Stock Exchange: Who Moved My Cheese?

The Stock Exchange is all about trading. Each week we do the following:

- discuss an important issue for traders;

- highlight several technical trading methods, including current ideas;

- feature advice from top traders and writers; and

- provide a few (minority) reactions from fundamental analysts.

We also have some fun. We welcome comments, links, and ideas to help us improve this resource for traders. If you have some ideas, please join in!

Review: Near-Term Momentum Versus Long-Term Fundamentals

Our previous Stock Exchange asked the question: How do long-term fundamentals impact your near-term trading thesis? As an example, we compared the near-term technical strength of monthly dividend REIT, Realty Income (O) to its long-term fundamental valuation. When they’re aligned, that’s one thing, but when they’re opposed that’s something entirely different.

This Week: Who Moved My Cheese?

As you may recall, Who Moved My Cheese was a popular business fable published in 1998 that remained on the New York Times business best seller list for almost 5 years. It was basically a parable about how to thrive in a world of change an uncertainty, as told through a tale of two mice (Sniff and Scurry) and two humans (Hem and Haw) living in a maze and constantly searching for cheese. And there’s an important takeaway for traders to learn, mainly that instead of constantly hemming and hawing about how the market is supposed to behave, successful traders can offer sniff and scurry their way into learning new things and adapting to find success in a constantly changing marketplace.

For example, trading psychologist, Dr. Brett Steenbarger, does an excellent job (as usual) describing The Perils of Trading Your Plan where he writes:

“We commonly hear the advice that traders should “stick to their plans” and that planning and remaining true to plans is the epitome of discipline and the key to success. It ain’t necessarily so.”

Our own trading models (which we’ll get into more later in this report) are regularly reacting to current information (at least weekly, and often daily). And we have recently made a small but important ‘tweak’ in our Athena trading model. Specifically, the market exit will now be based upon conditions affecting the specific underlying logic of this model. This replaces a groupwide criterion (Holmes already had this feature. Now, all of the models will). Also, this week Athena now has the green light for full investment positions. We expect the other models to join Athena and Holmes very soon.

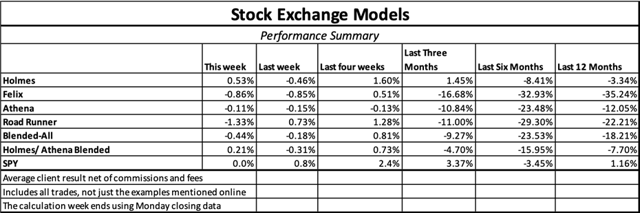

Model Performance:

We are sharing the performance of our proprietary trading models, as our readers have requested.

Controlling Risk:

We find that blending a trend-following / momentum model (Athena) with a mean reversion / dip-buying model (Holmes) provides two strategies, effective in their own right, that are not correlated with each other or with the overall market. By combining the two, we can get more diversity, lower risk, and a smoother string of returns.

Since many clients combine the trading models with our long-term fundamental methods, they have additional diversity of methods without the need for short-term timing.

For more information about our trading models (and their specific trading processes), click through at the bottom of this post for more information. Also, readers are invited to write to main at newarc dot com for our free, brief description of how we created the Stock Exchange models.

Expert Picks From The Models:

Note: This week’s Stock Exchange report is being moderated by Blue Harbinger, a source for independent investment ideas.

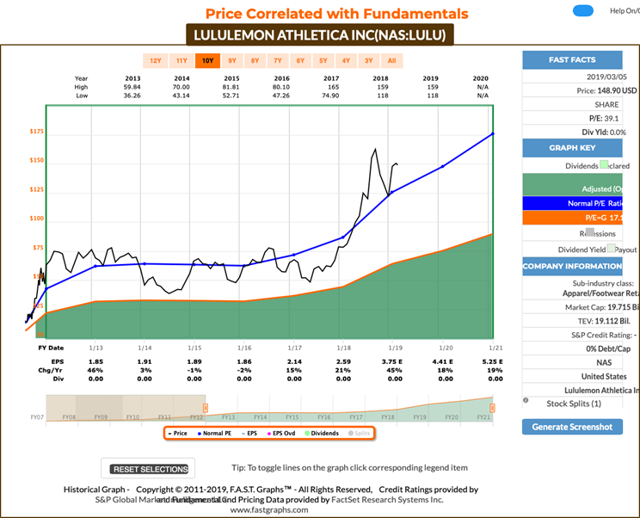

Holmes: I bought shares of Lululemon Athletica (LULU) this week on March 4th.

Blue Harbinger: Into yoga pants, Holmes? You know that’s what the sell, among other things, right?

Holmes: I know that’s what they sell, but that’s not why I bought. I bought because I am a contrarian dip-buyer. I typically hold my positions for about 6 weeks.

BH: Well apparently they’ve been selling a lot of yoga pants because revenue keeps rising, and the company keeps beating earnings expectations. Here is a look at some fundamentals in the Fast Graph.

Holmes: I am into technical data, and shorter-term price movements, not yoga pants. I am a technical trading model, not a human.

BH: Suit yourself, Holmes. How about you, Athena–any trades this week?

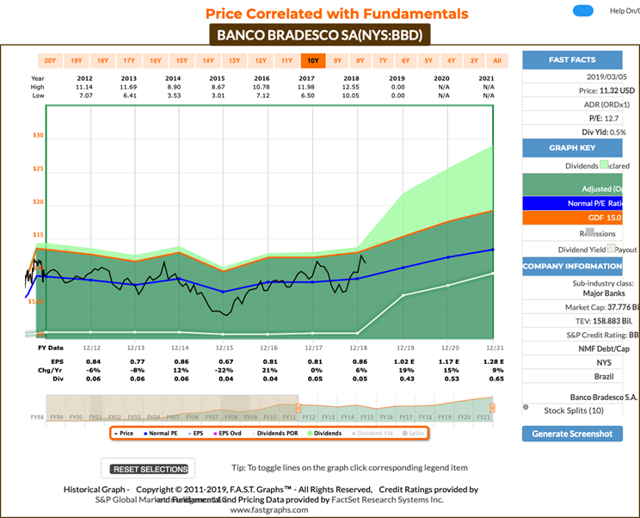

Athena: I bought shares of Bank Bradesco (BBC) this week.

BH: I see you’re into Brazil, considering that bank is based there. Are you still bullish on that economy following the election of new president, Jair Bolsonaro? He seems to be a bit more pro-capitalism than his predecessor. And by the way, based on your chart (above), you look more like a 6-week dip-buyer than Holmes.

Athena: I am a best ideas “queen of the mountain” trading strategy. I hold the best ideas from several of our trading models, until something better comes along and replaces an existing holding. I often end up holding for around 17-week, but that can vary. Also, Jeff recently made a small but important tweak to my parameters whereby I have my own independent trade exit rules–you know, I get the “who moved my cheese” thing.

BH: Oh really, Athena–you’re open to change? How about ditching the technical analysis, and considering some of the long-term fundamental data in the following Fast Graph.

Athena:Honestly, I already do take some fundamental data into consideration, but probably not in the way you think.

Felix:I am a momentum-based technical trading model, and this week I ran the stocks of the Dow through my model, and I’ve ranked the top 20 below.

BH: Thanks for sharing those rankings. I know your holding period is a lot longer than the other traders–typically around a 66 weeks.

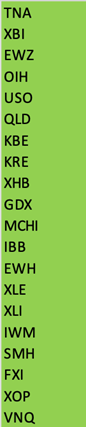

Oscar: I have some ETF rankings to share. As our resident sector/ETF rotation model, this week I ran our “High Liquidity ETFs with price-volume multiple over 100 million per day” through my model, and the top 20 are ranked in the following list.

Conclusion:

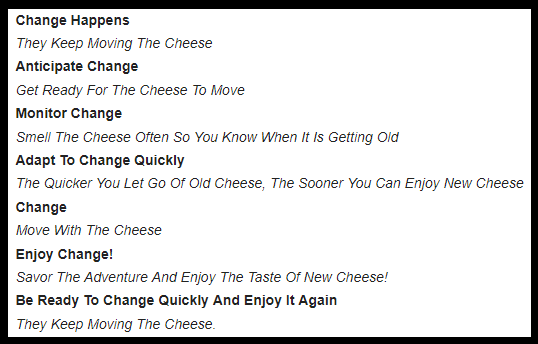

Do you stubbornly stick to your trading process instead of prudently adjusting to market dynamics? Market conditions change. For your consideration, here is some advice from “Who Moved My Cheese.”

Getting Updates:

Readers are welcome to suggest individual stocks and/or ETFs to be added to our model lists. We keep a running list of all securities our readers recommend, and we share the results within this weekly “Stock Exchange” series when feasible. Send your ideas to “etf at newarc dot com.” Also, we will share additional information about the models, including test data, with those interested in investing. Suggestions and comments about this weekly “Stock Exchange” report are welcome. Your can also access background information on the “Stock Exchange” here.

We have a new (free) service to subscribers to our Felix/Oscar update list. You can suggest three favorite stocks and sectors. We report regularly on the “favorite fifteen” in each ...

more