S&P 500 Price Update: US Equities Appear Upbeat Ahead Of Major Event Risk

Risk Appetite Rises On Hopes Of Looser Covid Policy In China

Details remain rather unclear regarding China’s revisions on Covid regulations but markets saw the mere mention of potential changes as a positive sign, resulting in continued gains after Friday’s move higher. China has announced its intention to revise the quarantine rules for foreign visitors in an attempt to stimulate the tourism sector, at a time when China is experiencing economic challenges.

However, yesterday Beijing confirmed that the strict zero-Covid strategy means that if there are to be any significant changes, those are more likely to materialize next year rather than this year and the reopening process is likely to be gradual in nature. Nevertheless, the S&P 500 futures continue to trade higher this morning, building on Monday’s gains. After the market close, there are a number of noticeable Q3 earnings reports, listed below.

Notable Q3 Earnings Reports This Week:

- AMC Entertainment (today) after market close

- Occidental Petroleum (today) after market close

- Walt Disney (today) after market close

- Rivian (Wednesday) after market close

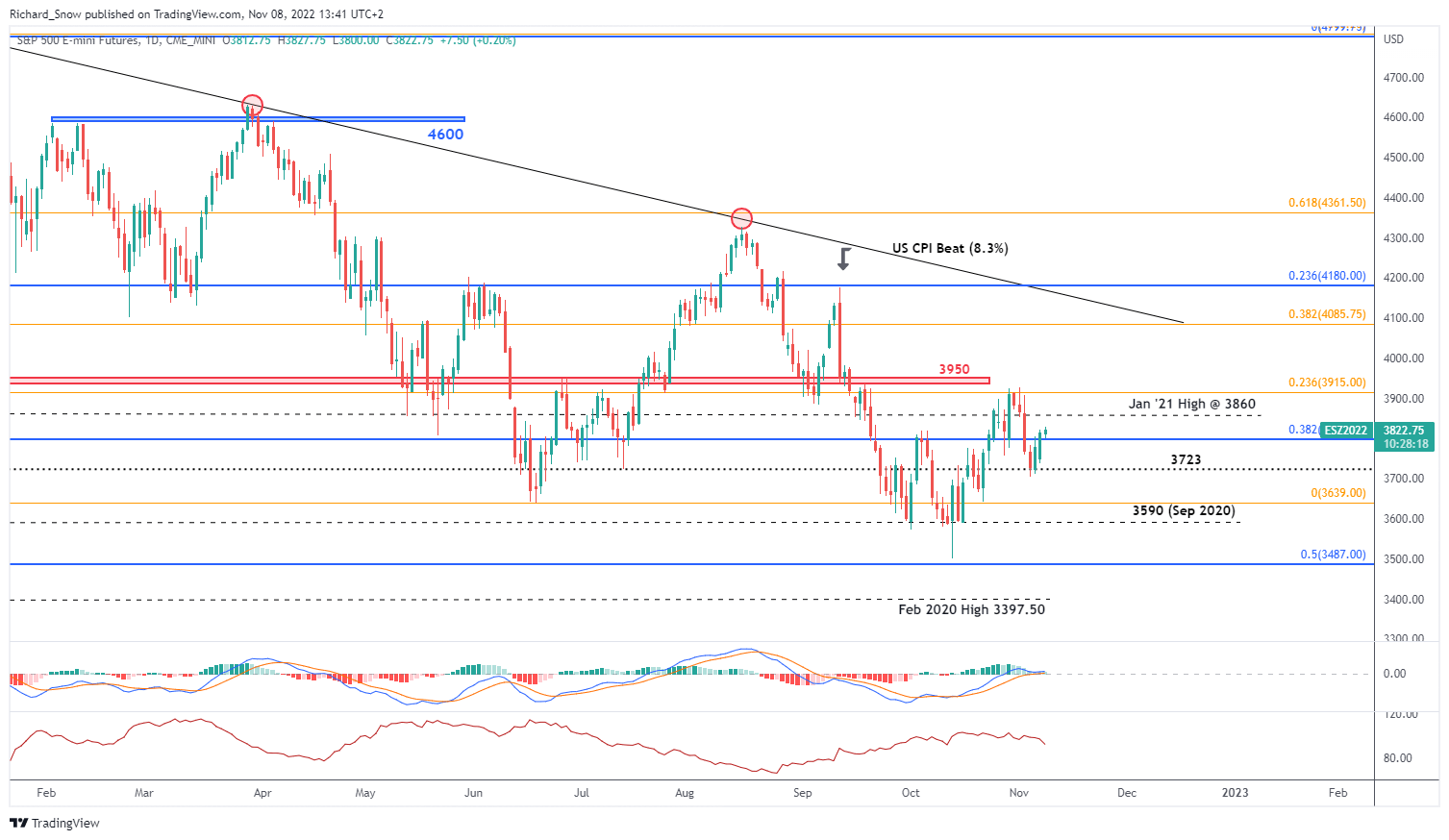

US Equities Technical Analysis (S&p 500 E-mini Futures)

US equities trade higher ahead of significant event risk on Tuesday as well as inflation data on Thursday and consumer sentiment on Friday. While Q3 earnings thus far, failed to impress, US companies remain fixated on the path of monetary policy as the hawkish Fed tightens financial conditions and has come to terms with the likelihood of tightening into a recession. This far, despite technically having entered a recession in Q2, economic fundamentals have shown otherwise with a robust labor market (although more and more companies are talking about layoffs), combined with a surprising 2.6% expansion in GDP for Q3.

A bullish continuation highlights the 3860 level before the 23.6% Fib at 3915 however, the ATR indicator reveals that volatility remains rather elevated, and considering this week’s event risk, we may be in for some choppy price action. A CPI print of less than 8% may reinvigorate those hoping for a change in Fed policy sooner than communicated and lift risk appetite, however short-term it may prove to be.

Should inflation continue to remain elevated, the long-term trend may come back into play once again. Levels of support to note come in at 3820, followed by 3727 and the 3640 level.

S&P 500 E-Mini Futures (ES1!) Daily Chart

(Click on image to enlarge)

Source: TradingView, prepared by Richard Snow

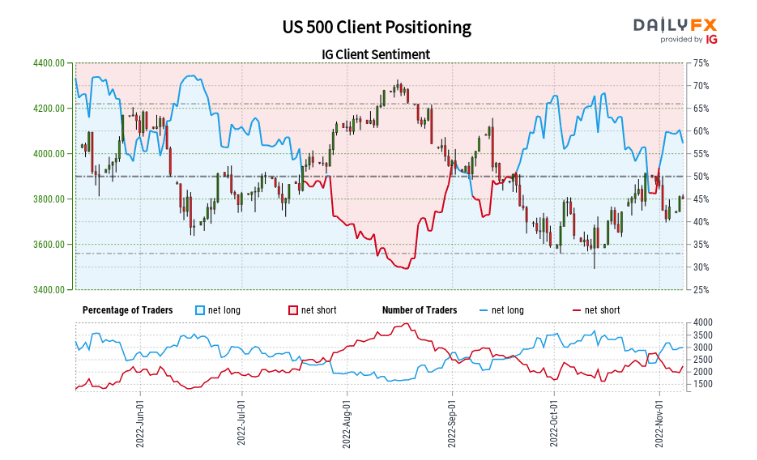

US 500 Client Sentiment

US 500: Retail trader data shows 57.77% of traders are net-long with the ratio of traders long to short at 1.37 to 1.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests US 500 prices may continue to fall.

The number of traders net-long is 0.27% higher than yesterday and 11.29% higher than last week, while the number of traders net-short is 7.93% higher than yesterday and 10.84% lower than last week.

Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed US 500 trading outlook

More By This Author:

Euro Holds High Ground As US Dollar Sidelined Ahead Of Mid-Terms; Higher EUR/USD?Fed Speak For The Week Ahead

Euro Weekly Forecast: EUR/USD Faces Inflation Packed Week