Should The Fed Cut Interest Rates Today?

The market is confident that a 25-basis-points reduction is a done-deal for today’s policy announcement, based on Fed funds futures. But the question of whether the Fed should cut is more complicated.

Recent inflation data has been sticky, which dulls the case for more cuts. The counter-argument points to a gradual but conspicuous softening of the labor market. The Fed has a dual mandate to minimize inflation and maximize employment, but sometimes conditions require the central bank favor one over the other, if only slightly. We appear to be in one of those times with employment maximization receiving a slightly stronger bias over the inflation-taming bias that’s prevailed until recently.

Using a simple model of inflation and unemployment to evaluate Fed policy suggests that the current stance is modestly tight, as shown in the chart below. But the hawkish bias is relatively mild compared with recent history and is close enough to an estimate of equilibrium to leave room for debate about whether policy should be left unchanged for the moment.

Inflation data provides a basis for pausing rate cuts. In the November report on consumer prices the numbers show that disinflation has stalled. Consider a measure of the inflation bias, which is based on several estimates of consumer inflation via various indices published by regional Fed banks along with the standard metrics published by the government. Taking the average of these indices indicates that the year-over-year bias has edged higher for two straight months through November – the first back-to-back increase in nine months. A third month of upside bias would further raise the reflation-risk potential.

But on the employment front there are signs that the labor market is slowing. It’s modest, at least so far, while the unemployment rate remains low at 4.2% in November. But the Fed seems increasingly focused on supporting payrolls while downshifting inflation fighting.

The case for switching to an employment-maximization mode can be seen in the year-over-year change in weekly jobless claims. Over the last several months, new filings for unemployment benefits have been rising vs. the year-earlier levels. The rise is relatively moderate so far, but the change gives the Fed a degree of cover for taking pre-emptive action to provide employment support.

Consider, too, that the year-over-year trend in nonfarm payrolls has been slowing over much of the past year. It’s debatable if the 1.4% annual rise through November reflects stabilizing from the extremes triggered by the pandemic, but the central bank appears inclined to err on the side of caution via more stimulus.

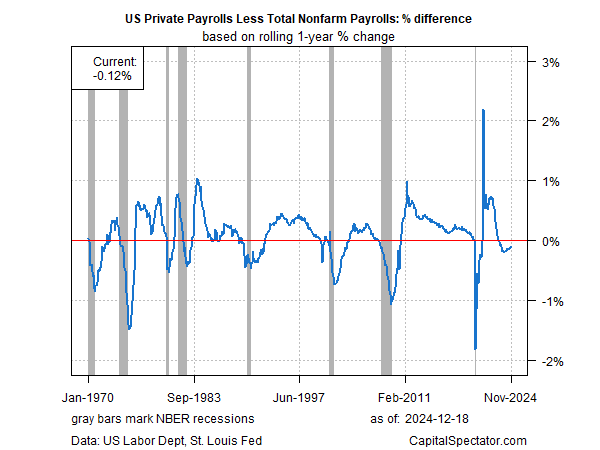

Another way to summarize the employment trend is by comparing the year-over-year trend in private payrolls less total payrolls. The latter includes government employment; to the extent that the spread is positive indicates relatively strong private-sector hiring. The fact that this spread has recent been falling lately suggests a negative bias for the labor market, albeit modestly. Note, too, that the negative bias has been easing in recent months and so this warning sign may reflect noise due to the lingering effects of the pandemic on the economy.

Yet there’s no getting around the fact that conditions may be ripe for stronger reflation risk in the near term. The incoming Trump administration. The president-elect has promised several policy changes that could lift inflation by sharply raising import tariffs (which would lift prices on many goods purchased by Americans) and deporting millions of immigrant workers (thereby raising wages as employers compete to find workers in a diminishing pool). Plans for lighter regulation and tax cuts could be a factor, too, at least in the short term, by juicing business activity, which in turn may provide a new tailwind for prices.

The challenge for the Fed is that the case for cutting rates has weakened via disinflation, which has stalled. Nonetheless, the Fed looks set to cut by a 1/4 point today. But in a telling sign, Fed funds futures are pricing in an 80% probability that the central bank will stand pat at the January meeting. Is today’s rate cut the last dovish move for the foreseeable future? Perhaps Fed Chairman Powell will shed some light on the question in today’s press conference following the policy announcement at 2pm eastern.

More By This Author:

US Q4 GDP Nowcast10-Year US Treasury Yield ‘Fair Value’ Estimate - Thursday, Dec. 12

Communications Services Leads US Equity Sectors In 2024

Disclosure: None.