Avalon Holdings Inc - A Low Float Stock Trading At A Steep Discount To Fair Value

Summary

- Earnings Momentum is strong.

- Valuation is still very cheap.

- Low float stocks with high volume are in vogue with day traders.

- Stimulus money is coming.

- Potential Catalysts in the future.

Avalon Holdings Inc. (AWX) stock price has had a pretty good start to the year already up 50%+ YTD but its market capitalization is still undervalued and based on a # of factors discussed in detail below, I expect at least another 50% rise in the price of AWX by years end and would not be surprised if it were to happen by the end of May after they report 1st Quarter earnings.

The 1st factor that should help AWX's stock to continue it's price appreciation is its strong earnings momentum. Recently AWX reported earnings of $0.12 vrs a loss of ($0.11) a year earlier. That is 2 consecutive quarters of positive earnings surprises and after reading the company's recently filed 10-K, I fully expect another good earnings report and YOY comparisons for the next report in mid May as the company will get a boost in the first quarters earnings from a gain of at least 1.1 million or $0.28 a share on the extinguishment of debt related to the PPP loan program forgiveness provisions

Taken from that 10K is the following statement: Subsequent to December 31, 2020, approximately $1.1 million of the loans and $8,000 of associated interest were forgiven by the Small Business Administration. The Company anticipates the remaining loans, and associated interest, will be forgiven in the first or second quarter of 2021. So earnings momentum should be positive heading into the 2nd and 3rd quarters, which is historically their best quarters.

The 2nd factor AWX's stock has going for it is that valuation at current price is still very cheap. At around $4 a share the company's market cap is only $15 million. With Annual Sales of $58 million and a tangible Book Value of $37 million the price to sales and price to book ratios are still well below 1 which is almost unheard of in todays market of overpriced stocks. Cheap valuation will put it on the radar of all potential value investors including institutional investors.

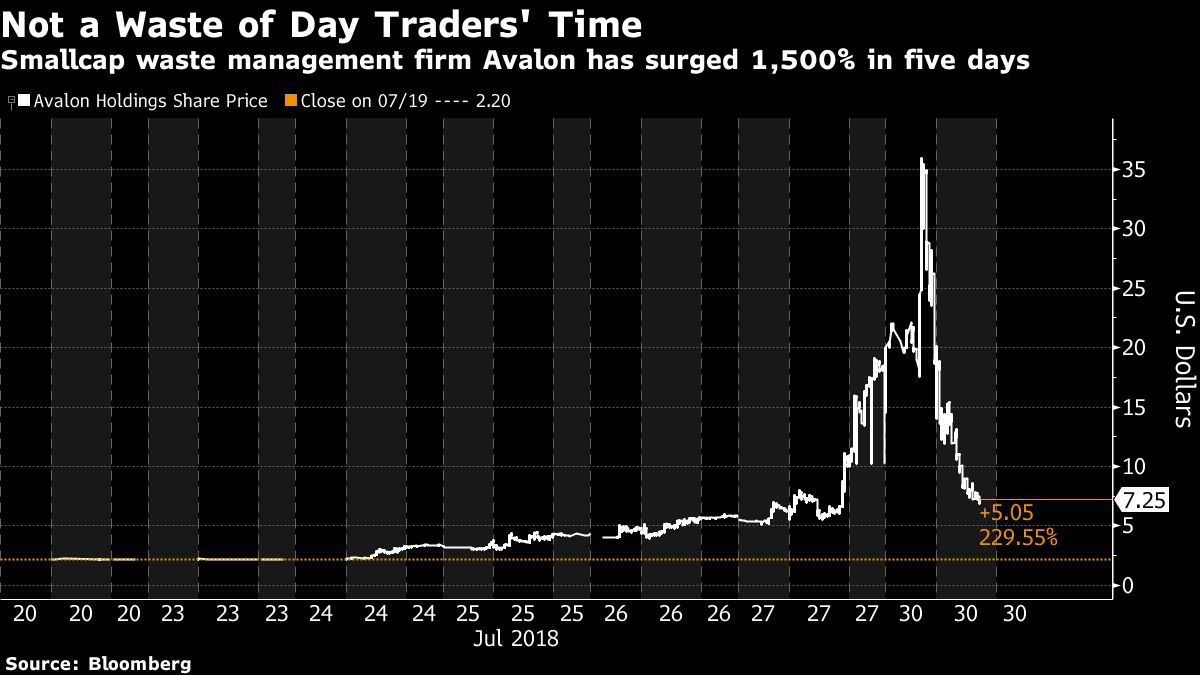

The 3rd factor that should help the appreciation in AWX's stock moving forward is AWX has an extremely small float with only 3.3 million outstanding shares and a float of only 2.2 million shares. While low float stocks offer greater risk in liquidity they also offer potentially explosive upside price potential. Low float stocks seem to be in vogue with day traders these days and something like what happened in July of 2018 could happen again in 2021

For 6 wild days beginning on July 24, 2018 the stock went from under $3 to $20 and back to $3 and in the pre market trading on July 30th actually traded as high as $36 a share. So you can see from AWX's recent past history how explosive the stock can be if there is a sudden interest in this stock

The 4th factor that may help the price of AWX's stock rise is new round of stimulus coming and a whole new breed of 18-34 year old looking to invest almost 1/2 in stocks the potential for some of that money making its way into AWX over the coming weeks is a real possibility. Especially with it being a low priced low float value stock.

The last factor that could cause the stock to rise is a potential news catalyst coming from AWX related to a positive outcome in a lawsuit filed by the company against Guy Gentile related to swing trade profits of 6.3 million he made back in 2018. A victory in this case would add over $1 in earnings and surely act as a catalyst for a rise in price of AWX. Even without this catalyst a 50% rise in price from AWX's recent price is only a move to $6 which it recently traded as high in after hours trading just a few weeks ago. I expect that sometime in the next few months we will see either a gradual rise in price to $6 or various sudden spikes potentially well above $6. Personally I look at AWX as idea for either the long term value investor or the swing trader. I have always held part of my position for the long term and traded part of my position and this strategy has done very well for me over the years.

I am long AWX stock ... I am not being paid by anyone to write this article. It is just my own personal analysis/opinion.

Thanks for the tip. Worth watching.

Good read, thank you. Following you.

Here is a great video of the Grand Resort Hotel that AWX owns

https://www.thegrandresort.com/

And the 4 golf courses they own

https://www.youtube.com/watch?v=W2E7I5KoEGY&t=163s

So you have no vested interest in this company other than being long $AWX?

Yes, I am an investor in the stock/company... that is my only interest. I have been an investor in this company since 1999 and it has been a great investment for me.

Impressive.

Good article, this stock is a worthy find. $AWX