Solana ETF Fee Cuts And $6B Bet Send SOL Price Into Overdrive

Image Source: Unsplash

- Bitwise has cut Solana ETF fee to 0.20%, sparking ETF competition.

- Helius plans $6B Solana purchase to boost institutional demand.

- The price of Solana (SOL) is up 4% on ETF optimism and strong technical recovery.

The price of Solana (SOL) has rebounded as optimism sweeps through the crypto market, fueled by two major catalysts — the aggressive fee cuts in proposed Solana exchange-traded funds (ETFs) and a massive institutional bet worth more than $6 billion.

The combined effect has pushed SOL up nearly 4% in 24 hours to trade around $227.71, significantly outperforming the broader crypto market, which gained just 0.55%.

Bitwise slashes ETF fees, intensifying competition

Asset manager Bitwise on Wednesday set off a wave of excitement after amending its US-based Solana ETF application to include staking and an ultra-low 0.20% annual management fee.

The fee will also be waived for the first three months on the initial $1 billion in assets.

The fund, renamed the “Bitwise Solana Staking ETF,” would not only track the value of Solana’s spot price but also earn staking rewards from the network itself.

Analysts say the move could trigger a “fee war” among ETF issuers, similar to the fierce competition seen before the approval of US Bitcoin ETFs in early 2024.

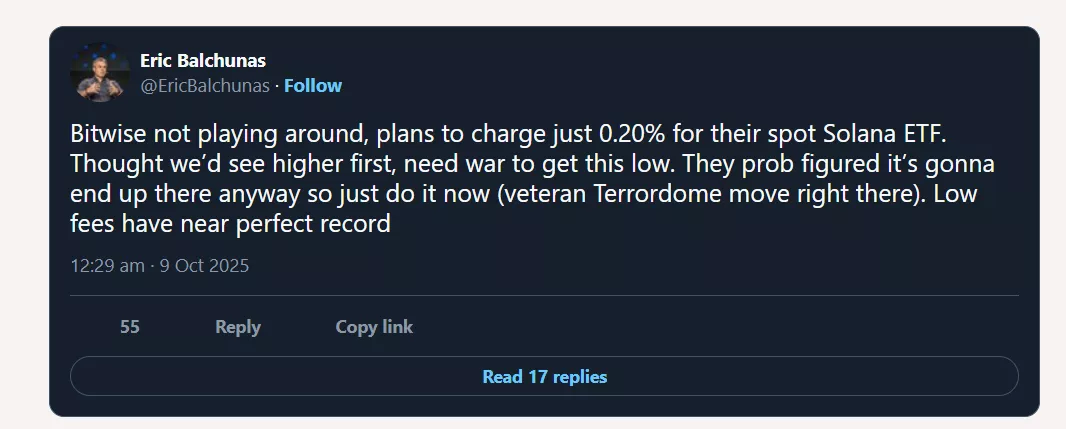

ETF expert Eric Balchunas described Bitwise’s strategy as a “veteran Terrordome move,” noting that historically, low fees have a near-perfect record of attracting investor inflows.

Bitwise not playing around, plans to charge just 0.20% for their spot Solana ETF. Thought we’d see higher first, need war to get this low. They prob figured it’s gonna end up there anyway so just do it now (veteran Terrordome move right there). Low fees have near perfect record

By undercutting rivals such as the REX-Osprey Solana Staking ETF, which charges 0.75%, Bitwise has positioned itself as the front-runner in what could become one of the most competitive crypto fund markets yet.

21Shares joins in with staking expansion

Bitwise’s announcement came just as 21Shares unveiled enhancements to its Ethereum ETF, adding staking functionality and waiving its 0.21% fee for a full year.

The synchronised filings show that the ETF landscape is evolving beyond passive price exposure to active participation in blockchain ecosystems.

By integrating staking, funds can distribute network rewards to investors, effectively increasing returns without raising risk profiles.

This evolution comes on the heels of Grayscale’s Ethereum ETF adding staking earlier in October — the first to do so in the United States.

Helius leads a $6B institutional push

While ETF issuers battle on fees, institutional demand is also accelerating.

Hong Kong-based Helius, a digital asset treasury firm, plans to acquire at least 5% of Solana’s circulating supply — a stake valued at more than $6 billion.

The acquisition will proceed once regulatory and market capitalisation thresholds are met, according to Joseph Chee, who leads the firm’s Solana treasury strategy.

Helius has already secured $500 million to launch its Solana treasury initiative, transforming the company from a healthcare technology firm into a major digital asset player.

Its strategy mirrors the early success of Metaplanet’s Bitcoin-based digital asset treasury in Japan, which saw its share price quadruple before recent corrections.

Chee and Zhu Junwei, both former UBS executives, believe Solana’s technical strength and scalability make it an ideal asset for a long-term treasury portfolio.

Solana price outlook

Beyond the institutional news, technical indicators are hinting at bullish momentum.

Also, Solana’s price recently reclaimed the 61.8% Fibonacci retracement level at $231.05 after rebounding from support at $191.63.

(Click on image to enlarge)

Solana price analysis: CoinMarketCap

And while the price has pulled back from the 61.8% Fibonacci level, the MACD histogram has turned positive, while the Relative Strength Index (RSI) sits at 54.37, signalling healthy momentum without overbought pressure.

A sustained close above $230 could open the door to a move toward $245, though weaker trading volumes suggest investors remain cautious ahead of the SEC’s ETF decision on October 16.

More By This Author:

PayPal And Spark Partner To Supercharge PYUSD With $1B LiquidityLINK Price Prediction As Chainlink Partners With Polymarket

LINK Price Prediction As Grayscale Files To Launch A Chainlink ETF

Disclaimer: Invezz is a place where people can find reliable, unbiased information about finance, trading, and investing – but we do not offer financial advice and users should always ...

more