Retails Sales And Vehicle Sales Hold

Image source: Pixabay

“Davidson” submits:

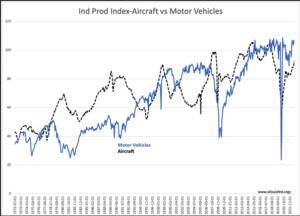

Real Retail Sales with a good history of forecasting recessions hold at recent levels. Gasoline and clothing retailers saw declines which correlate to falling prices while vehicle sales show a surprise positive indicating some easing of supply issues. The Ind Prod Index-Aircraft vs Motor Vehicles hinted at rising activity 3mos ago. These indices incorporate whole products and parts manufacturing trends. Media and corporate reporting have focused on EV sales for the automobile sector and the resumption of manufacturing and deliveries for Boeing’s Dreamliner and 737Max. The net/net trends in manufacturing are one of the supply line issues easings.

The Trucking Tonnage Index(seasonally adjusted) indicates a rising goods transport trend. Together with the rise in vehicle sales, the underlying post-COVID economic demand remains in an uptrend despite the rise in inflation and rates. Meanwhile, the market and media continue to focus on the COVID-favored issues as predicting recession with their dramatic price declines from wildly over-priced (many remain priced at 10x revenue with no sign of profitability near-term). Insiders have signaled for 2yrs they believed their businesses are undervalued. Their buying continues but at much lower activity levels indicating they have likely exhausted their capital to the point of being unbalanced owners. Yet, there remain buyers at prices that have not materially moved higher since we emerged from lockdowns. These same companies have reported for several quarters expanding robust demand with expectations of positive surprises through the rest of 2022 and into 2023 with no investor interest.

In my experience, companies that report positive surprises in the current period of pessimism are likely to draw substantial investor interest. With several years of demand still ahead, they are likely to become the new favored Momentum issues. Simply because they have been so undervalued, many are in the range of 0.25-0.50x revenue when in better times they saw 2x-4x pricing in normalized periods. These issues comprise the 70%+ of issues ignored during the COVID panic into SPACs, IPOs chasing the ‘new, new thing’. A sea change towards these neglected but very viable economically sensitive issues has the potential to drive the SP500 substantially higher even with declines in the dominant COVID-favored.

Despite the continuous stream of pessimistic news on inflation, US economic growth continues to recover. Growth can continue even at rates in the 4%-6% range as these levels remain cheap relative to inflation at 8% and corporations have little difficulty passing through costs. Buy economically sensitive equities and avoid COVID-favored issues. By all means, avoid Fixed Income.

More By This Author:

Oil Inventories Continue Their Downward MarchWhat Is Causing “Inflation”?

The Dollar, Crypto And Meme Stocks

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more