Record Debt Payments And Rising Unemployment

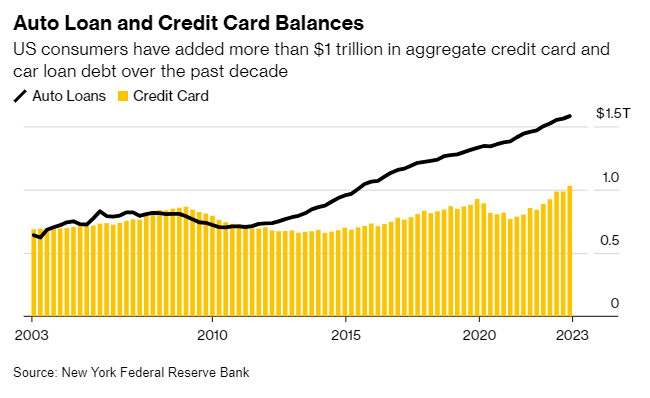

US household debt has surpassed a fresh record of $17.1 trillion. $12 trillion is in mortgages (more than twice the 2006 bubble top), $1.6 trillion in auto loans, and over $1 trillion in credit card debt, all with the highest interest rates in 22 years and rising unemployment. Courtesy of Bloomberg, the chart below shows the trend in auto (black line) and credit card balances (yellow) since 2003.

The discussion below lays out the economic implications well.

Ted Oakley interviews Danielle DiMartino Booth discussing current Fed policy, employment implications, and debt implications. Here is a direct video link.

Video Length: 00:38:21

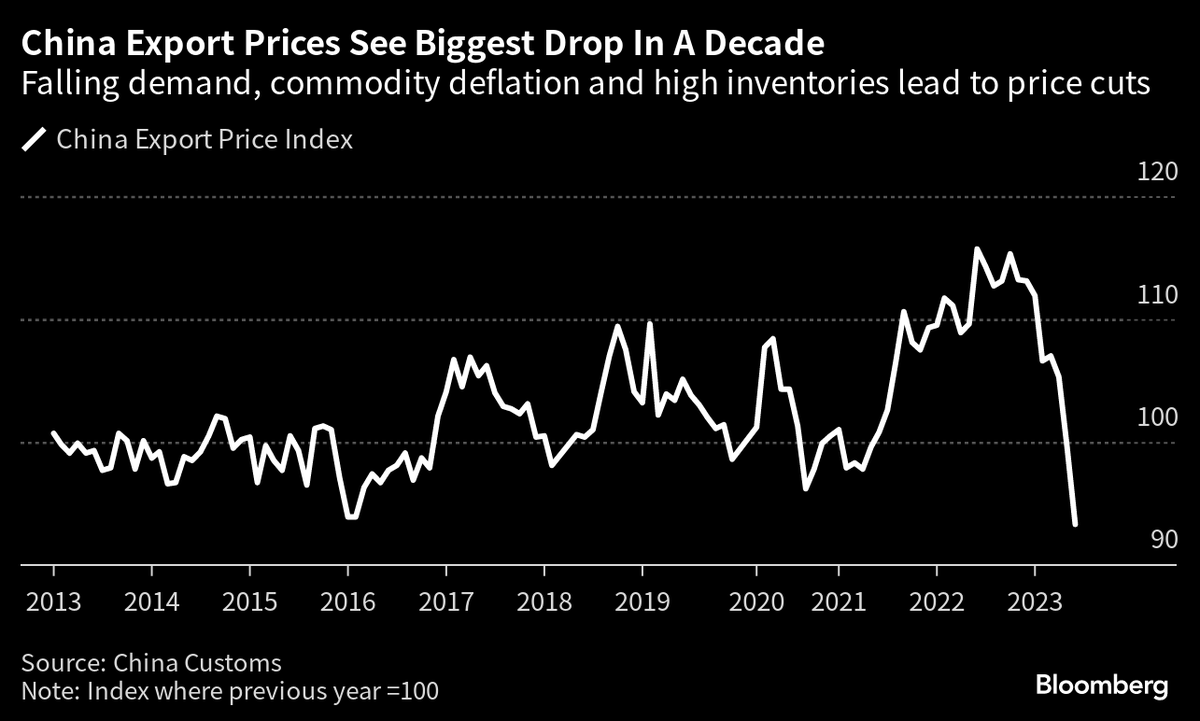

Not just in America, China’s debt crisis is also compounding, see China’s largest surviving developer, sinks into crisis. Meanwhile, the year-to-date freefall in China’s export prices is shown below as softening consumer demand and inflated inventories force prices lower for the world’s second largest economy #disinflation. See China slides into deflation as consumer, factory prices drop.

More By This Author:

No Time For Delusions“Normalized” Rates And Record Debt Mean Tough Times

Homeownership Becoming A Nightmare For Many