Solid 2Y Treasury Auction Prices At Lowest Yield In Two Years

Image Source: Pixabay

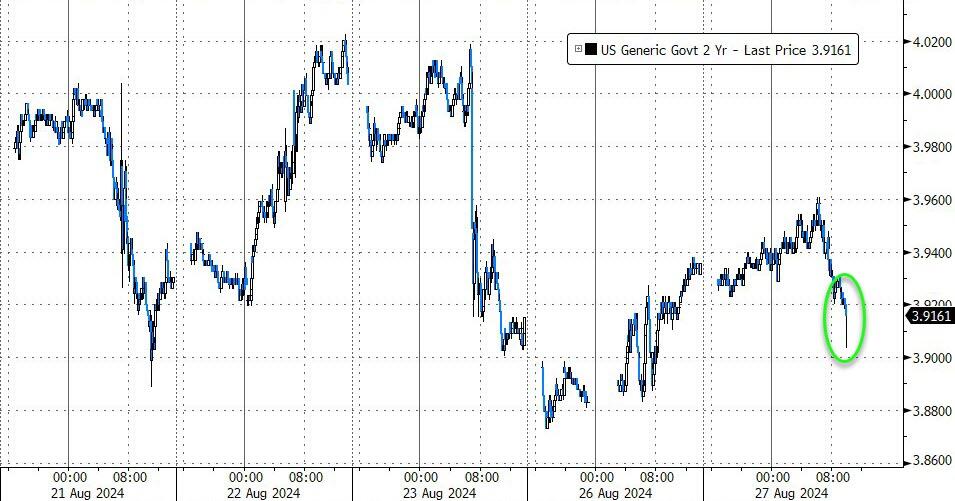

After a sharp reversal in yields, which in August tumbled to a fresh 2024 low, some traders were eyeing today's 2Y auction nervously to see if the move higher in yields would lead to some indigestion. In the end, it turned out there was no reason to be worried because moments ago the Treasury sold $69BN in paper to stellar market demand.

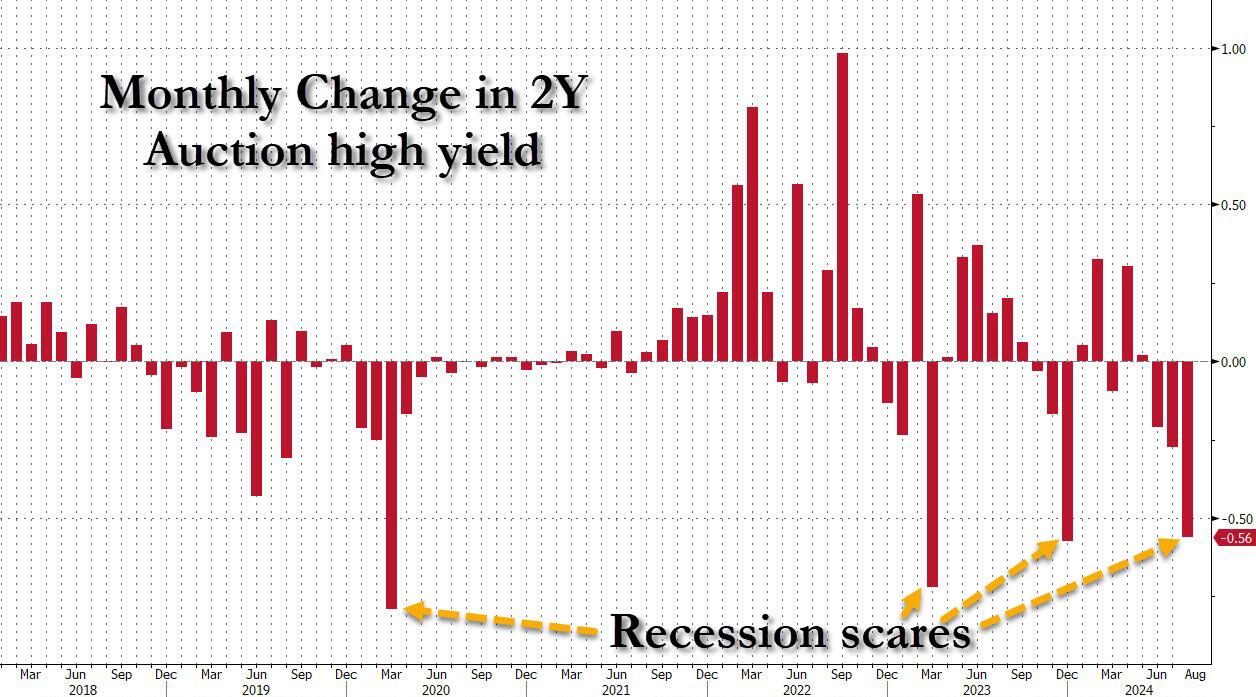

The auction stopped at a high yield of 3.874%, the lowest since August 2022 and down sharply from the 4.434% last month, a 56bps drop which was the biggest since the December recession scare (when we saw a 57bps drop), which in turn was the biggest since the March 2023 bank crisis. In short: any time you have a 50bps+ drop in sequential 2Y bond yields, you get a powerful recession scare. And yet, aside from March 2020 when the entire world shut down, the past two such recession scares ended up being a false start. We'll see if this latest one is the same.

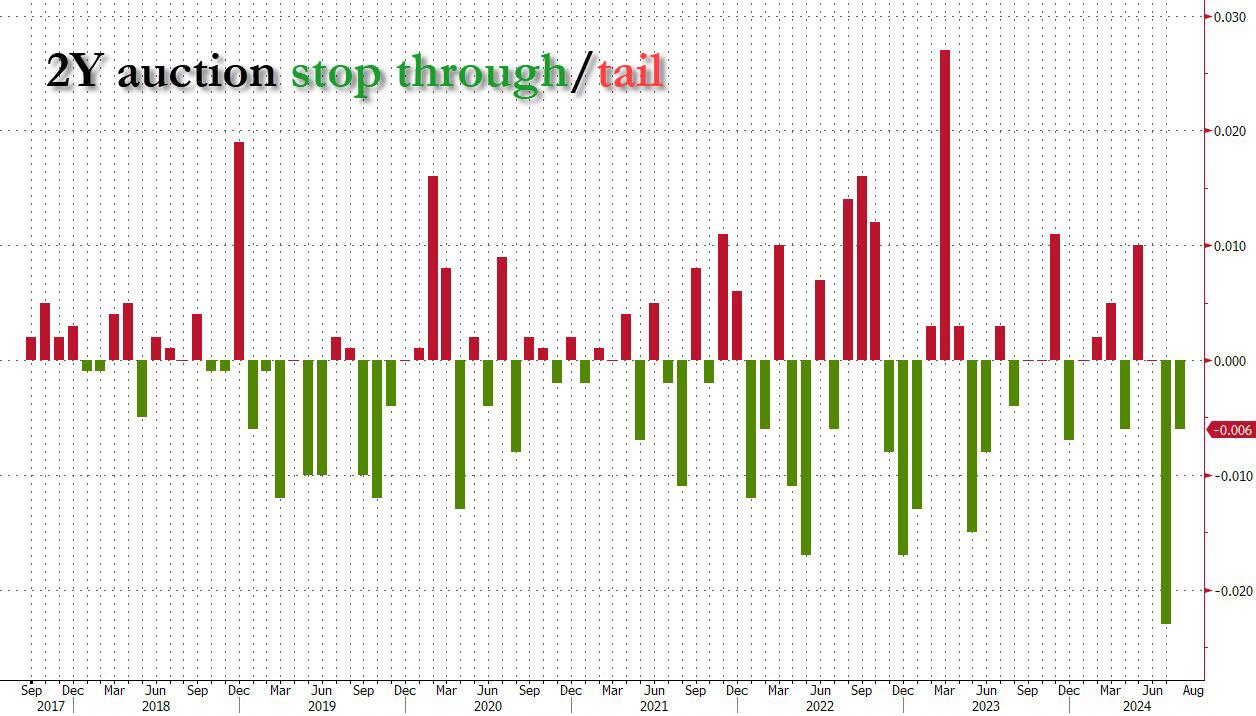

The auction also stopped through the 3.800% When Issued by 0.6bps, which was good but not as good as last month's 2.3bps stop through which was the biggest in the past decade.

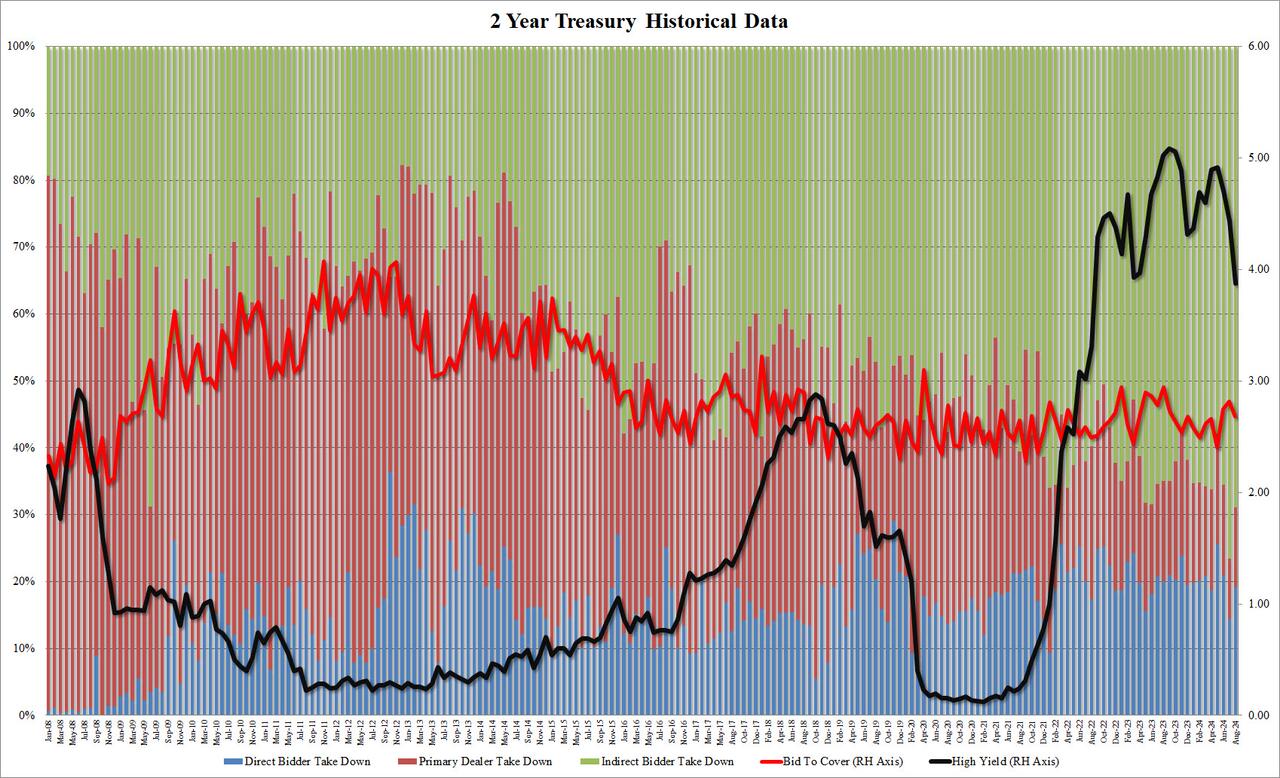

While the bid to cover dropped to 2.68 from last month's stellar 2.81, it was still one of the highest in the past year, and well above the six-auction average of 2.62.

The internals were also on the meh side, with Indirects awarded 69.0%, down from 76.6% but above the recent average of 66.2%, and with Directs taking down 19.1%, the most since June, Dealers were left holding 11.9%, up from the record low 9.0% last month but above the recent average of 13.7%.

Overall, this was a solid if not stellar 2Y auction, and one which helped push 10Y yields lower, toward 3.83% after rising as high as 3.86% earlier in the session. Still, with the Fed now on pace to cut rates by 25bps no matter what, the real catalyst will be the August payrolls report next week while tomorrow's NVDA earnings may also have some impact on where the US rates complex will trade.

More By This Author:

Super Micro Shares Plunge 8% After Hindenburg Shorts, Claims "Fresh Evidence" Of Accounting ManipulationUS Home Prices Surged To New Record High In June

Big US Corn Crop Pressures Chicago Prices To Four-Year-Low Amid Severe Farm Income Downturn

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more