Shareholder Yield Explained

In the previous lesson of this dividend investing course, we outlined that dividend yield is equal to the annual dividends per share paid by a company divided by the stock price per share. Investors love dividends because they provide a consistent stream of cash income from their investment portfolio. However, the dividend yield alone doesn't present the whole story. What if a company is financing the dividend with debt or by issuing new shares?

On the other hand, instead of paying a cash dividend, a company may opt to reward shareholders by buying back shares or paying off debt since that's generally more tax efficient.

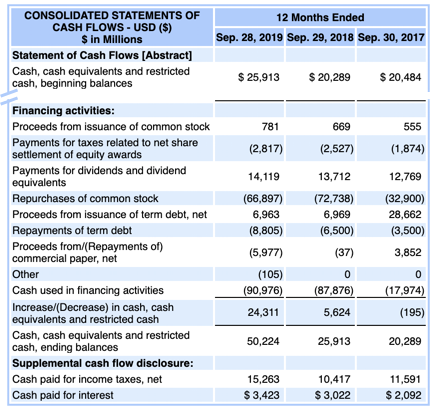

To get the complete view of how a company is rewarding shareholders, we need to evaluate the components of the "cash flow from financing activities" section of the Statements of Cash Flows and calculate a shareholder yield. Here's what the statement looks like for Apple:

Source: Apple Inc, FY 2019 10K

In this lesson, you will learn how to calculate shareholder yield by building up to it using its components – dividend yield, buyback yield, and debt paydown yield.

What Is The Shareholder Yield?

The shareholder yield is a financial metric that gives investors a complete picture of how the company uses its cash flow to reward shareholders. Instead of focusing on dividends alone, the shareholder yield also considers the buyback yield and the debt paydown yield.

Dividends are just one way in which companies can reward their shareholders, and many of them decide to use their cash flow differently because of legal or tax considerations. So if you are looking for yield, this metric is an excellent alternative to the more popular dividend yield ratio.

How To Calculate The Shareholder Yield With The Right Formula?

Some investors define the shareholder yield as buyback yield plus dividend yield. At Finbox, we call this yield the net payout yield. We believe that the more comprehensive definition to calculate shareholder yield is as follows:

Dividend Yield + Buyback Yield + Debt Paydown Yield = Shareholder Yield

We prefer this formula because it provides investors a better picture of a company's total yield. If a firm puts cash into shareholders' hands by taking on debt, it is merely replacing equity value in its capital structure with debt.

In the context of shareholder yield, investors typically calculate dividend yield by dividing the total gross dividend paid over the last twelve months by the company's market capitalization. If a company paid $10 billion in dividends and has a market capitalization of $200 billion, the dividend yield would be equal to 5%.

The buyback yield is equal to net shares repurchased by a company over the trailing twelve months period divided by the company's market capitalization. If a company repurchased shares worth $10 billion and sold shares worth $5 billion, and has a market capitalization of $200 billion, the buyback yield would be equal to (10 - 5 / 200), or 2.5%.

The debt-paydown yield is equal to the net change in long term debt over the trailing twelve months period divided by the company's market capitalization. If a company issued $50 billion in debt notes and has a market capitalization of $200 billion, the debt-paydown yield would be equal to 25%.

Shareholder Yield Example Calculation

To illustrate, we can use the formula above to calculate Apple (AAPL)'s shareholder yield:

Apple's Shareholder Yield = Dividend Yield + Buyback Yield + Debt-Paydown Yield

Using the Finbox data explorer, we can find the values of the metrics required to apply the formula:

- Market Capitalization: $1,658.9 billion.

- Common Dividends Paid: $14.0 billion.

- Share repurchases: $821.0 million.

- Share issuances: $76.6 billion.

- Total Debt, Beginning Balance: $112.6 billion.

- Total Debt, Ending Balance: $118.8 billion.

Dividend Yield

First, we can calculate Apple's historical dividend yield:

Common Dividends Paid / Market Cap = Dividend Yield

14.0 B / $1,658.9 B = 0.85%.

Buyback Yield

Second, we can calculate Apple's buyback yield:

(Share repurchases + Share issuances) / Market Cap = Buyback Yield

($76.6 B - $821.0 M) / $1,658.9 B = 4.57%

Debt-Paydown Yield

Third, we can calculate Apple's buyback yield:

(Beginning Debt - Ending Debt) / Market Cap = Paydown Yield

($112.6 B - $118.8 B) / $1,658.9 B = -0.37%

Lastly, we can calculate Apple's shareholder yield:

Dividend Yield + Buyback Yield + Debt Paydown Yield = Shareholder Yield

0.85% + 4.57% + -0.37% = 5.05%

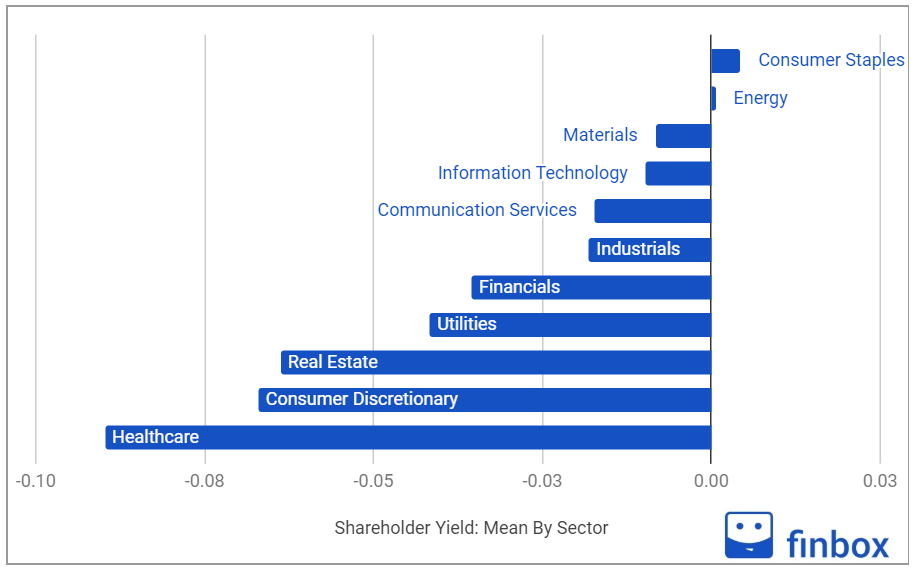

Shareholder Yield: Benchmark By Sector

As of July 4, 2020, the sectors with the highest shareholder yields are consumer staples and energy. Not surprisingly, the shareholder yield is negative for all the other sectors since companies have slashed dividends, halted buybacks, and added debt to their balance sheets to survive the coronavirus crisis.

Beat The Market Using Shareholder Yield

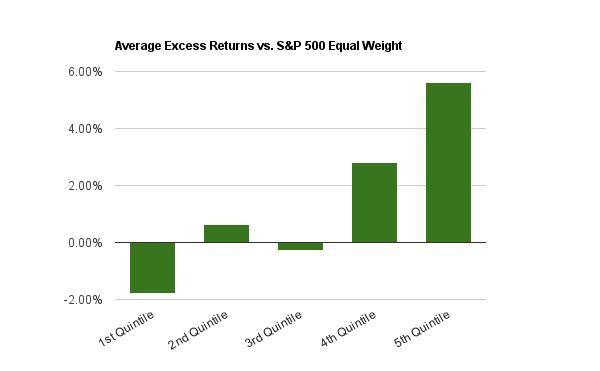

Here is some data demonstrating that the shareholder yield is a powerful financial metric that can help you achieve exceptional investment performance and beat the market.

According to fatpitchfinancials research, by investing in a portfolio of stocks with the highest shareholder yield between January 1, 2000, and December 31, 2016, you would have obtained an average excess return of 5.63%, beating the market to a large extent. At the same time, if you had invested in the 1st quintile of stocks with the lowest shareholder yield, you would have underperformed the market.

Average annual excess returns from 2000 to 2016 for Shareholder Yield (Source: fatpitchfinancials research)

If you want to beat the market and pick the stocks with the highest shareholder yield, you can use the highest shareholder yield ...

more