Retail Sales Unexpectedly Soared In August, As Gasoline Costs Jumped

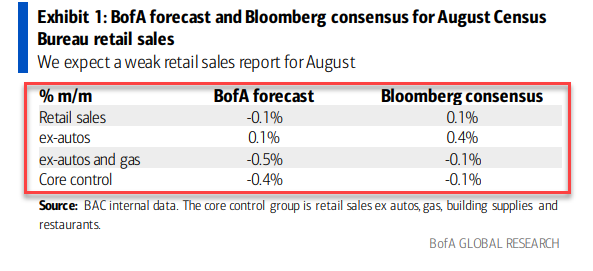

Following July's buying spree, expectations are for a slowdown in retail sales in August as BofA omnipotent analysts forecast a decline of 0.1% MoM (worse than the consensus +0.1% MoM) with gas prices rising as the only saving grace (ex-autos and gas expected to be down 0.5% MoM).,

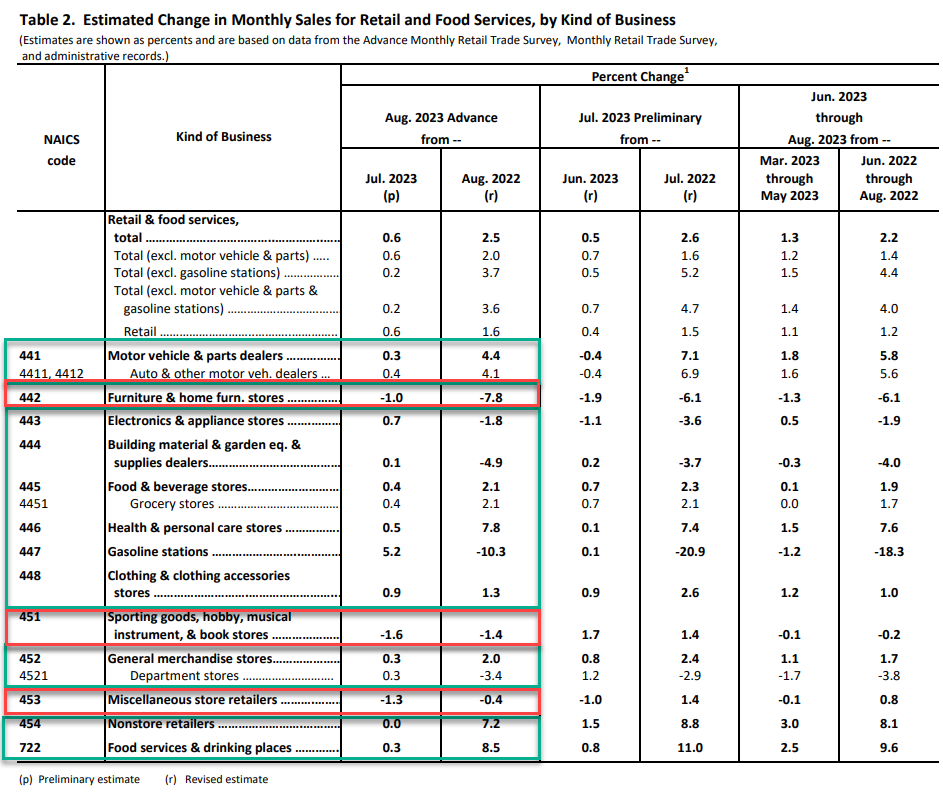

But for once, BofA was wrong (or rather the Census Bureau was given clear political marching orders from the senile administration) as the party kept going in August with retail sales exploding 0.6% MoM (smashing the +0.1% exp) - rising for the 5th month in a row...

Source: Bloomberg

That is a 2.5% YoY gain (thank the lord for credit cards, right?)

Retail sales beat across the board with Core (ex-autos and gas) up 0.2% MoM (+0.1% MoM exp) and the 'control group' - which is used for GDP calcs - rose 0.1% MoM (vs expectations for a 0.1% decline).

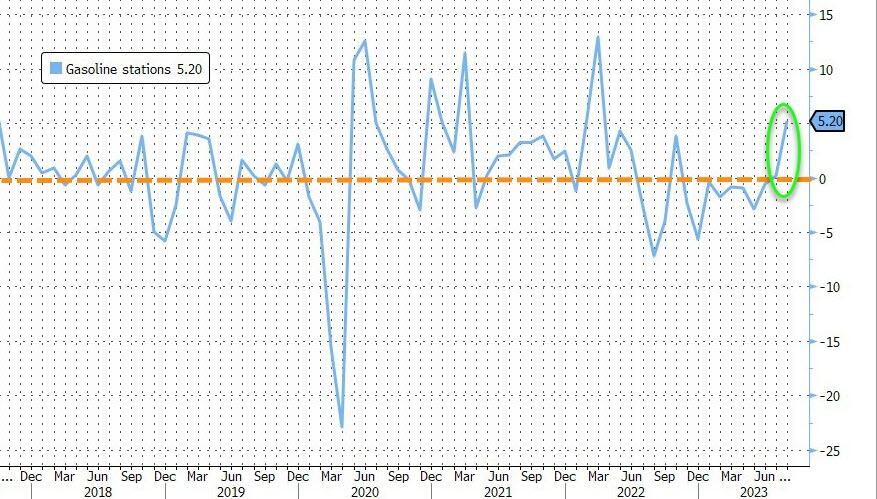

Under the hood, the big driver was a 5.2% MoM jump in spending at gasoline stations

Source: Bloomberg

And non-store retailers were flat in August after surging in July on Amazon's Prime Day

(Click on image to enlarge)

Finally, remember this data is 'nominal' not 'real'. So be careful at how excited you get about this data.

More By This Author:

WTI Holds Yesterday's Gains Despite Big Crude/Product Builds, US Production HikeUS CPI Surges More Than Expected In August As Gas Prices Soar

Bitcoin, Banks, & Black Gold Bid As Tech Stocks Tumble Ahead Of CPI

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more