September Inflation: The Components

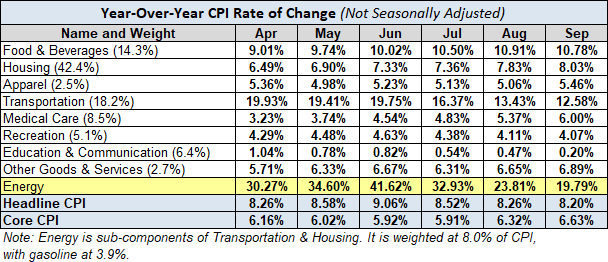

Here is a table showing the annualized change in Headline and Core CPI, not seasonally adjusted, for the past six months. Also included are the eight components of Headline CPI and a separate Energy entry, a collection of sub-indexes in Housing and Transportation.

We can make some inferences about how inflation impacts our personal expenses depending on our relative exposure to the individual components. Some of us have higher transportation costs, others medical costs, etc.

A conspicuous feature in the year-over-year table is the volatility in energy, significantly a result of gasoline prices, which is also reflected in Transportation.

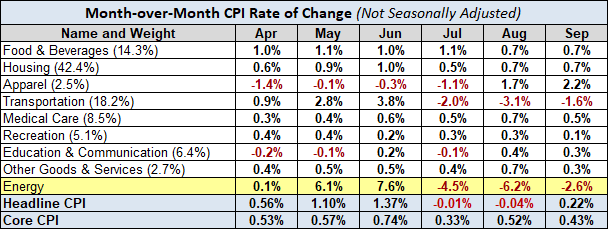

Here is the same table with month-over-month numbers (not seasonally adjusted).

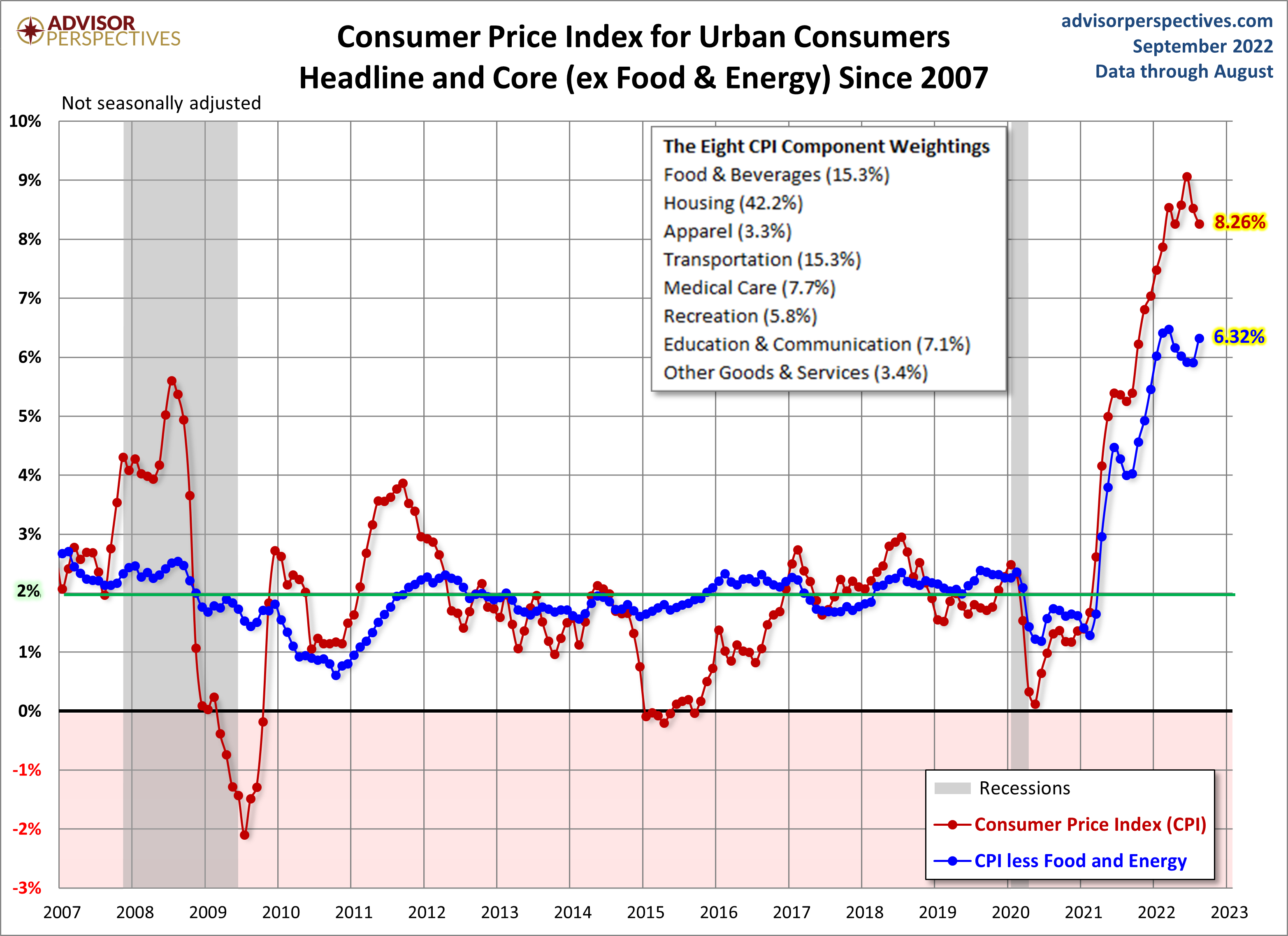

The Trends in Headline and Core CPI

The chart below shows Headline and Core CPI for urban consumers since 2007. Core CPI excludes the two most volatile components: food and energy. We've highlighted the 2% level that the Federal Reserve is targeting for inflation, although the Fed traditionally uses the Personal Consumption Expenditure (PCE) price index as their preferred inflation gauge. In August 2020, Fed Chairman Jerome Powell introduced a policy that not only allows for a level above 2% but welcomes it.

"In order to anchor longer-term inflation expectations at this level, the Committee seeks to achieve inflation that averages 2 percent over time, and therefore judges that, following periods when inflation has been running persistently below 2 percent, appropriate monetary policy will likely aim to achieve inflation moderately above 2 percent for some time." See Statement on Longer-Run Goals and Monetary Policy Strategy update (revised January 2021).

Year-over-year Core CPI (the blue line) was above 2% from the end of 2015 through February 2017 only to flip flop again until the COVID-19 pandemic in April 2020, when Core CPI fell below 2%. The more volatile Headline CPI has spent part of the last five years under the 2% lower benchmark, and much of the volatility in this metric has been the result of broad swings in gasoline prices (more on gasoline here). Beginning in April 2021, both Core and Headline were above the 2% benchmark.

We are now seeing the highest Headline inflation rates since the second of the two recessions in the early 1980s. Headline inflation was at today's rates or higher between 1978-1982.

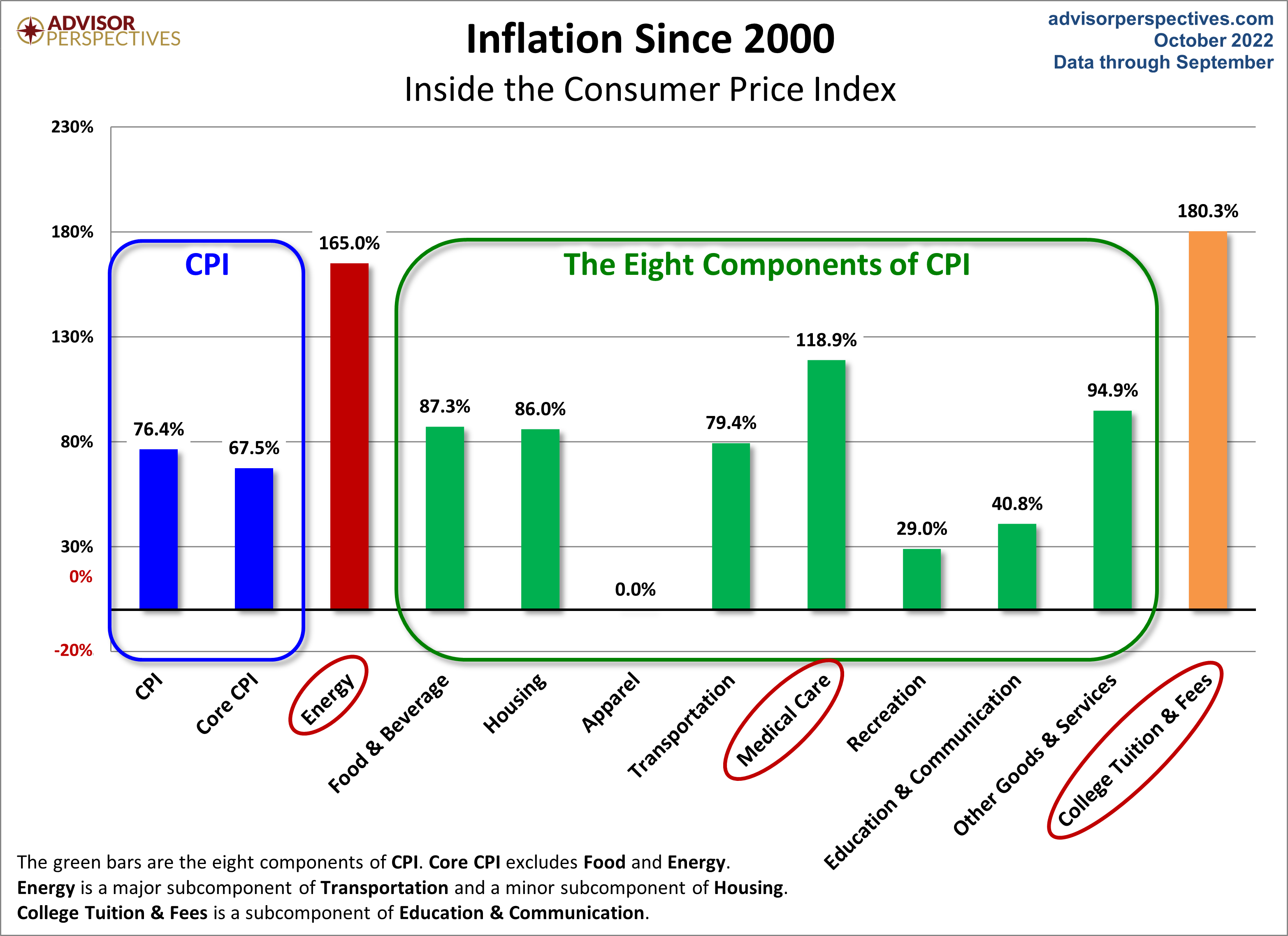

For a longer-term perspective, here is a column-style breakdown of the inflation categories showing the change since 2000.

More By This Author:

Cryptocurrencies Through Wednesday, Oct. 19New Residential Housing Starts Down 8.1% In September

New Residential Building Permits: Up 1.4% In September