Right For The Wrong Reasons

Image Source: Pexels

Here are some claims I’ve been seeing discussed in the more thoughtful sections of the internet.

-

Austin is seeing high levels of housing construction and falling prices. This shows that the supply and demand model does apply to housing.

-

It’s bad when the government takes a stake in private corporations.

-

The US should not set up a sovereign wealth fund.

-

The Fed should remain independent.

-

The government should reduce the budget deficit by ending the practice of paying tens of billions of dollars in interest on bank reserves.

I view these claims as being mostly correct, but for the wrong reasons. Here are my own views on the issues above:

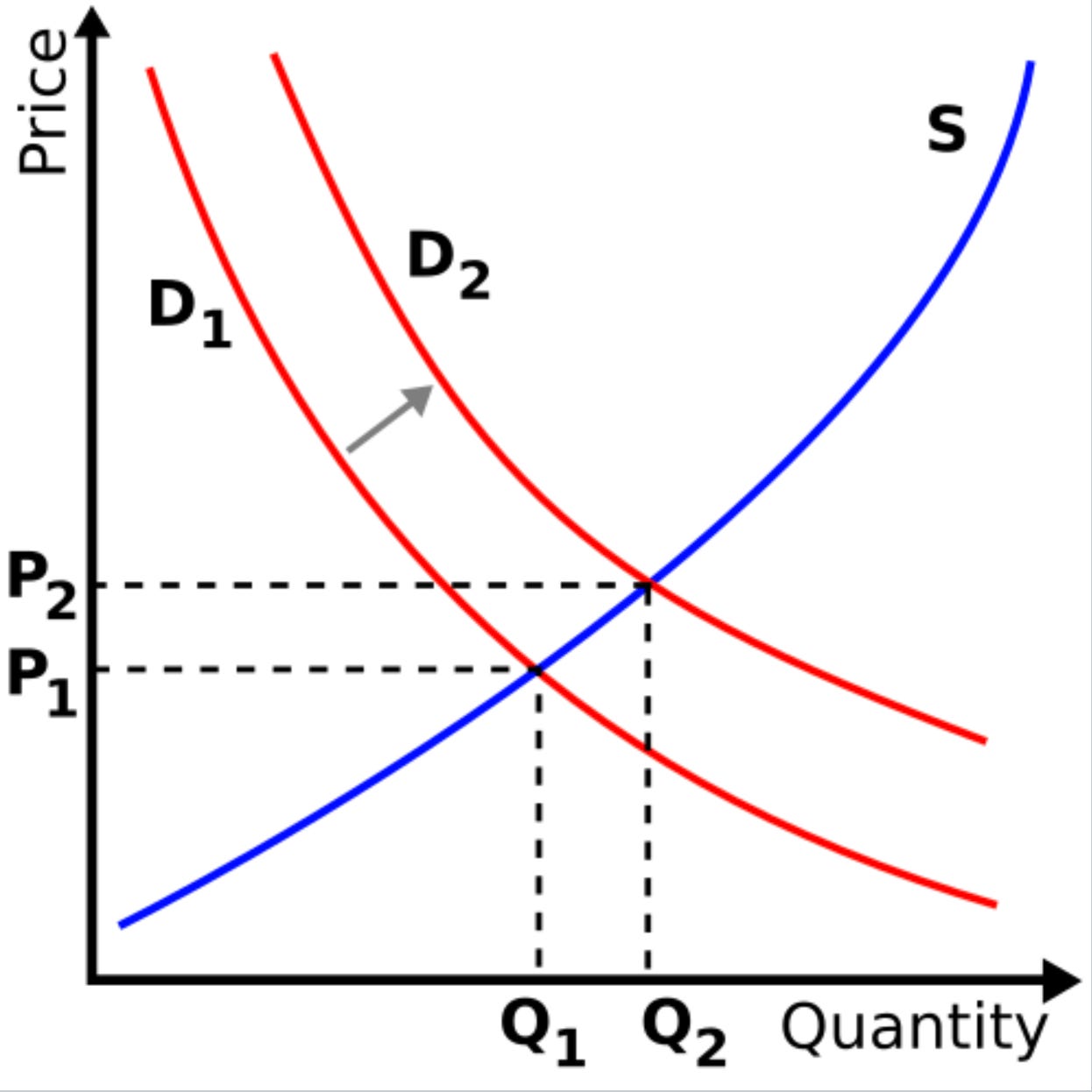

1. The supply and demand model does not predict any particular correlation between housing prices and housing construction. Thus, an increase in housing demand would be expected to result in both higher prices and higher construction.

Those claiming that high levels of construction have brought down prices are probably correct, but only because the construction was generated by a supply shift, that is, by policies to encourage housing construction in Austin. Changes in the quantity of construction prove nothing.

Why be so picky on this point? I worry that at some point in the future there might be a situation where both housing prices and housing construction rise at the same time in a given city, and NIMBYs use that as evidence that supply and demand doesn’t apply to housing.

2. The mere fact that a government takes a stake in a private corporation is not necessarily a bad thing. Rather the real problem is that government ownership is usually associated with other bad public policies, such as subsidies and protection. In the absence of subsidy and protection, I see no reason to oppose government ownership. Let a thousand flowers bloom. Government should be free to compete with private firms.

Before people start accusing me of being a socialist, let me emphasize that I would oppose the US government or the City of New York taking a stake in a private business. That’s because I believe they would engage in some combination of subsidy and protectionism—barriers to entry. Because governments tend to be inefficient, it is generally the case that government-owned firms are given preferential treatment. Indeed, firms are often nationalized precisely because the government wishes to distort the market with subsidies and barriers to entry.

Why be so picky on this point? I worry that socialists might cite examples of successful government-owned firms such as Singapore Airlines. But Singapore Airlines did not receive government subsidies or protection from foreign competition. In other words, although Singapore Airlines was government owned, they operated like a private firm. I have no problem with that sort of public ownership. But that only works in non-corrupt countries, which obviously doesn’t apply to the US.

3. There’s nothing wrong with governments having a sovereign wealth fund. They seem to work fine in places like Singapore, Norway and the UAE. So why do I oppose the US creating a sovereign wealth fund? The answer is simple; for a sovereign wealth fund to makes sense the sovereign must have some . . . you know . . . wealth. But the US government is completely broke, indeed we are deeply in debt depth. The proposals I’ve seen involve the US government borrowing even more money to invest in the stock market. Eh, what could go wrong? If we do go that route, I suggest we call it our “Sovereign Ponzi Scheme”.

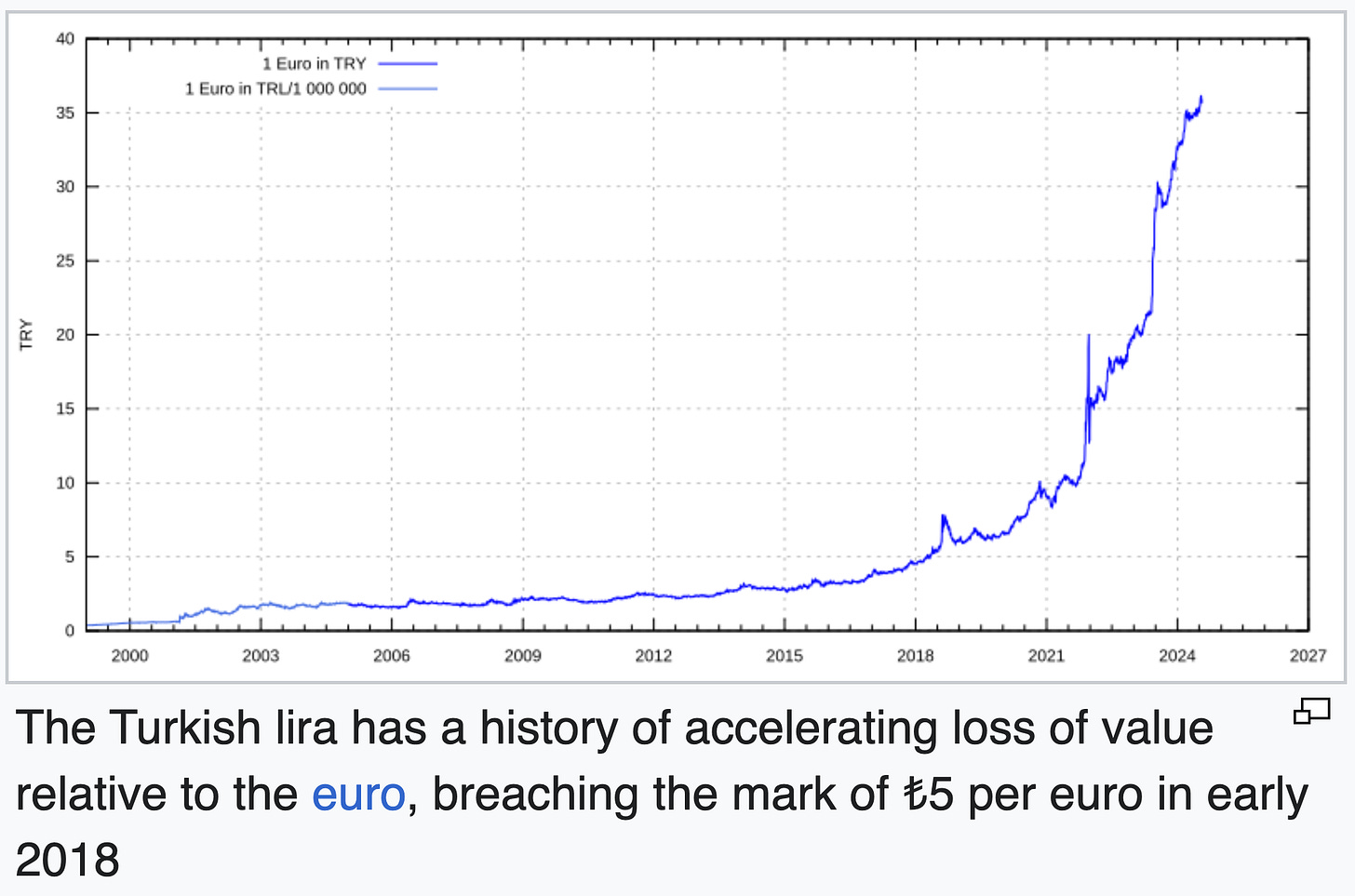

4. Yes, the Fed should remain independent. But that’s not because independent central banks are necessarily better than non-independent central banks. Rather the real problem is that aggressive attempts to end central bank independence are often correlated with attempts to implement populist monetary policy regimes.

Once and a while, populist monetary policy actually makes sense. The most famous example occurred in the early 1930s, when the Roosevelt administration weakened central bank independence in a variety of ways. But we are no longer on the gold standard, and populist monetary policies are more likely to do harm than good in a fiat money world, as we saw during the late 1960s and 1970s. Turkish president Erdogan is a big fan of populist monetary policies:

(Click on image to enlarge)

In my previous post (“Less Wrong”), I pointed out that the same term can cover a multitude of sins. In my view, Nixon’s attack on the Fed independence was far less egregious than Trump’s attack on Fed independence, even if its direct consequences ended up being far more harmful than Trump’s are likely to be. Nixon tried to influence Burns within the existing system. Trump seems determined to reshape the Fed.

[To be clear, I don’t expect Turkish inflation. Trump will probably end up having very little influence on Fed policy.]

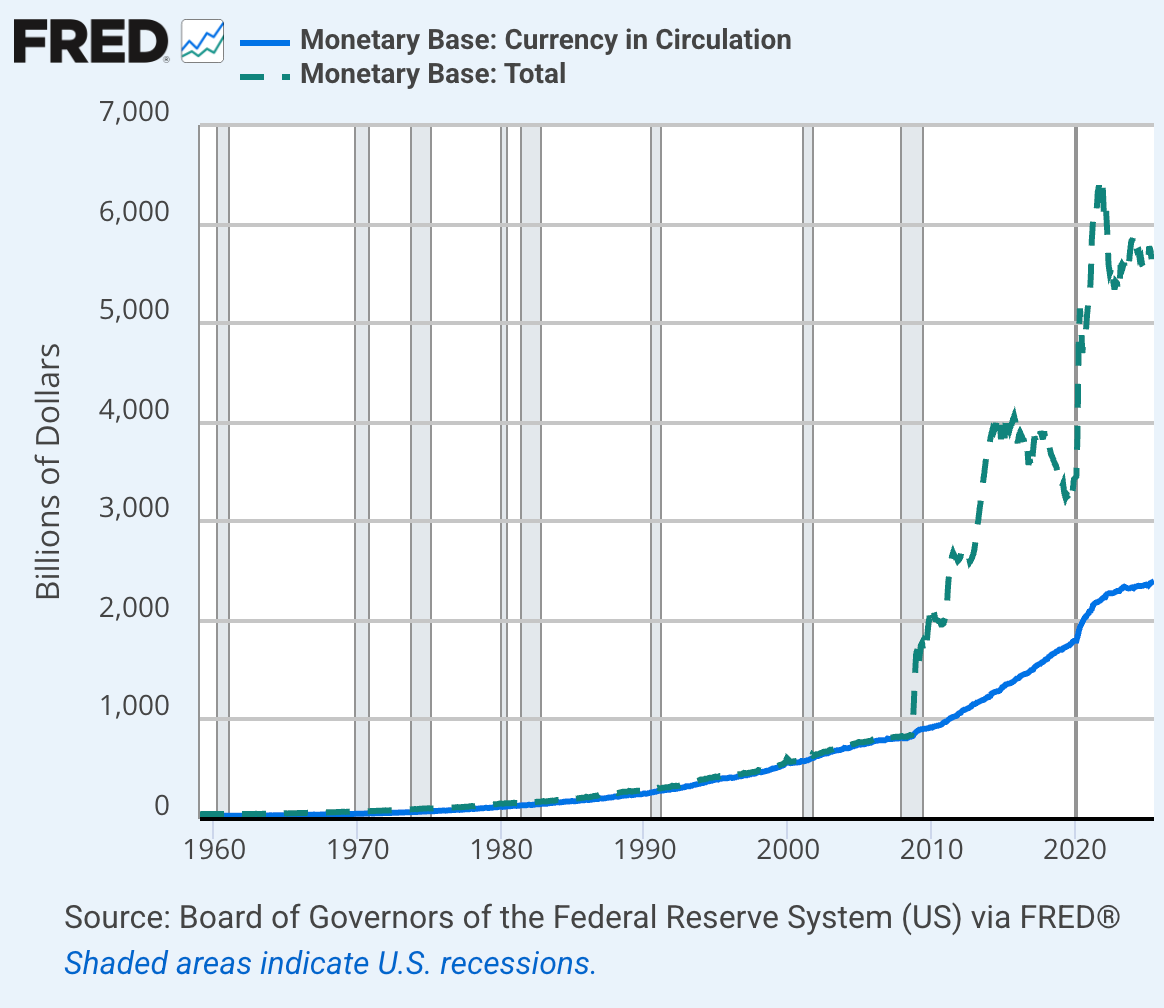

5. It does make sense to stop paying interest on bank reserves and go back to the pre-2008 system where the monetary base was 98% currency. But ending IOR would probably not save any money in the long run, as you’d merely be swapping one government liability (T-bonds) for another (interest-bearing reserves).

(Click on image to enlarge)

The actual reason for ending IOR is that it moves the government slightly away from an interest rate-centric approach to monetary policy. The Fed would probably still be influencing the fed funds rate (as it did prior to 2008), but it would no longer be directly setting interest rates on reserves. Ultimately, I’d like to move to a system where the government adjusted the monetary base (which would be 98% cash) to affect NGDP expectations and let markets set interest rates.

Prior to 2008, changes in the supply and demand for cash determined NGDP, which drove the business cycle and inflation.

More By This Author:

The JugglerA Serious Look At Interest Rates

Federalism And Housing Policy