Stock Exchange: Are You Trading Bear Momentum?

The Stock Exchange is all about trading. Each week we do the following:

- discuss an important issue for traders;

- highlight several technical trading methods, including current ideas;

- feature advice from top traders and writers; and

- provide a few (minority) reactions from fundamental analysts.

We also have some fun. We welcome comments, links, and ideas to help us improve this resource for traders. If you have some ideas, please join in!

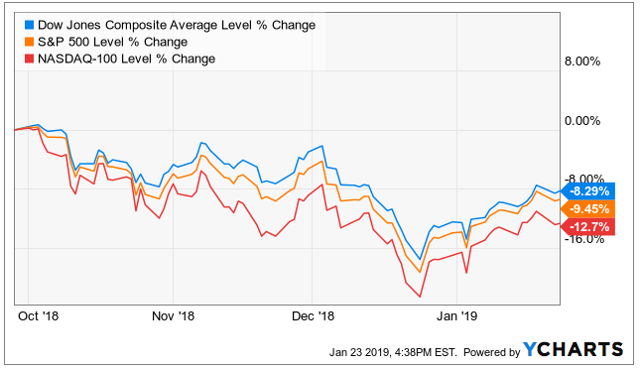

Review: Bear Market Relief Rally?

Our previous Stock Exchange asked the question: Is This A Relief Rally Within A Bear Market? We noted the market has been strong so far this year, but it pales in comparison to the weakness of last quarter. And that technical indicators have not yet confirmed momentum is to the upside; this may be a relief rally in a bear market. To again quote truly legendary Trader, Charles Kirk:

“Bear markets are bear markets because they suck in buyers when it feels safe to do so only to roll back over again.”

(image source: Barron’s cover 4/10/00)

This Week: Are You Trading Bear Momentum?

Until proven otherwise, and despite this year’s rebound, the broader market trend remains to the downside.

For perspective, market psychologist and trader, Dr. Brett Steenbarger, did an excellent job (as usual) back in 2017 describing How to Read Market Cycles, in explaining the “Bear Momentum Phase” as follows:

“The inability of buyers to push the market to new highs attracts the participation of sellers and volume and volatility once again pick up. The market can remain oversold for a while, as bulls exit their positions and shorts are emboldened. Correlations rise, and we move toward a market momentum bottom.”

We have certainly experienced the correlation rise as the stocks that sold off the hardest in Q4 have been the ones that have rebounded the hardest so far this year (but they still have a way to go before reaching previous high water marks). Dr. Steenbarger’s market cycles include:

- Market Momentum Bottom

- Market Bottoming

- Bull Momentum Phase

- Bull Topping Phase

- Bear Momentum Phase

If we are in fact in the later phases of the market cycle, Steve Burns offers some advice on How To Trade A Bear Market. The article notes that

“In fact in 2008 when people where in full panic mode and the economy crashed along with stocks. Walmart’s stock actually closed the year up 20%- a mere 58% outperformance over S&P!… And if you think that Walmart gets crowded, try walking around a Dollar Tree store… Dollartree’s stock went up 60% in 2008.”

But where are we in the current broader market cycle? According to Bank of America Merrill Lynch:

“Putting the pieces of the puzzle together, we see an economy that is set to slow into the end of next year as fiscal stimulus fades and the Fed brings interest rates higher.”

But is this type of punditry tradable?

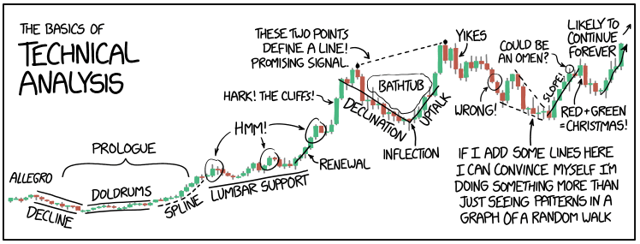

Especially in light of the market’s recent split personality. And if that is still not technical enough for you, consider The Basics of Technical Analysis in the following chart.

Risk Management:

Risk management is always critically important as a trader. As we’ve discussed in the past, it’s important to know when to be aggressive and when to be prudent. And given the market’s recent split personality, we continue to exercise prudence in our own trades. For example, we use varying types of risk controls within our own trading models, one of which is simply to exit our short and mid-term trading positions when market conditions are not healthy. And our momentum based models have exited their trades recently, waiting for more conducive conditions. This is not a call on the direction of the market, but rather a risk control measure. We get aggressive with our positions when conditions are right, but exhibit prudence when they’re not.

Model Performance:

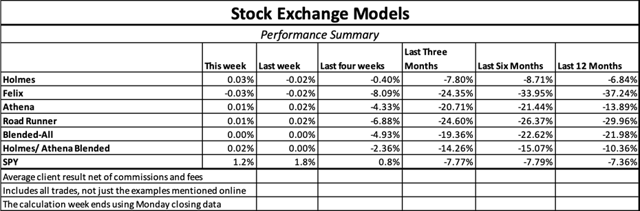

We are sharing the performance of our proprietary trading models, as our readers have requested, as shown in the following table:

We find that blending a trend-following / momentum model (Athena) with a mean reversion / dip-buying model (Holmes) provides two strategies, effective in their own right, that are not correlated with each other or with the overall market. By combining the two, we can get more diversity, lower risk, and a smoother string of returns.

For more information about our trading models (and their specific trading processes), click through at the bottom of this post for more information. Also, readers are invited to write to main at newarc dot com for our free, brief description of how we created the Stock Exchange models.

Expert Picks From The Models:

Note: This week’s Stock Exchange is edited by Blue Harbinger, a source for independent investment ideas.

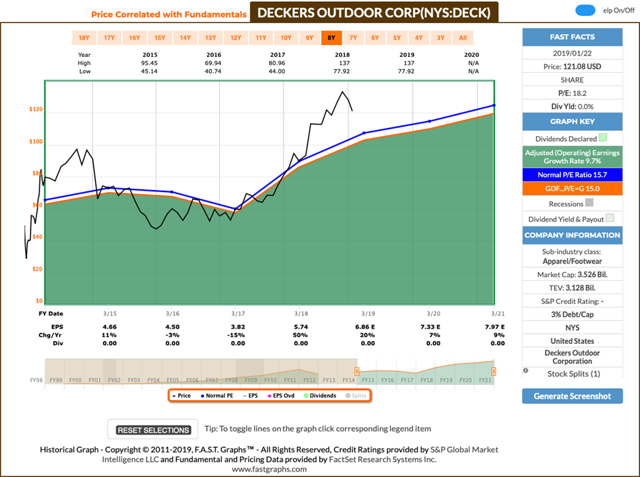

Holmes: Being the aggressive yet prudent dip-buyer that I am, I bought shares of Deckers Outdoor (DECK) last week, and I turned right around and sold them this week

Blue Harbinger: That is quite a trade, Holmes. It looks like you turned a quick profit. But how did you know when to buy and when to sell?

Holmes: As a technical-based trading model, I focus on hard data. I am a dip buyer, and the setup on this trade was obvious based on the circumstances. I typically hold for about 6 weeks, but given our split personality market–I chose to take the profits on this one after only a week.

BH: Well to those of us who are curious, Deckers is in the business of designing, marketing and distributing footwear, apparel and accessories developed for both everyday casual lifestyle use and high performance activities. Here are a few of their brands.

And here is a look at some of the fundamental data in the fast graph.

However, Holmes is clearly not interested in the business or the long-term fundamentals. He just likes the technical data.

Holmes: Not exactly true, but close enough. I am happy to find an attractive trade and turn a profit in this volatile market. And how about you Road Runner and Athena–any trades to share with us this week?

Road Runner: No trades. We need a little more proven market momentum before we start placing trades. Perhaps technical conditions are still not healthy for our momentum trading style. But don’t worry, there will be plenty of time to make money with less risk when conditions are more favorable.

BH: I can respect that. This market has been crazy lately. How about you, Felix–do you have anything to share?

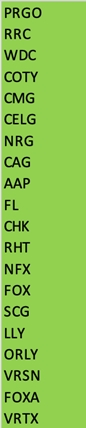

Felix: Yes. This week I ran the stocks of the S&P 500 through my technical trading model, and I have ranked the top 20 for you in the following list. As a reminder I am a momentum trader, but I hold for a longer time period than the other models–typically around 66 weeks.

BH: Thanks for that ranking, Felix. I see you’ve got Perrigo (PRGO) ranked first. That stock has been weak over the previous 66 weeks, but maybe you have a forward looking view on the market cycle? Perrigo engages in the production of over-the-counter consumer goods and specialty pharmaceutical products. You know according to that that BofA analyst article we linked earlier, there are certain sectors that perform better in late market cycle conditions.

Felix: I have read that in July this will become the longest economic expansion in U.S. history, running 9-plus years.

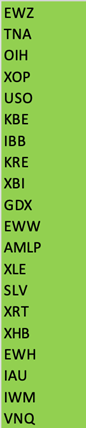

Oscar: While you two bicker over where you think we are in the market cycle, I have some ETF rankings for you. As our resident sector/ETF rotation model, this week I ran our “High Liquidity ETFs with price-volume multiple over 100 million per day” universe through my model, and the top 20 are ranked in the following list.

BH: Interesting. And remind us, what is your trading strategy?

Oscar: I am into momentum. I typically hold for 6 weeks, and then I usually rotate into a new sector or style ETF.

BH: I see a lot of energy ETFs on your list again. For example, the SPDR S&P Oil & Gas Exploration & Production ETF (XOP), the United States Oil ETF (USO) and the energy sector ETF (XLE). As we mentioned last week, oil had a horrible 4th quarter, but it has been rebounding hard, and arguably has good momentum on its side now. Thanks for sharing those rankings.

Conclusion:

Given the seemingly strong uptick in markets this year, it may seem the bulls are winning. However, this year’s up move is still small compared to last quarter’s bear move which may still have momentum. The market has been schizophrenic, conditions have been challenging, and the market cycle may be changing. If it’s not consistent with your strategy, it’s okay to favor prudence over aggressiveness, and to hold off on some of your trades. There will be plenty of time to make money with less risk when conditions are more favorable.

Stock Exchange Character Guide:

We have a new (free) service to subscribers to our Felix/Oscar update list. You can suggest three favorite stocks and sectors. We report regularly on the “favorite fifteen” in each ...

more