Retail Sales & Producer Prices Drop In February

With CPI having slapped some macro-sense back into people's minds after a week focused on SVB's fallout, this morning's PPI and Retail Sales data could further that trend - despite Credit Suisse grabbing everyone's attention today so far.

Producer Prices unexpectedly soared in January and analysts expected February data to show a slowdown in an acceleration of prices. It did dramatically, dropping 0.1% MoM (+0.3% MoM exp) to its lowest YoY since March 2021...

(Click on image to enlarge)

Source: Bloomberg

The pipeline for PPI is also now dragging the headline even lower...

(Click on image to enlarge)

Source: Bloomberg

Who could have seen that coming?

There is now less pipeline inflation than final; next 2-3 months PPI will accelerate to downside pic.twitter.com/t8C01boDGv

— zerohedge (@zerohedge) February 16, 2023

And PPI is now leading CPI lower...

(Click on image to enlarge)

Source: Bloomberg

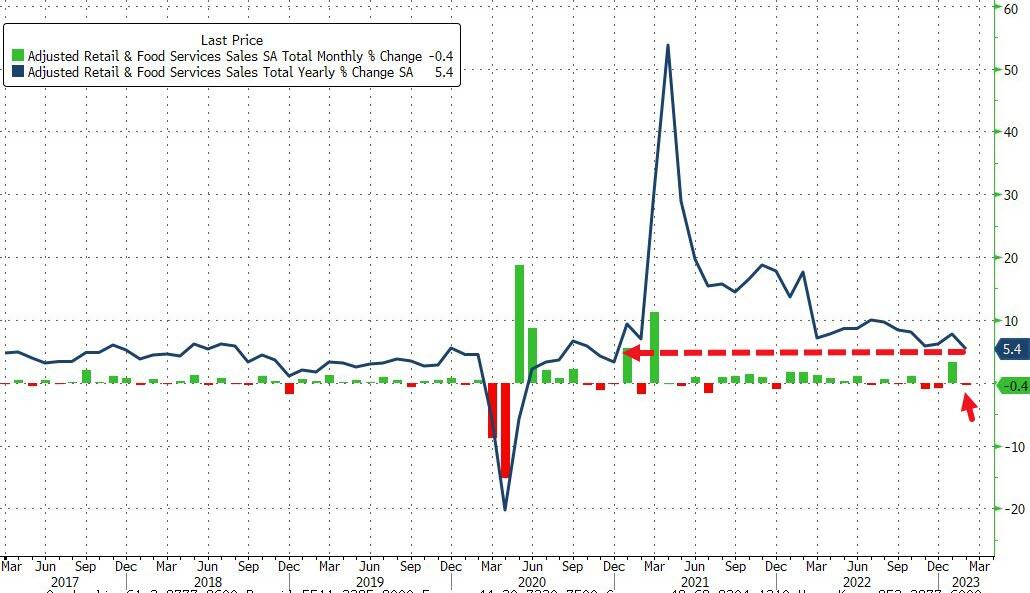

With price rises slowing, retail sales (measured nominally) were expected to shrink in February and they did, down 0.4% MoM as expected...

(Click on image to enlarge)

Source: Bloomberg

That is the lowest YoY rise in retail sales since Dec 2020...

Verdict: January's spending spree was a one-time outlier

— zerohedge (@zerohedge) March 3, 2023

"The latest BAC card spending data suggest that the acceleration in consumer spending might have been more short-lived than we were expecting. Card spending per household slowed to 1.3% y/y in the week ending Feb 25" - BAC pic.twitter.com/MPyyV89lWD

Excluding gasoline and autos, retail sales were flat.

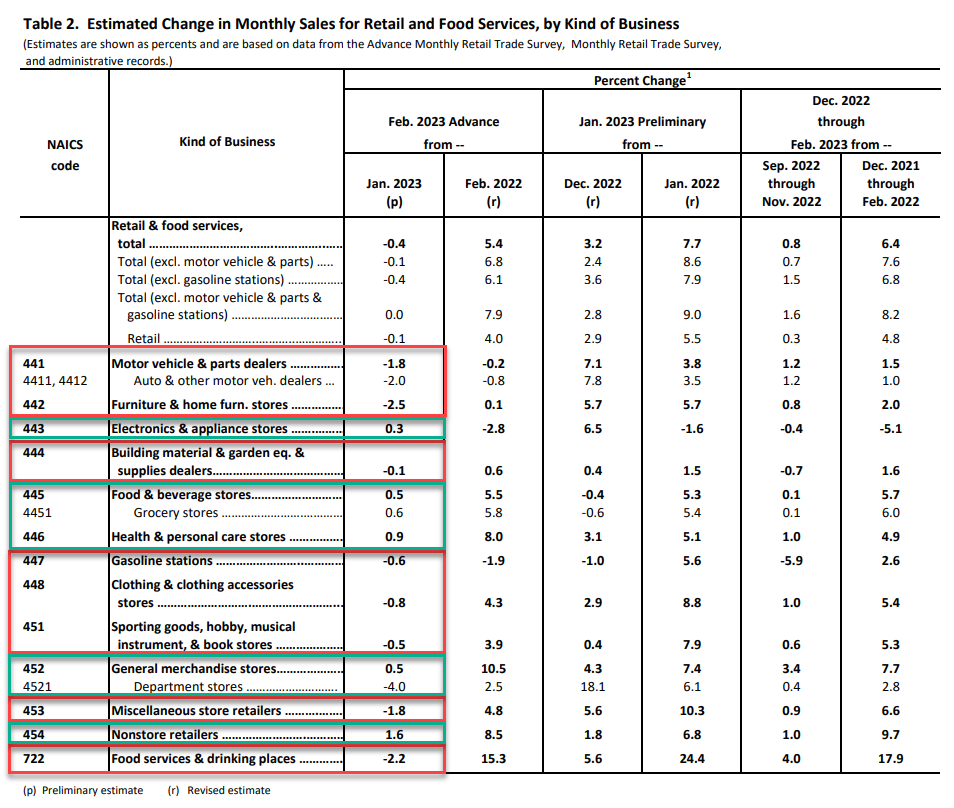

Nine out of 13 retail categories fell last month, led by furniture and restaurants.

(Click on image to enlarge)

The report showed vehicle sales declined by 1.8% in February. The value of sales at gasoline stations decreased by 0.6%, likely reflecting lower prices in the month.

It looks like the 'lag' from monetary policy is catching us up.

More By This Author:

Cathie Wood's ARKK Recorded Largest Inflows In Years As SVB CollapsedShelter Inflation Hits Record High As Americans' Real Wages Drop For 32nd Straight Month

Nomura Calls For Rate Cut At Next FOMC Meeting, End Of QT

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more