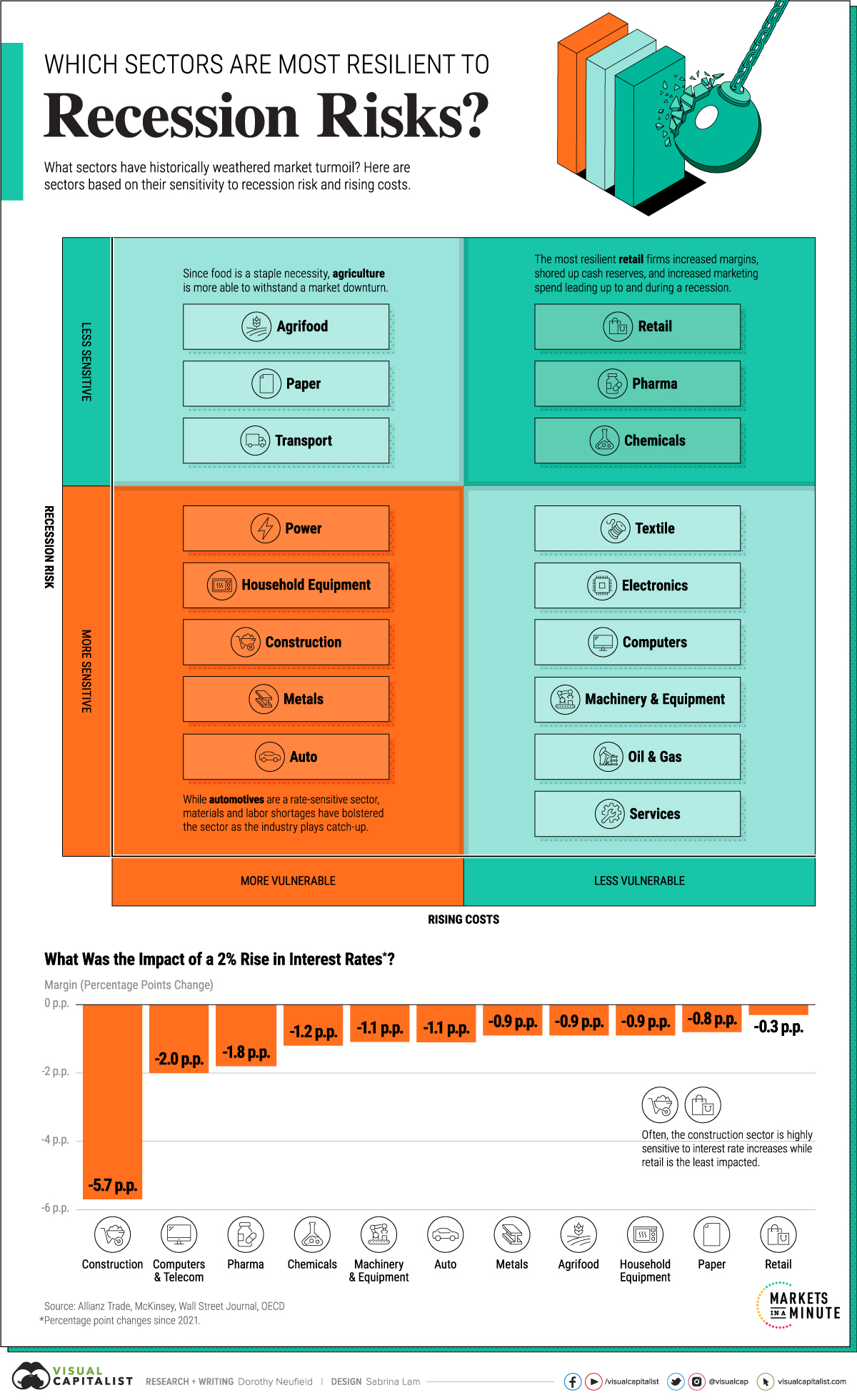

Recession Risk: Which Sectors Are Least Vulnerable?

(Click on image to enlarge)

In the context of a potential recession, some sectors may be in better shape than others.

They share several fundamental qualities, including:

- Less cyclical exposure

- Lower rate sensitivity

- Higher cash levels

- Lower capital expenditures

With this in mind, the above chart looks at the sectors most resilient to recession risk and rising costs, using data from Allianz Trade.

Recession Risk, by Sector

As slower growth and rising rates put pressure on corporate margins and the cost of capital, we can see in the table below that this has impacted some sectors more than others in the last year:

| Sector | Margin (p.p. change) |

|---|---|

Retail Retail |

-0.3 |

Paper Paper |

-0.8 |

Household Equipment Household Equipment |

-0.9 |

Agrifood Agrifood |

-0.9 |

Metals Metals |

-0.9 |

Automotive Manufacturers Automotive Manufacturers |

-1.1 |

Machinery & Equipment Machinery & Equipment |

-1.1 |

Chemicals Chemicals |

-1.2 |

Pharmaceuticals Pharmaceuticals |

-1.8 |

Computers & Telecom Computers & Telecom |

-2.0 |

Construction Construction |

-5.7 |

*Percentage point changes 2021- 2022.

Generally speaking, the retail sector has been shielded from recession risk and higher prices. In 2023, accelerated consumer spending and a strong labor market has supported retail sales, which have trended higher since 2021. Consumer spending makes up roughly two-thirds of the U.S. economy.

Sectors including chemicals and pharmaceuticals have traditionally been more resistant to market turbulence, but have fared worse than others more recently.

In theory, sectors including construction, metals, and automotives are often rate-sensitive and have high capital expenditures. Yet, what we have seen in the last year is that many of these sectors have been able to withstand margin pressures fairly well in spite of tightening credit conditions as seen in the table above.

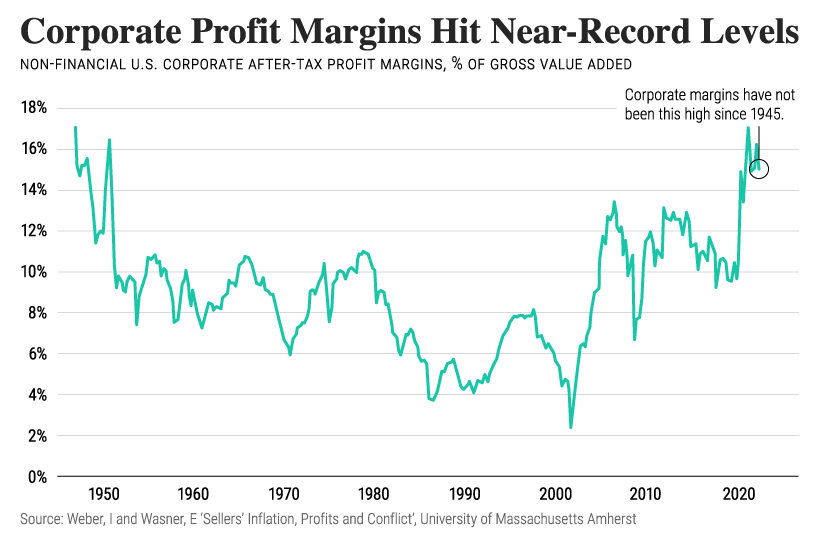

What to Watch: Corporate Margins in Perspective

One salient feature of the current market environment is that corporate profit margins have approached historic highs.

As the above chart shows, after-tax profit margins for non-financial corporations hovered over 14% in 2022, the highest post-WWII. In fact, this trend has been increasing over the past two decades.

According to a recent paper, firms have used their market power to increase prices. As a result, this offset margin pressures, even as sales volume declined.

Overall, we can see that corporate profit margins are higher than pre-pandemic levels. Sectors focused on essential goods to the consumer were able to make price hikes as consumers purchased familiar brands and products.

Adding to stronger margins were demand shocks that stemmed from supply chain disruptions. The auto sector, for example, saw companies raise prices without the fear of diminishing market share. All of these factors have likely built up a buffer to help reduce future recession risk.

Sector Fundamentals Looking Ahead

How are corporate metrics looking in 2023?

In the first quarter of 2023, S&P 500 earnings fell almost 4%. It was the second consecutive quarter of declining earnings for the index. Despite slower growth, the S&P 500 is up roughly 15% from lows seen in October.

Yet according to an April survey from the Bank of America, global fund managers are overwhelmingly bearish, highlighting contradictions in the market.

For health care and utilities sectors, the vast majority of companies in the index are beating revenue estimates in 2023. Over the last 30 years, these defensive sectors have also tended to outperform other sectors during a downturn, along with consumer staples. Investors seek them out due to their strong balance sheets and profitability during market stress.

| S&P 500 Sector | Percent of Companies With Revenues Above Estimates (Q1 2023) |

|---|---|

| Health Care | 90% |

| Utilities | 88% |

| Consumer Discretionary | 81% |

| Real Estate | 81% |

| Information Technology | 78% |

| Industrials | 78% |

| Consumer Staples | 74% |

| Energy | 70% |

| Financials | 65% |

| Communication Services | 58% |

| Materials | 31% |

Source: Factset

Cyclical sectors, such as financials and industrials tend to perform worse. We can see this today with turmoil in the banking system, as bank stocks remain sensitive to interest rate hikes. Making matters worse, the spillover from rising rates may still take time to materialize.

Defensive sectors like health care, staples, and utilities could be less vulnerable to recession risk. Lower correlation to economic cycles, lower rate-sensitivity, higher cash buffers, and lower capital expenditures are all key factors that support their resilience.

More By This Author:

Visualizing U.S. GDP By Industry In 2023Visualizing The Global Coffee Trade By Country

Ranked: The Biggest Retailers In The U.S. By Revenue

Disclosure: None