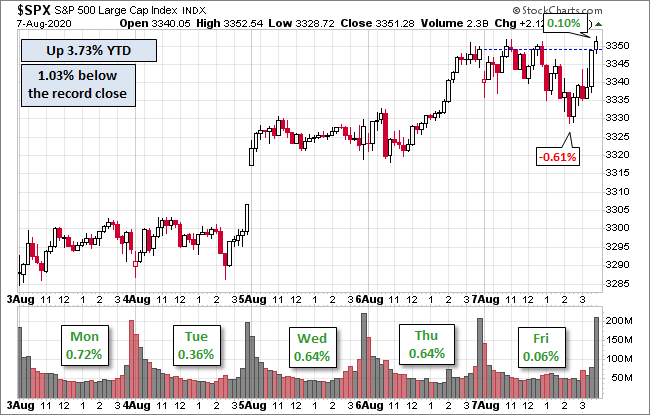

S&P 500 Snapshot: 1% Below Record Close, Index Up 3.7% YTD

Despite the global COVID-19 pandemic, a recession, and a looming election, the S&P 500 is up 3.7% YTD and just 1.03% below its all-time record high.

The U.S. Treasury puts the closing yield on the 10-year note as of August 7 at 0.57%, just above its record low (0.52% on August 4). The 2-year note is at 0.13 q%.

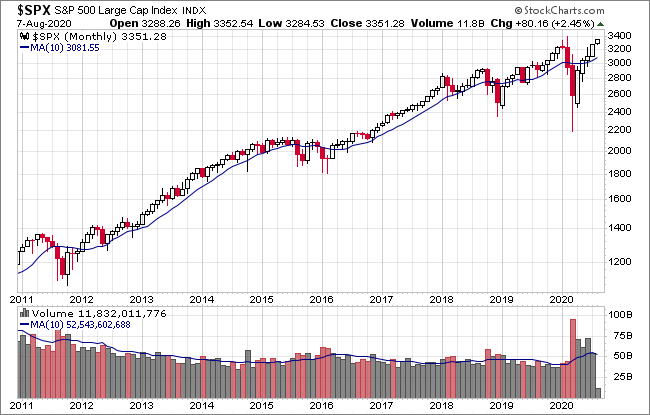

Here's a snapshot of the index going back to 2010.

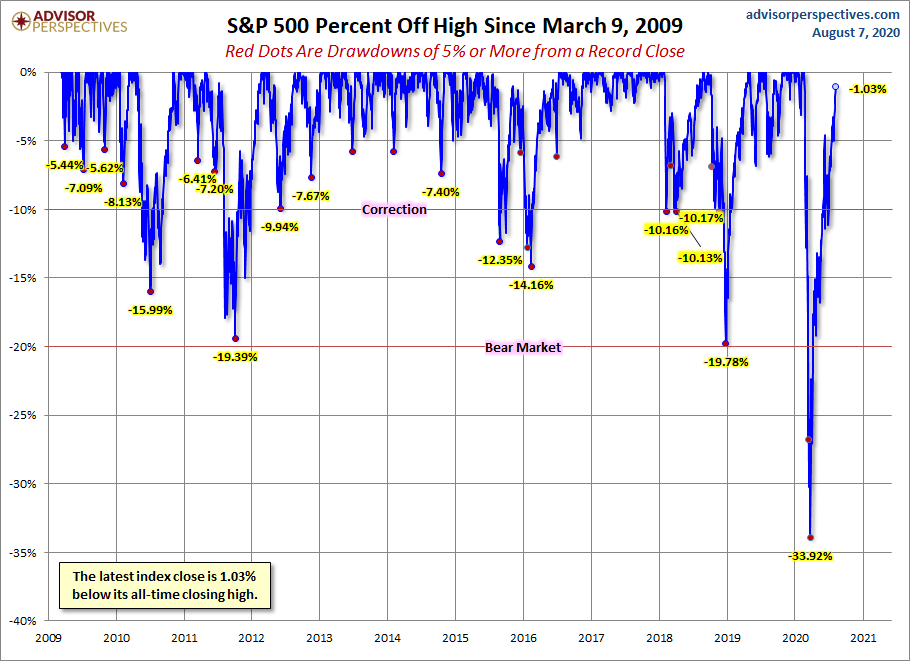

A Perspective on Drawdowns

Here's a snapshot of record highs and selloffs since the 2009 trough.

Here's a table with the number of days of a 1% or more change in either direction and the number of days of corrections (down 10% or more from the record high) going back to 2013.

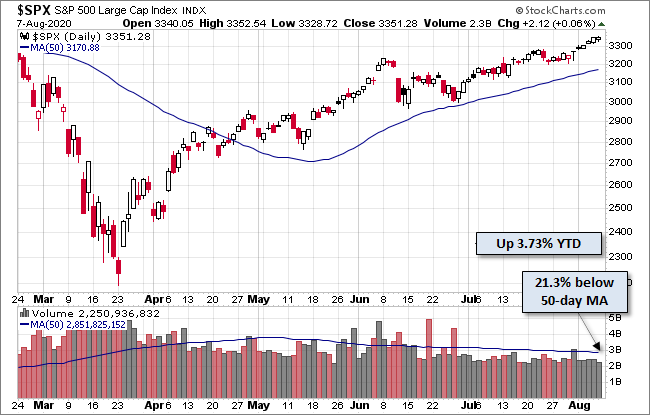

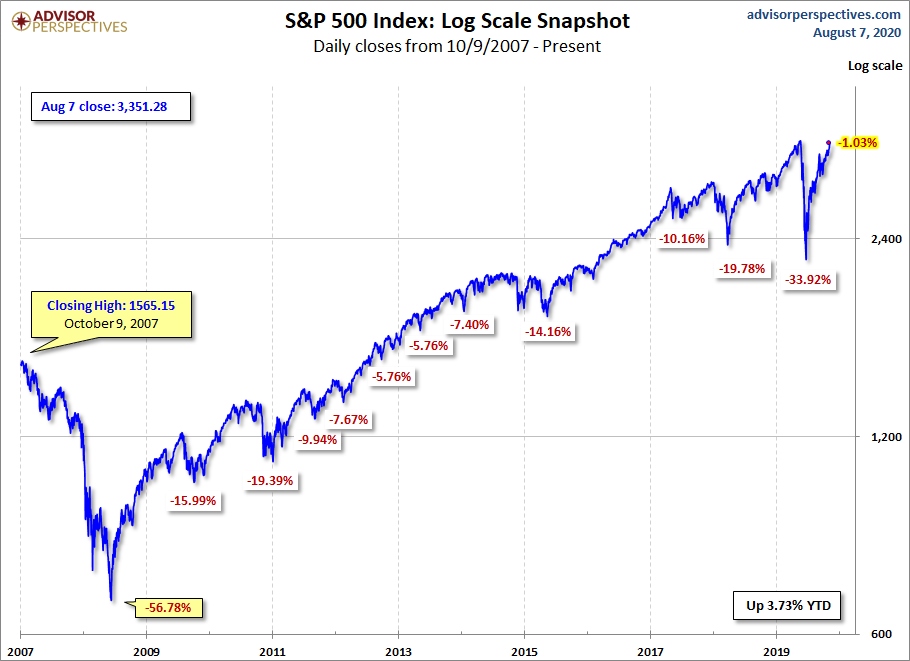

Here is a more conventional log-scale chart with drawdowns highlighted.

Here is a linear scale version of the same chart with the 50- and 200-day moving averages.

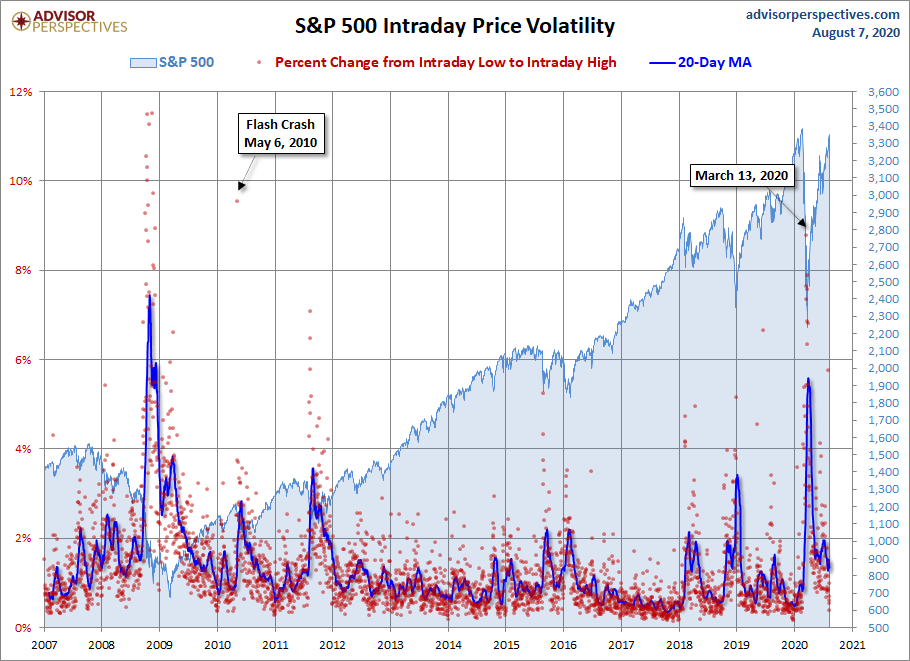

A Perspective on Volatility

For a sense of the correlation between the closing price and intraday volatility, the chart below overlays the S&P 500 since 2007 with the intraday price range. We've also included a 20-day moving average to help identify trends in volatility.