Record-Breaking 20Y Treasury Auction Sends Yields Tumbling

It's not as if the bond market needed another reason to send yields sharply lower after the BOJ last night, and the trifecta of recessionary prints today (huge misses in PPI, retail sales, and industrial production) had already hammered yields, but it got it anyway moments ago when today's sale of $12BN in 20Y paper was nothing short of blockbuster with at least one new record set.

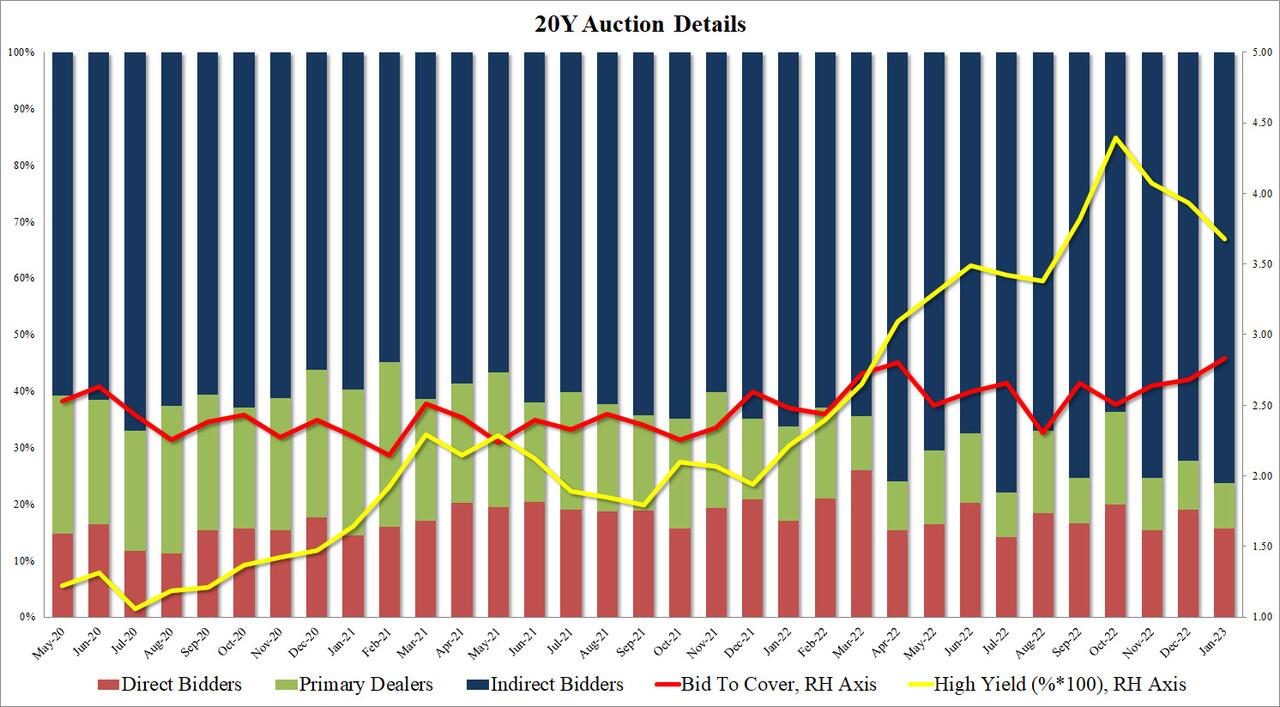

The high yield of 3.678% was not only sharply lower than last month's 3.935% and a far cry from the 4%+ auctions in October and November but also stopped through the When Issued 2.705 by 2.7bps, tied for the third biggest stop through on record in the 20Y auction's history.

The bid to cover was even more remarkable: jumping from last month's 2.68, the January BTC was 2.83, the highest on record and above the previous all-time high of 2.80 in April 2022.

The internals were also stellar with Indirects awarded 76.25% just shy of another all-time high (hit in July 22 when it came at 78.0%) and with Directs awarded 15.6%, below the recent average of 17.2%, Dealers were left holding just 8.1%, which was also just shy of the record low 7.9% hit in July 2020.

(Click on image to enlarge)

Overall, this was a stellar, record-breaking 20Y auction, and no wonder why the 10Y yield dumped from 3.43% to 3.38% after news of the stellar demand for today's paper hit.

(Click on image to enlarge)

More By This Author:

Stocks & Crypto Are Suddenly Puking...

Wall Street Reacts To Ryan Cohen Going Activist On China's Tech Giant Alibaba

Goldman Tumbles After Big Revenue, EPS Miss; Loan Loss Provisions Soar 183%

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more