Solana Price Prediction: Traders Eye $500 Target As SOL Breaks $200 Barrier

Image Source: Pexels

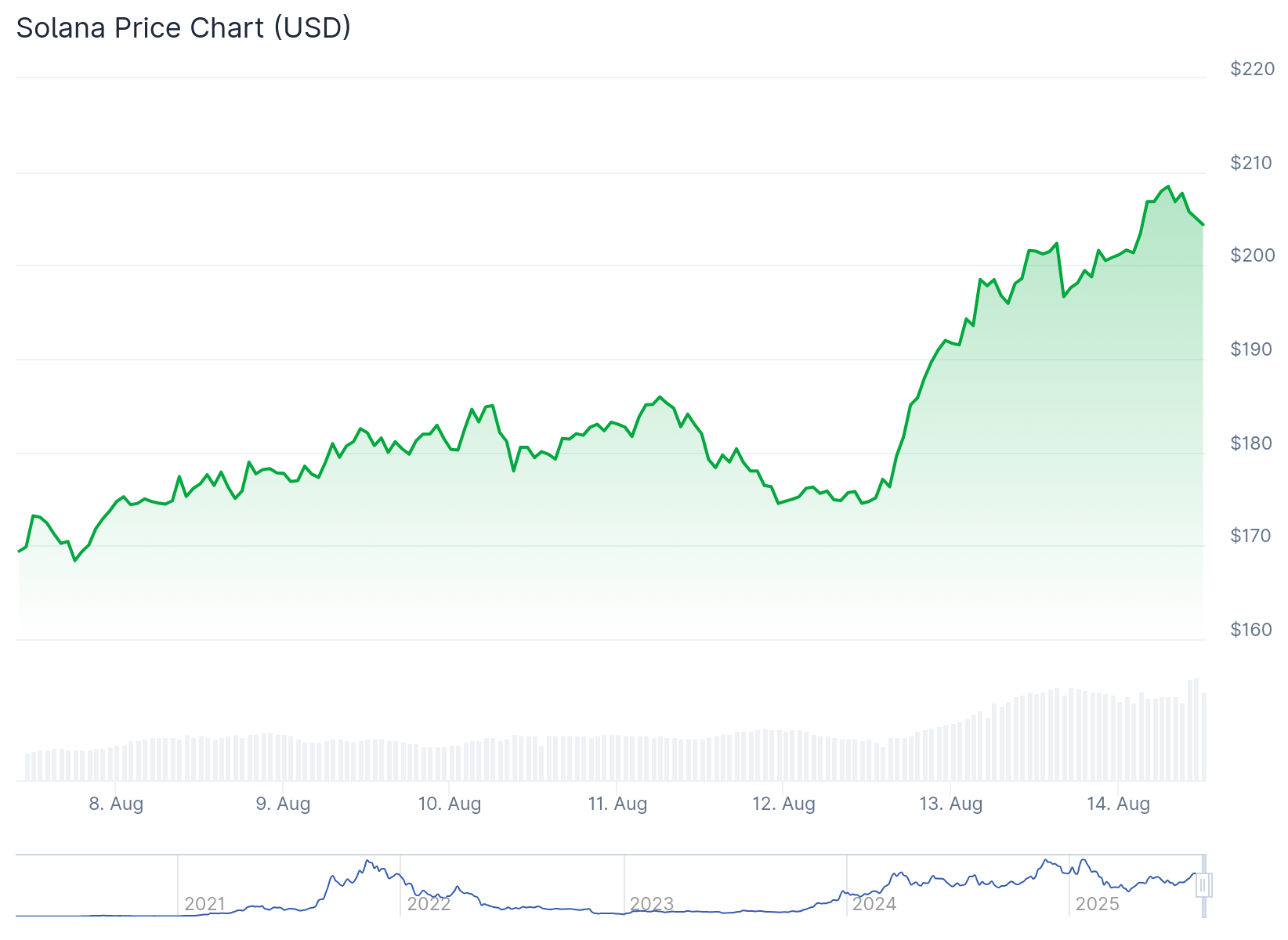

Solana has gained over 20% in the past week as traders position for a potential breakout past the crucial $200 resistance level. The cryptocurrency broke through the $195 barrier that had acted as a ceiling for weeks.

Solana (SOL) Price

Technical indicators now point toward bullish momentum building. The daily MACD line formed a golden cross, surpassing the signal line for the first time since July’s bull run.

The RSI pushed into bullish territory at 66, though it approaches overbought conditions above 70. This suggests possible short-term pullback risk before further gains.

Exchange data shows strong underlying demand for SOL tokens. On August 11, over $85 million worth of Solana left exchanges as traders moved coins to private wallets.

This outflow pattern typically reduces selling pressure in the market. When large amounts of cryptocurrency move off exchanges, it often signals that holders plan to keep their positions longer term.

Derivatives Market Shows Bullish Positioning

Open Interest for Solana derivatives increased 15% over the past week according to Coinglass data. This indicates growing speculative demand among professional traders.

The long/short ratio on Binance reached 2.08, meaning over 67% of traders are betting on price increases. This positioning suggests market participants expect continued upward movement.

Liquidation data reveals a large cluster of short positions worth almost $95 million near the $219 level. If SOL price crosses $206 and heads toward $219, forced buying from liquidated shorts could provide additional upward pressure.

(Click on image to enlarge)

Source: TradingView

Solana is currently testing the upper boundary of a symmetrical triangle pattern that formed since April’s market bottom. A confirmed breakout above $200 would validate this bullish formation.

The next key resistance level sits at $207, which capped July’s previous rally. Breaking this level would give SOL a clear path toward reclaiming its $300 all-time high.

Solana Price Prediction

Softer than expected US inflation data has increased speculation about Federal Reserve rate cuts. Market participants now anticipate up to three rate cuts before year end, potentially starting in September.

JUST IN 🚨: The odds of a September rate cut have soared to over 94% pic.twitter.com/E8copNJVuO

— Barchart (@Barchart) August 12, 2025

Lower interest rates typically drive capital into riskier assets like cryptocurrencies. This macro backdrop has supported the recent rotation into altcoins including Solana.

The Chaikin Money Flow indicator sits at 0.12, showing positive buying pressure but still below July’s peak of 0.35. This suggests room for additional buying interest to develop.

If Solana price manages to break decisively above $200, the next targets include $237 based on Fibonacci extensions and $287 as a stretch goal. Some analysts even project potential moves toward $500 if the broader crypto market continues its upward trajectory.

Current market structure shows little historical resistance above $300 if Solana reclaims its previous highs. The combination of technical breakout patterns and improving macro conditions creates a foundation for potential price discovery.

Traders are watching the $206 level closely as the previous local high that needs to be reclaimed for bullish continuation.

More By This Author:

Shiba Inu Price Forecast: Burn Rate Soars 48,000%, Targets $0.0000254Robotaxi Revenue Surges 158% as Pony AI Accelerates Gen-7 Production

Sea Limited Stock: Q2 Revenue Surges 38% to $5.3B As All Segments Deliver Strong Growth