Some Good And Not So Good Reasons To Buy Gold

Gold is an investment (or an asset class, if you may) that has demanded a lot of attention recently, including comments from the Oracle of Omaha, Mr. Buffett himself. Besides its glittering allure since the beginning of mankind, we had the"gold standard" till 1971 (no pun intended), a safe haven in the times of crisis and more recently, an inflation hedge (or has it?).

Below I look at some pros and cons of owning gold as an investment rather than addressing its undeniably important but intangible psychological benefits, especially in countries such as India which is one of the largest consumers of gold.

The Bear case

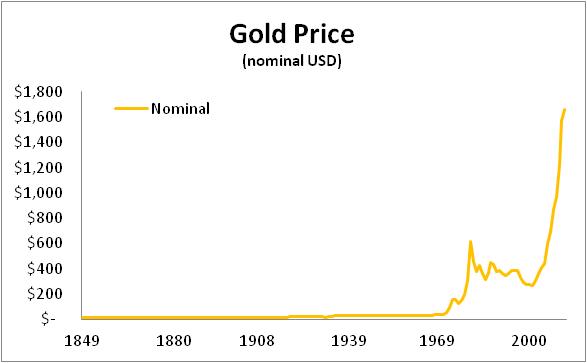

First, take a peek at the nominal (not inflation adjusted) price of gold in US Dollars since the 1800s. Pictures are worth a thousand words, so I will let them do most of the talking. Gold cost about $19/ounce for a very long time, up until 1933 and then $35 until 1971, when it was delinked from the USD.

Fallacy: Gold always goes up. Truth: If you purchased gold at its 1980-81 peak, you would been in a loss, in nominal terms, for 25 years! Should you buy now at these $1600-1800 levels? Remember, it has no yield cushion.

Inflation hedge?

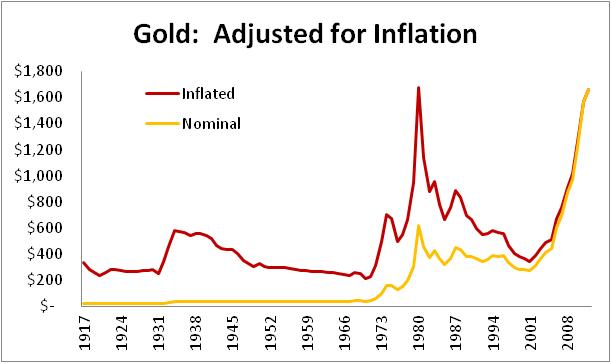

Below is the chart of gold in terms of the value of the Dollar in 2012, adjusted for inflation (as measured by the US CPI-U). Now, you can see, that as an inflation hedge, you would have been in a loss from the mid 1930s till mid 1970s - a span of 40 years! And then, again, if you happened to get into gold during the 1981 peak (of roughly about $2200), you would still be underwater today, after 30+ years! Yes, many gold bulls use this very same fact to make the case for buying "undervalued" gold. I don't know about you, but when I see such rapid increases in the valuation of any asset, the word "bubble" does make a fleeting dash across the mind.

Note: The data is based on year end values, so the intra year highs and lows are not reflected. So, even though the chart indicates the prior inflation adjusted ("inflated") price of about $1800, the real intra year value is closer to $2200.

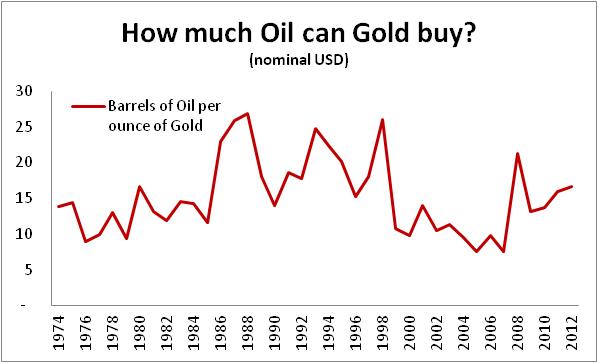

The purchasing power of gold, in terms of "black gold", is another way of looking at its inflation hedging power. Below is the chart of gold, in terms of barrels of oil (WTI crude) it can buy, both priced in nominal USD. Despite gold being high, it can buy less oil today than in the past few decades. There are many factors (geopolitical issues, financial crisis, inflation expectations etc) that influence the price of both these assets, but here I am just looking at the net result - the nominal prices in efficient financial markets.

Currency effect?

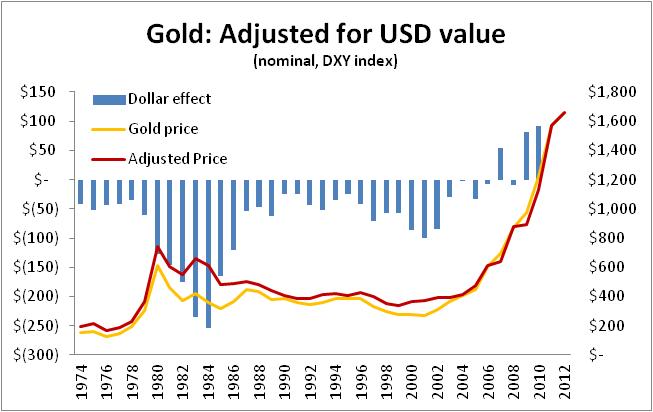

Gold is priced in USD. Below is the effect of the value of the currency, as measured against a basket of international currencies and the price of gold. I have used the DXY index, using the year 2012 as the base value. The nominal price is in yellow, the adjusted price in red (both on the right axis) and the difference between the two, which is the currency contribution on the price of gold, is shown in blue on the left axis of the chart.

In recent years, a declining dollar has also added to the price of gold, whereas in the last quarter of the previous century, it would have decreased the price.

The case for long term bullishness

Bulls take heart. Despite the short term richness of gold, there are several factors in its favor. But how they play out is anyone's guess, and therefore, subjective.

As mentioned earlier, gold has been higher in the past, in inflation adjusted terms. And given the expectation of significant inflation (US 10 year TIPS recently auctioned at negative yields) due to the several rounds of global Quantitative Easings (QE1 to 3, LRTO, liquidity injections etc), there is a potential for gold to hit new inflation adjusted highs. Question is, when, if, and does it take a significant breather before that, given that the Greece crisis has been kicked down the road for now, the US economy has improved in general, risk appetite is better and the fear index (VIX) is hitting multi year lows.

Secondly, the structural changes in gold ownership are also an important bullish factor. Global central banks, Money managers and Sovereign Wealth Funds (SWFs) own gold in their portfolios, for reasons ranging from concerns over the global reserve currency , inflation, global debt levels and sovereign debt risk, diversification etc, and because it has historically been an important reserve asset. About 20% of gold is held by Banks, 50% is in jewelry, in addition to 16% in investments and 12% in industrial uses (2008 data). The US Central Bank holds about 75% of monetary assets in gold, while China and India are in about 2% and 5% respectively (2011 data). For most of the past two decades, Central Banks were reducing their gold holdings, only to reverse course from 2009 - they are buying. As accumulation by these massive institutions increases, we will have a strong secular support for gold.

So, if you are a long term investor and need to own gold, you could buy it via Dollar cost averaging via instruments such as GLD, IAU. You can trade (versus invest) in gold via UGL (2X move) or the gold miners via GDX. If you want to buy it for inflation or a short-USD play, there are other ways to do so, such as TIP and WIP ETFs, or long foreign ETFs, although the latter is a much broader play.

I have no positions in any stocks mentioned, and no plans to initiate any positions within the ...

moreComments

No Thumbs up yet!

No Thumbs up yet!