September Seasonals Not Great For The Bulls, But Year-End Looking Good

Image Source: Pixabay

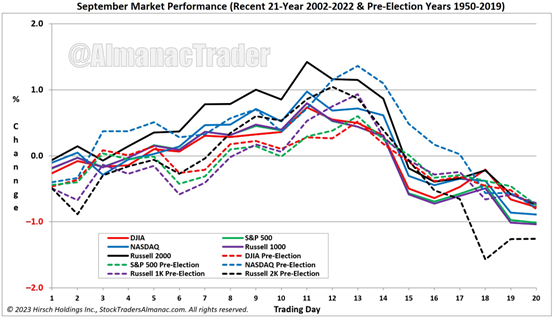

Although the month of September used to open strong, the S&P 500 has declined nine times in the last fifteen years on the first trading day. With fund managers tending to sell underperforming positions ahead of the end of the third quarter, there have also been some nasty selloffs near month-end over the years, explains Jeff Hirsch, editor of The Stock Trader’s Almanac.

Recent substantial declines occurred following the terrorist attacks in 2001 (DJIA: –11.1%), 2002 (DJIA –12.4%), the collapse of Lehman Brothers in 2008 (DJIA: –6.0%), and the US debt ceiling debacle in 2011 (DJIA –6.0%) and in 2022 (DJIA –8.8%).

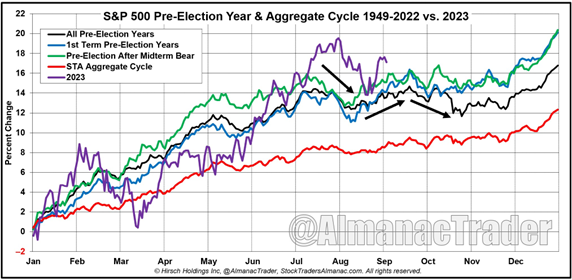

I do not anticipate any major selloff, and I expect to see new highs around year-end. But I do expect some sort of surprise to send stocks into another mild correction before the Q4 rally ensues.

Nobody wants to talk about it or hear about it, but inflation appears to be done cooling. Further hints at higher inflation will likely heat up the “higher-for-longer” chatter and weigh on stocks.

I’m also concerned that we are poised for a September surprise in the financial sector. I would not be shocked if one of the rating agencies comes out and announces a host of bank downgrades, perhaps starting at the top with a big bank. They did warn us back in March during the banking scare and most recently with the Fitch downgrade of the US credit rating.

Either way, expect any weakness to be temporary and for the market to continue to track the seasonal and four-year cycle patterns illustrated in these charts as it has all year and since 2021.

About the Author

Jeffrey Hirsch is editor-in-chief of The Stock Trader's Almanac and Almanac Investor, and the author of The Little Book of Stock Market Cycles (Wiley, 2012), along with Super Boom: Why the Dow Will Hit 38,820 and How You Can Profit from It (Wiley, 2011). A 30-year Wall Street veteran, he took over from founder, Yale Hirsch, in 2001. Mr. Hirsch regularly appears on CNBC, Bloomberg, Fox Business, and many other financial media outlets.

More By This Author:

Bull Vs. Bear: Two Competing Stock Market Strategist Takes For 2023 And Beyond"CLEAR" Progress At Esperion

Mixed Inflation Data. Fed Likely To Sit Tight With Interest Rates Next Week!

Disclaimer: © 2023 MoneyShow.com, LLC. All Rights Reserved.