Still Waiting For Inflation To Peak

The Federal Reserve yesterday decided to take a slightly more hawkish position on inflation, laying the groundwork for several rate hikes in 2022. Part of the calculus, probably the dominant part: inflation continues to accelerate.

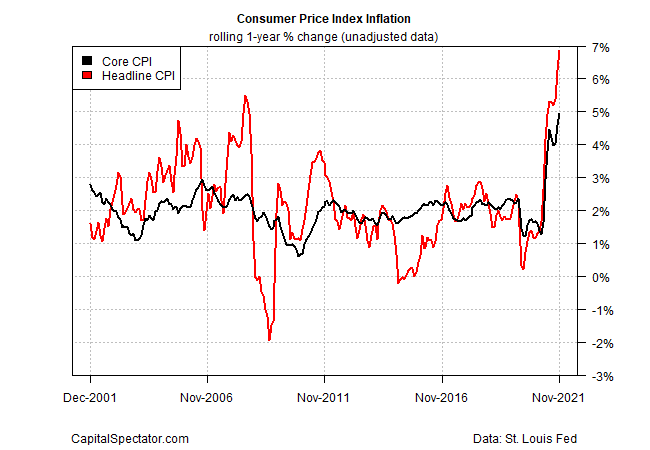

Consumer prices in November were hotter than expected, rising 6.9% year-over-year – a 39-year high. Core CPI, a more reliable measure of the trend, increased 4.9% — the fastest pace since the early 1990s.

Federal Reserve officials are no longer describing the surge in inflation as “transitory,” but the central bank hasn’t given up on the concept, at least not yet. Yesterday’s FOMC policy statement advised that “supply and demand imbalances related to the pandemic and the reopening of the economy have continued to contribute to elevated levels of inflation.”

The implication: when the imbalances ease, so will inflation. Indeed, the Fed reports that “progress on vaccinations and an easing of supply constraints are expected to support continued gains in economic activity and employment as well as a reduction in inflation.” But “risks to the economic outlook remain, including from new variants of the virus.”

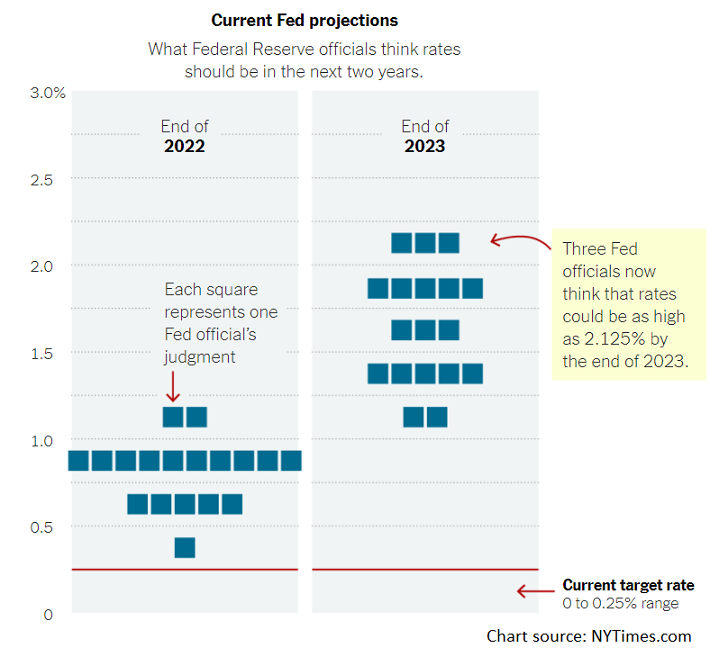

The net result: the central bank left its target rate pinned to a 0%-to-0.25% range while announcing that it would speed up the dialing back of its bond purchasing program, which brings forward the start of interest rate hikes.

The Fed’s new economic projections suggest that rates will rise next year, reaching roughly 2.0% by 2023.

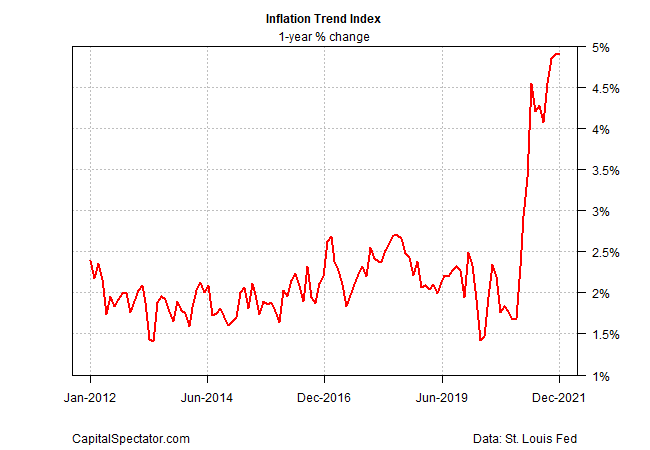

The key variable will likely be the path of inflation over the next several months. At this point, the transitory view has been wrong. That includes recent estimates of CapitalSpectator.com’s Inflation Trend Index (ITI), which has been estimating that inflation pressures would peak. Like many other attempts to forecast near-term pricing pressure, ITI has underestimated the upside bias.

To be fair, the full range of ITI’s estimates have allowed for hotter inflation than reflected in the point forecast. No less is expected for the December CPI report, due next month. A fresh run of ITI, which uses 13 indicators to estimate inflation pressure in real-time (see the list here), still shows a peaking process unfolding, or at least when we look at the median of the estimates (shown by the red line in the chart below).

Reviewing the full range of ITI estimates for this month is a reminder that the possibility of hotter inflation numbers is very much alive and kicking. The most likely range of estimates for ITI this month: roughly 3.3% to 6.8% (interquartile range), with an extreme upside outlier of 20%-plus.

Inflation uncertainty, in short, remains high. Perhaps the only thing about inflation risk that is certain at this point might be labeled the Yogi Berra model: It ain’t over till it’s over.

Disclosures: None.