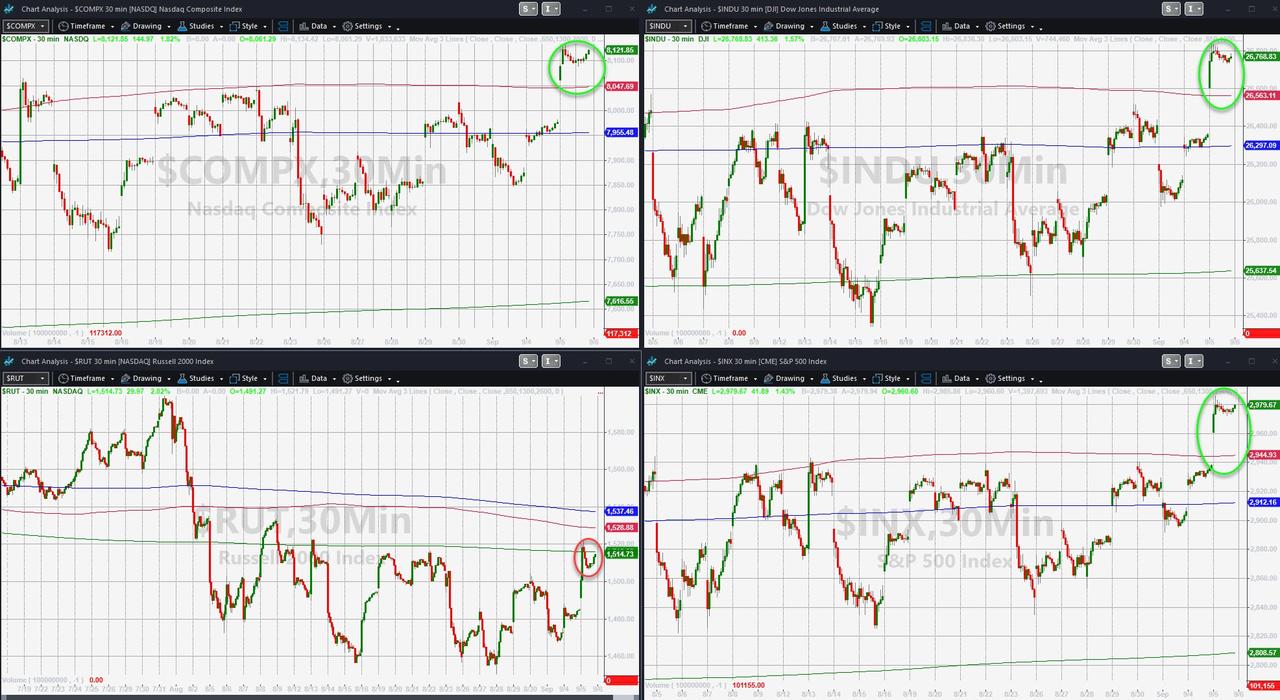

US equity markets were all higher on the day, smashing above Trump tariff tantrum levels...

(Click on image to enlarge)

And as futures show, the bulk of the gains overnight...

(Click on image to enlarge)

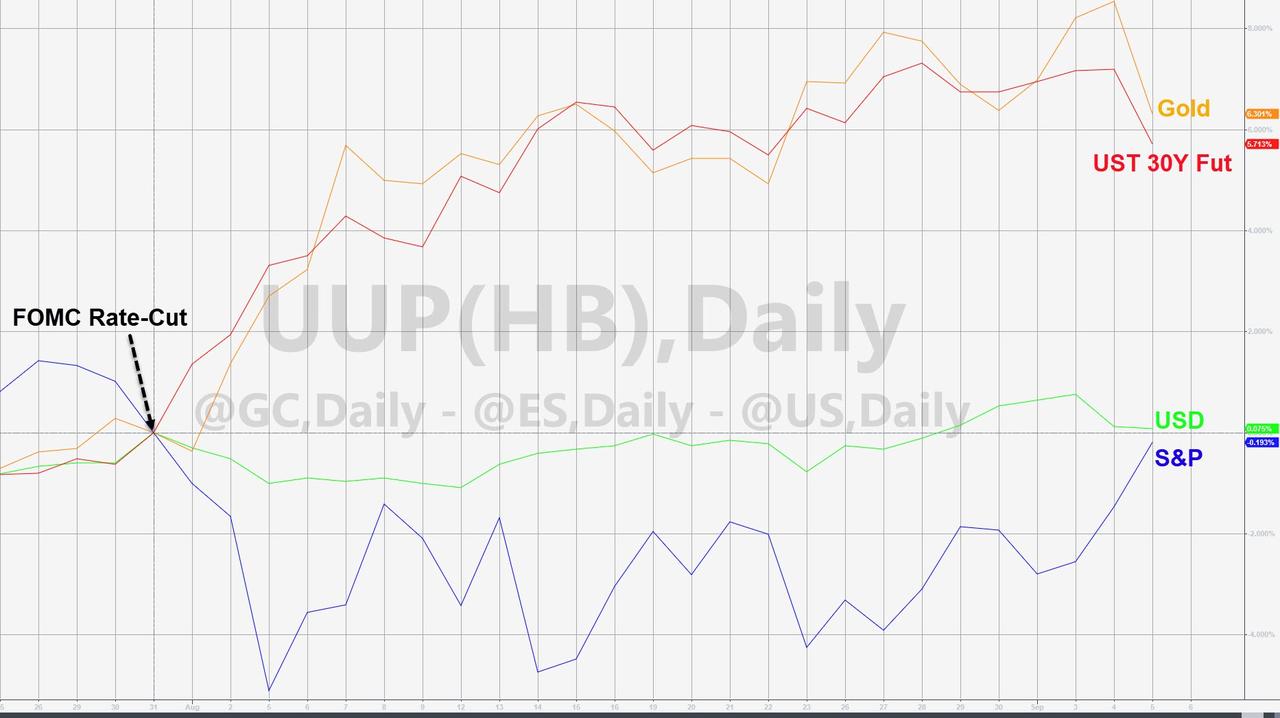

Notably, today's buying extravaganza lifted the S&P back to unchanged since The Fed cut rates in July...

(Click on image to enlarge)

All the majors crossed above key technical levels today (Russell 2000tagged its 200DMA but was unable to hold above it)

(Click on image to enlarge)

Cyclicals dominated as the odds of a China trade deal surged...

(Click on image to enlarge)

Source: Bloomberg

Shorts were dramatically squeezed yet again...

(Click on image to enlarge)

Source: Bloomberg

And then there was Slack which crashed over 10% after cutting guidance but was panic-bid back to unchanged after the open...

(Click on image to enlarge)

Bonds don't seem to be buying it though...

(Click on image to enlarge)

Source: Bloomberg

Treasury yields surged today with the long-end modestly outperforming (30Y +8bps, 2Y +11bps)...

(Click on image to enlarge)

Source: Bloomberg

NOTE - between a record-high $74 billion calendar (rate-locks), Fed POMO bid disappearing due to "technical difficulties", trade-deal hopes, and the better-than-expected ISM services data (despite everything else being weaker)

Today was among the biggest absolute spikes in 10Y (above 1.50%) and 30Y (above 2.00%) Yields since the election in 2016...

(Click on image to enlarge)

Source: Bloomberg

NOTE - after the initial spike, yields rallied back lower.

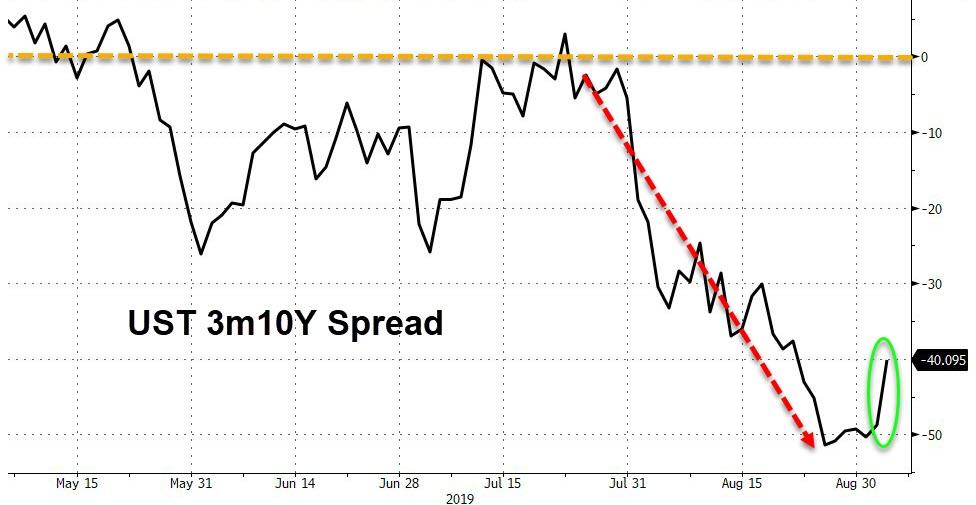

The yield curve steepened on the day but 3m10Y remains deeply inverted...

(Click on image to enlarge)

Source: Bloomberg

The dollar ended the day lower, but roundtripped off overnight lows...

(Click on image to enlarge)

Source: Bloomberg

Yuan is higher overnight but well off the highs, notably divergent from US stocks...

(Click on image to enlarge)

Source: Bloomberg

Cryptos were mixed with Altcoins fading but Bitcoin stable...

(Click on image to enlarge)

Source: Bloomberg

Commodities were mixed with copper best, crude pumped-n-dumped, and PMs weak after the PMI data...

(Click on image to enlarge)

Source: Bloomberg

Gold was hit on very heavy volume...

(Click on image to enlarge)

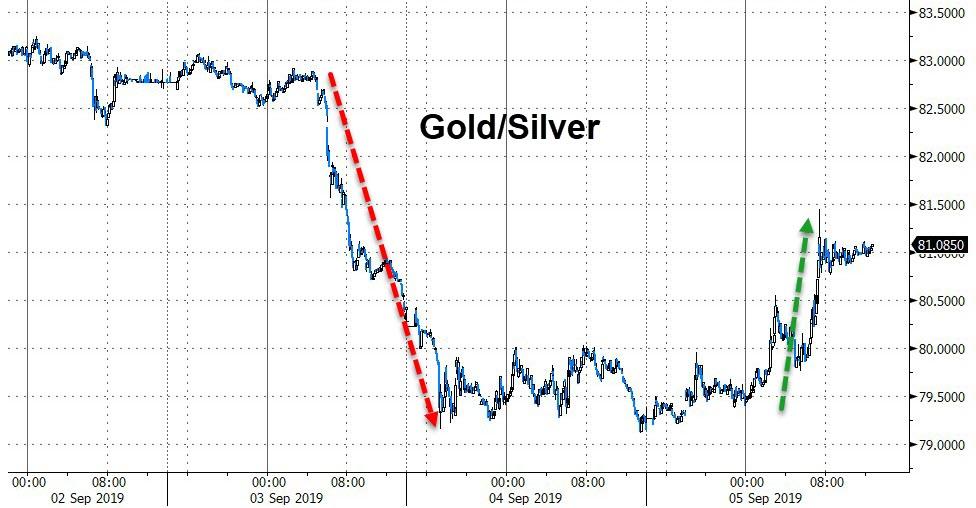

But silver was worse...

(Click on image to enlarge)

Sending Gold/Silver higher for a change...

(Click on image to enlarge)

Source: Bloomberg

Oil pumped and dumped today after inventory data spiked it up to 5-week highs briefly...

(Click on image to enlarge)

Finally, we should note that while the market has pushed for more and more easing in recent weeks, since The Fed first cut, the macro-economic data has beaten (admittedly low) expectations dramatically...

(Click on image to enlarge)

Source: Bloomberg

Disclosure: Copyright ©2009-2019 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more

Crazy manipulated market in spite of little chance for success in trade talks.

Yes, I have to say you are correct.