Sticky US Inflation Reduces Chances Of An Early Fed Rate Cut

Image Source: DeopositPhotos

In the wake of the Federal Reserve's dovish shift in December, financial markets had moved to price an interest rate cut as soon as March. However, the tight jobs market and today's firmer-than-expected inflation numbers suggest this is unlikely, barring an economic or financial system shock. We continue to think the Fed will prefer to wait until May.

CPI comes in above expectations

December US CPI has come in at 0.3% month-on-month/3.4%year-on-year and core 0.3%/3.9% versus the 0.2/3.2% expectation for headline and 0.3/3.8% for core. So, it is a little disappointing, but not a huge miss. Meanwhile, initial jobless claims and continuing claims both came in lower than expected with continuing claims dropping to 1834k from 1868k – the lowest since late October. The combination of the two – slightly firmer inflation and good jobs numbers really brings into doubt the market expectation of a March rate cut from the Federal Reserve. We continue to see May as the most likely starting point.

Core CPI measured in MoM, 3M annualized, and YoY terms

Image Source: ING, Macrobond

This means that the annual rate of headline inflation has actually risen to 3.4% from 3.1% in November while the core rate (ex food and energy) has only fallen a tenth of a percentage point, so we appear to have plateaued after a strong disinflationary trend through the first nine months of 2023. The details show housing remains firm, with the key rent components continuing to post 0.4/0.5% MoM gains while used cars also rose 0.5% and airline fares increased 1% while medical care is also still running pretty hot at 0.6%. Motor vehicle insurance is especially strong, rising another 1.5% MoM, meaning costs are up more than 20%YoY. The so-called “super-core” measure (core services CPI ex housing), which the Fed has been emphasizing due to it reflecting tightness in the labor market given high wage cost inputs, posted another 0.4% MoM increase. This backdrop remains too hot for the Fed to want to cut rates imminently, especially with the economy likely posting 2-2.5% GDP growth in the fourth quarter of last year and the labor market remaining as tight as it is.

But this is just one measure and the outlook remains encouraging

Nonetheless, the CPI report isn’t the only inflation measure the Fed looks at. In fact the preferred measure – the core personal consumer expenditure deflator – has shown much better performance. To get to 2% YoY we need to see the MoM% change averaging 0.17%. 0.31% MoM for core CPI is near enough to double what we want to see, but for the core PCE deflator, we have seen it come in below 0.17% MoM in five of the past six months. The reasons for the divergence are slight methodological differences in the calculations, with weights for key components such as housing and cars, being very different.

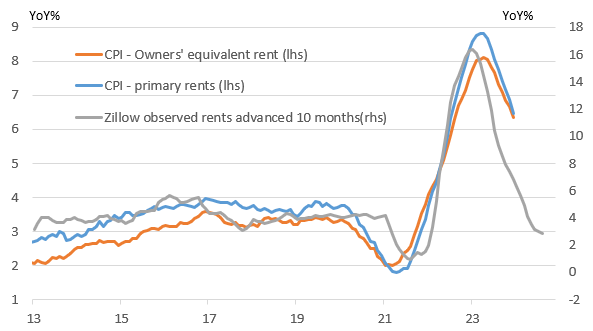

Observed rents still point to a sharp slowdown in housing inflation

Image Source: ING, Macrobond

Nonetheless, the prospects for consumer price inflation returning to 2% YoY remain good. We have to remember that cars and housing have a 50% weighting within the core CPI basket and we have pretty good visibility for both components. Observed private sector rents point to a clear slowdown in the housing components, while declines in Manheim car auction prices point to used car prices falling outright over the next two months. Also, note that the NFIB small business survey showed only 25% of businesses are raising prices right now versus 50% in the fourth quarter of 2022. In fact, the last time we saw fewer businesses raising prices was January 2021. So, while today's report wasn't as good as it could have been, there are still reasons for optimism about sustained lower inflation rates in 2024. We still see a good chance headline and core CPI to be in the 2-2.5% YoY range by the late second quarter.

More By This Author:

Asia Week Ahead: GDP Figures, Unemployment Data And A Bank Indonesia Decision

December Inflation Surprise Opens The Door To Faster Rate Cuts In The Czech Republic (Waiting On Chart Sources)

FX Daily: US CPI Not A Game-Changer In FX

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more