America Express Is Popular With Both Travelers And Investors

Image Source: Unsplash

Summary

- American Express (AXP) is showing strong technical momentum, hitting all-time highs and maintaining a 100% 'Buy' opinion from Barchart.

- AXP has delivered a 31.61% gain over the past year, with robust revenue and earnings growth projected for the next two years.

- Analyst sentiment is mixed, but most individual investors and several major firms maintain bullish ratings and high price targets for AXP.

- Despite valuation concerns, AXP's technical strength and positive investor sentiment support its current momentum, though the stock remains volatile and speculative.

Today’s Featured Stock

Valued at $248 billion, American Express is a diversified financial services company, offering charge and credit payment card products, and travel-related services world wide. American Express and its main subsidiary, American Express Travel Related Services Company, Inc., are bank holding companies. The company offers business travel-related services through its non-consolidated joint venture, American Express Global Business Travel. The company's range of products and services include charge card, credit card and other payment and financing products, Merchant acquisition and processing, servicing and settlement, and point-of-sale marketing and information products and services for merchants, Network services, other fee services, including fraud prevention services and the design and operation of customer loyalty programs, Expense management products and services and Travel-related services.

What I’m Watching

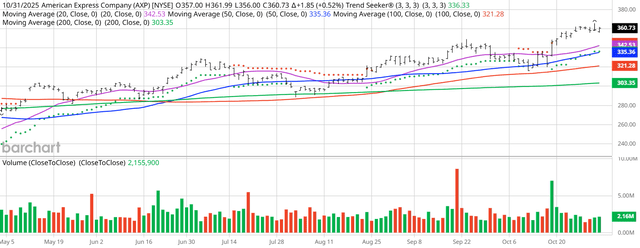

I found today’s Chart of the Day by using Barchart’s powerful screening functions to sort for stocks with the highest technical buy signals; superior current momentum in both strength and direction; and a Trend Seeker “buy” signal. I then used Barchart’s Flipcharts feature to review the charts for consistent price appreciation. AXP checks those boxes. Since the Trend Seeker signaled a new “Buy” on Oct.20, the stock has gained 3.22%.

AXP (Barchart)

Barchart Technical Indicators for American Express

Note: The technical indicators below are updated live during the session every 20 minutes and can therefore change each day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart website when you read this report. These technical indicators form the Barchart Opinion on a particular stock.

American Express hit an all-time high of $365.75 in intraday trading on Oct. 1.

- AXP has a Weighted Alpha of +36.73.

- American Express has a 100% “Buy” opinion from Barchart.

- The stock gained 31.61% over the past year.

- AXP has its Trend Seeker “Buy” signal intact.

- The stock recently traded at $360.73 with a 50-day moving average of $335.36.

- American Express has made 10 new highs and gained 8.60% in the last month.

- Relative Strength Index (RSI) is at 66.29.

- There’s a technical support level around $357.16.

Don’t Forget the Fundamentals

- $248 billion market capitalization.

- 24.09x trailing price-earnings ratio.

- 0.88% dividend yield.

- Revenue is projected to grow 9.30% this year and another 8.86% next year.

- Earnings are estimated to increase 15.83% this year and an additional 12.46% next year.

Analyst and Investor Sentiment on American Express

I don’t buy stocks because everyone else is buying, but I do realize that if major firms and investors are dumping stock, it’s hard to make money swimming against the tide.

It looks like Wall Street analysts are mixed on AXP but not individual investors.

- The Wall Street analysts tracked by Barchart have issued 8 “Strong Buys”, 2 "Moderate Buys", 19 “Hold” and a single "Strong Sell" opinion on the stock with price targets between $280 and $400 – a very wide range.

- Value Line rates the stock “Highest” with a price target of $435 and comments:" American Express seems to be headed for another successful year. "

- CFRA’s MarketScope Advisor rates it a “Buy” with a price target of $440.

- Morningstar thinks the stock is 36% overvalued.

- 6,200 investors following the stock on Motley Fool think the stock will beat the market while 1,176 think it won’t.

- 120,980 investors monitor the stock on Seeking Alpha, which rates the stock a “Hold” and comments:" AXP demonstrates robust profitability and positive stock momentum, its high valuation relative to the sector presents a challenge."

The Bottom Line on American Express

Although Morningstar focuses on the high price-earnings ratio, Wall Street analysts and individual investors seem to be bullish.

More By This Author:

Ahead Of Earnings, Everybody Loves AMD Stock

McKesson - This ‘Strong Buy’ Healthcare Stock Just Hit New All-Time High

Celestica - Strong Electronics Stock With Double Digit Growth Projected

Disclosure: The Barchart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stocks are extremely ...

more