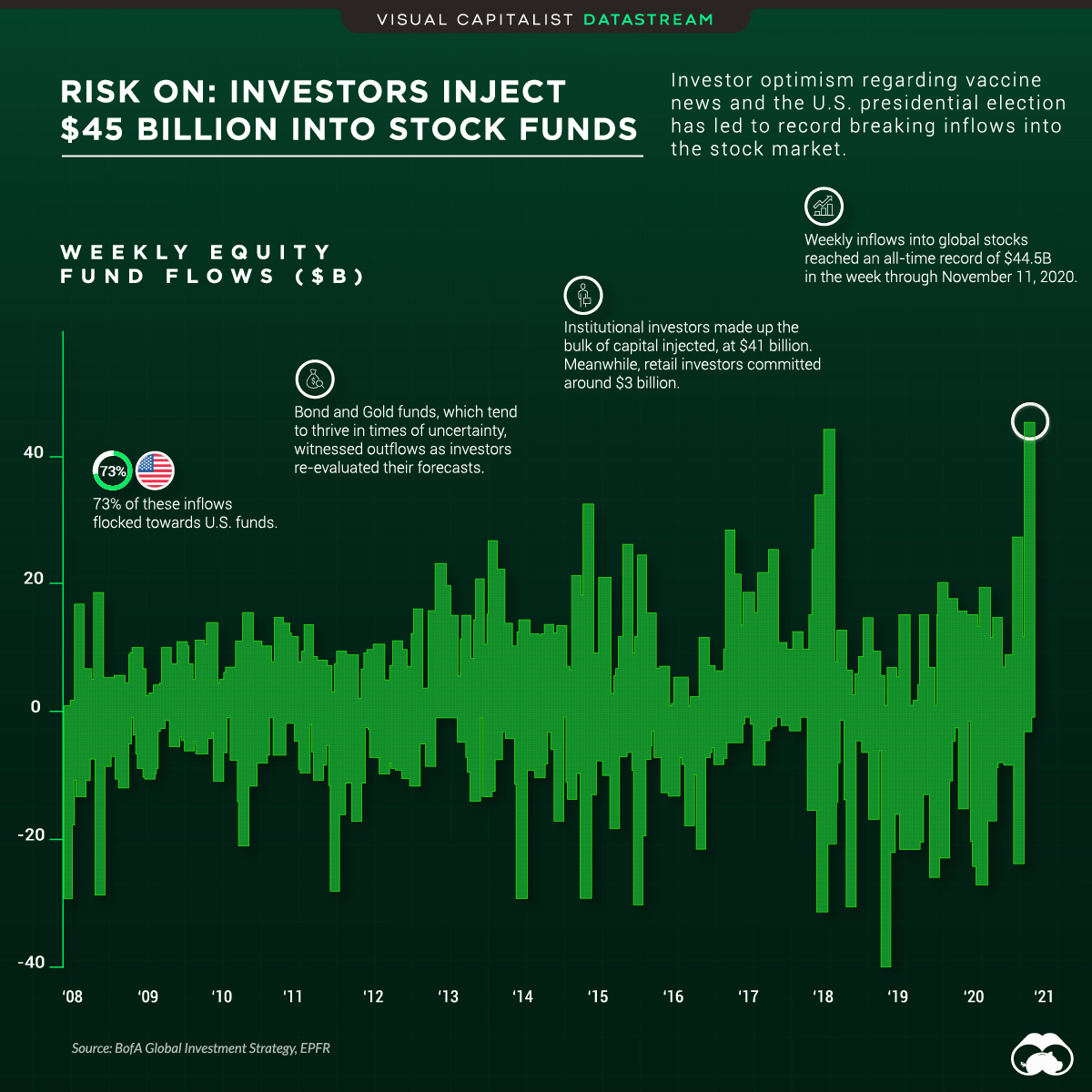

Risk On: $45 Billion Injected Into Stock Market Funds In One Week

Risk On, Risk Off

Few events can grasp the world’s attention in the same manner the pandemic and U.S. presidential election have. This attention also sparks conflict and discord—and thus, for some time, they’ve been identifiable risks as it pertains to financial markets.

The uncertainty that arises in relation to these two events is subsiding. The election is over and the roll out of vaccines has commenced.

For Wall Street and their forward looking estimates, greener pastures appear to be on the horizon. As a result, this has translated into record-breaking inflows into stock market funds near the end of 2020.

Stock Market Funds

In the week through November 11, 2020, $44.5 billion of stock market inflows were injected into markets through various funds—the largest weekly inflow into equity funds ever recorded.

The appetite for risk is also reflected in the options market, where call option volume is breaking all-time highs.

Taking a step back, here are the funds with the largest inflows in 2020:

| Ticker | Fund Name | 2020 Net Inflows ($ Millions) |

|---|---|---|

| VTI | Vanguard Total Stock Market ETF | $32,623 |

| VOO | Vanguard S&P 500 ETF | $21,431 |

| BND | Vanguard Total Bond Market ETF | $17,217 |

| QQQ | Invesco QQQ Trust | $16,733 |

| VXUS | Vanguard Total International Stock ETF | $16,002 |

| GLD | SPDR Gold Trust | $15,129 |

| LQD | iShares iBoxx USD Investment Grade Corporate Bond ETF | $15,020 |

| VCIT | Vanguard Intermediate-Term Corporate Bond ETF | $14,790 |

| AGG | iShares Core U.S. Aggregate Bond ETF | $12,475 |

| BNDX | Vanguard Total International Bond ETF | $11,929 |

One Funds Inflow Is Another Funds Outflow

Gold and fixed income, which tend to thrive in times of uncertainty, saw net outflows during the same week. Fixed income in particular has fared worse. The spread between U.S. bond and U.S. stock ETFs is widening, with almost $3 trillion more dollars in stock funds.

As Wall Street re-evaluates for rosier forecasts ahead, this may further widen the growing gap between these respective assets. Despite a volatile year where markets whipsawed, the S&P 500 finished 2020 up 16%, a boost from its historical average of 10-11%.

(Click on image to enlarge)

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more

Wow!