Revised US GDP Nowcast For Q4 Still Reflects Modest Slowdown

The US economy remains on track to end the year with a moderate increase in output, according to the median Q4 GDP estimate based on a set of nowcasts published by several sources. Recession risk, as a result, is still a low-probability risk for the near term. The question is whether a sharp change in US economic policy in 2025 will change the calculus?

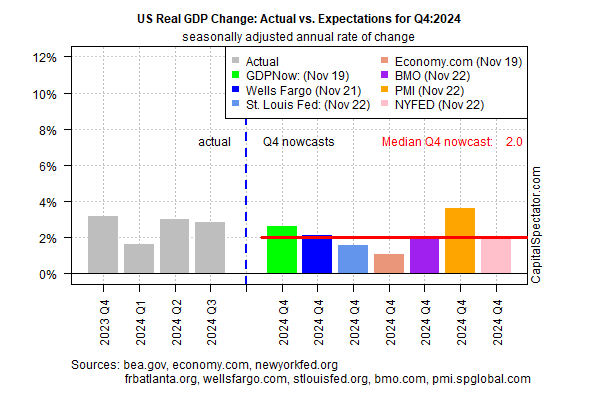

For the immediate future, the US economy is humming along at a respectable pace. Real (inflation-adjusted) growth is projected to increase 2.0% in Q4 for the annualized comparison, based on the median. The estimate is down from Q3’s 2.8% advance. Today’s Q4 nowcast, if correct, will mark the second straight quarter of modestly softer growth.

Today’s updated median nowcast is unchanged from the previous estimate, published on Nov. 18. The stability of recent revisions lends a degree of confidence for assuming that the upcoming Q4 report (Jan. 30) will match or be near the current estimate. One way to read the current nowcast is that the economy is normalizing from pandemic effects at a 2%-plus growth rate.

Beyond Q4, however, there’s renewed uncertainty about how the Trump 2.0 economic agenda will reshuffle macro conditions for the US and beyond. The incoming administration is expected to prioritize sharply higher tariffs, tax cuts, deregulation and deporting millions of immigrant workers. Analysts are debating how aggressively the incoming administration will pursue each of the items on its agenda. Meanwhile, economists advise that the overall mix is expected to be inflationary in some degree.

Alan Blinder, a former vice-chairman of the Federal Reserve, predicts: “the new Trump policies might add 2% to 3% to total inflation over two to three years, a percentage point a year.”

Another challenge for the economy in 2025: rising government debt that’s been a low priority for both political parties in recent years. Trump and many top Republicans are eager to extend his 2017 cut law, which could cost $4.6 trillion, according to a projection by the Congressional Budget Office (CBO). Republicans dispute the estimate as they prepare to enact a tax package that they say is pro-growth.

On Tuesday Trump doubled-down on his plans for imposing tariffs on trading partners, writing that he will implement new import duties on three key US trading partners: China, Mexico and Canada once he takes office.

As for monitoring Q4 economic conditions, there’s a growing divergence in some indicators. Yesterday’s October update of the Chicago Fed National Activity Index shows that US economic activity slipped in October to its weakest reading since April.

By contrast, PMI survey data for November indicates that output growth accelerated. “The business mood has brightened in November, with confidence about the year ahead hitting a two-and-a-half year high,” says Chris Williamson, chief business economist at S&P Global Market Intelligence. Aggregating various GDP nowcasts helps mitigate the noise and on that score it’s reasonable to assume that the 2% estimate for Q4 is a reasonable guestimate. The outlook for Q1 and beyond, by contrast, may be entering a relatively extreme state of flux.

More By This Author:

US Stocks Continue To Lead Markets By Wide Margin In 2024

US Continuing Jobless Claims Rise To 3-Year High. Time To Worry?

Is The Relatively Weak Trend For US Private Payrolls A Warning?

Disclosure: None.