Should I Invest In An IPO?

Just Because You Can Invest in an IPO, Doesn’t Mean That You Should

Sometimes it feels like the best time to invest in stocks is 50 years ago—not an encouraging thought for someone looking to get started investing in 2018! Since it seems like everything good is already too expensive to start investing in, you might wonder if you should invest in an IPO.

An IPO, or an Initial Public Offering, is when a company first makes its stocks publicly available for purchase. This typically happens when the company is young and hip and has potential for some serious growth.

Sometimes it can be advantageous to invest early. If a stock does increase in value rapidly, it’s always better to have bought early to make the most profit. But there are a few thinks you should take into consideration before you decide if it is a good idea to invest in an IPO.

Some Experts Recommend Waiting 6 Months Before You Invest in an IPO

Dylan Lewis and Michael Douglass from The Motley Fool recommend waiting at least 6 months, if not a year, before investing in an IPO.

Their reasoning is sound: IPOs are designed to help companies raise money. If the company is going public with its shares, the owners know that the company looks appealing right now. That may not be the case in the near future.

IPOs can be volatile in the begging investing stages, so waiting it out and seeing how the shares fare over a 6-month period can be a good indicator of how this IPO will perform for you. (Although nothing is guaranteed in the stock market!)

IPOs are Not Get Rich Quick Schemes

It is a good idea to invest in an IPO if you have time to spare.

Some IPOs do amazingly well within the first few weeks—some double their worth!

That’s the good news, though. Even successful companies that many of us use, like Blue Apron and Groupon, dropped substantially after they released their IPOs: 40% and 90%, respectively.

If you have time to wait out the rollercoaster of an IPO’s first few years, it might be a good move to invest in an IPO.

If You Invest in an IPO You Should Have a Tolerance for High-Risk Investments

For some of the reasons already mentioned, IPOs are not good investments for many investors. If you have limited finances and can’t afford a total loss, you should not invest in an IPO.

If you already have a diversified portfolio and are looking to add more high-risk options, it could be a good idea to invest in an IPO to round out your investments. However, you are still going to want to proceed carefully; even if you have money to spare in case of a total loss and a tolerance for high-risk investing, you should still let some time pass before diving in so you can analyze the stock performance.

Remember That IPO Excitement Does Not Always Mean Stock Growth

Your emotions should not guide your investing decisions.

We see the hype all the time with new technological inventions: people line up for hours (or days!) to get the newest gadget. But how frequently do these gadgets comes out? How quickly do they become obsolete or boring?

Investing in an IPO can be a similar experience. The initial excitement over a new company or product can lead to enthusiastic investors making impulse purchases, only to realize that they, and the rest of the world, lost interest in the company very quickly.

If the company’s novelty wears off and they have nothing else to offer, you’ll be out your initial investment.

There are IPO Success Stories, But These May Not Be the Norm.

If you had invested in Coca-Cola 50 years ago, your initial investment would be worth millions. Wal-Mart, Starbucks, and Microsoft are also high on the list of successful IPOs that have made their initial investors a lot of money.

Still, many experts express the need for caution when investing. Since IPOs have no track record when they are first released, there is no way of estimating how your investment will perform.

Remember: many of these successful IPO investments took a lot of time to get to where they are today. Rarely can you count on an overnight success with an IPO.

So, Is It a Good Idea to Invest in an IPO?

For most investors and most IPOs, the answer is “probably not.” There are a lot of things to keep in mind about IPOs, including features that make them bad investing decisions. Before you decide if you should invest in an IPO, remember:

- Experts think you should wait 6-12 months before investing in any IPO. This gives you time to watch the growth (or failure!) from a safe distance before jumping in.

- The huge earnings from a lot of the most-cited IPOs have developed over years (and years, and years). IPOs are not get rich quick schemes, and you will want to invest time as well as money in order to be sure you’re really making money.

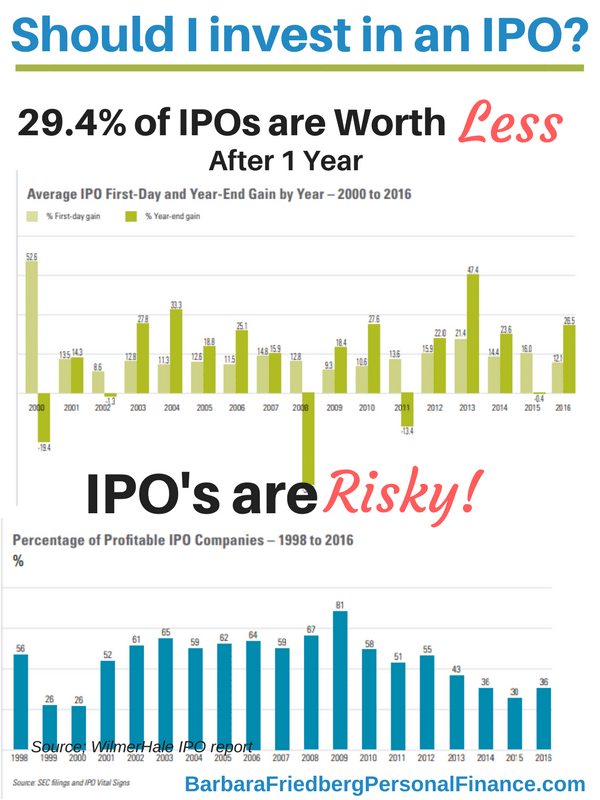

- IPOs are definitely high-risk! They are very volatile in the early stages, and the potential for losing money is ever present.

- Emotions are not good reasons for investing in an IPO. Make sure something has staying power before investing, instead of running with the initial hype.

- Success stories do exist, but, like anything in the stock market, are no guarantee of your own success. Consider the market, the company, and the product before making a move.

Wondering How to Invest in an IPO?

Like any financial decision, you (and possibly your financial advisor) need to make the decision that best fits your situation. If you are still wondering how to invest in an IPO after this article, here are some things you should know.

- Family and friends of the company are typically offered first dibs on any IPOs. If you know someone getting ready to launch a hot new product, try starting there.

- Big buyers are typically also sought-after investors for IPOs. If you fit this description, you might be approached anyway—no need to do anything else!

- Talk to your broker. They might know something coming up or have an “in” with a new IPO.

- Invest with one of the big investment brokers (Schwab, Fidelity, and Ameritrade, for example). Build a relationship with them by staying an active investor, and you may have advanced access to IPOs.

Disclaimer: I am a former portfolio manager, former university finance instructor, and successful investor committed to sharing my personal finance expertise with you. I am not a licensed financial ...

more