Recession Probability Nearing 50%

Six weeks ago, an analytical model developed by an analyst at the U.S. Federal Reserve said the odds the NBER will say a recession began sometime between mid-December 2022 and mid-December 2023 was just one in six. As of 30 January 2023, that same model is signaling the probability the NBER will someday say the U.S. went into recession during 2023 is nearing 50%.

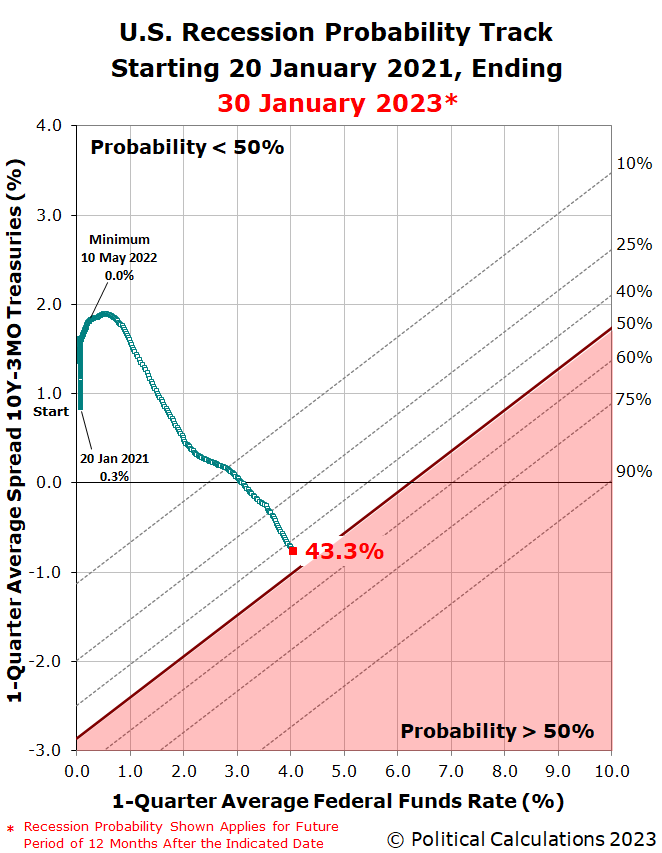

The latest update to the Recession Probability Track shows how that probability has evolved since our last update in mid-December.

The chart shows the current probability of a recession is officially determined to have begun between 30 January 2023 and 30 January 2024 is 43.3%. Assuming the Fed follows through on hiking the Federal Funds Rate by another 0.25% tomorrow, the probability of an "official" recession will continue rising. Doing some back-of-the-envelope math using our recession odds reckoning tool, with the 10-Year and 3-Month Treasuries as inverted as they are today, the odds of recession should rise above 50% in the next two weeks. In six weeks, when the Fed's Open Market Committee next meets to discuss implementing another potential quarter-point rate hike, the recession probability will have reached nearly 60%.

Keep in mind this model is really trying to forecast what range of months will contain the month the NBER's analysts will say the U.S. business cycle hit its peak of expansion after bottoming during the 2020 Coronavirus Pandemic Recession before starting to contract into a new recession. While similar, it's not the same as forecasting when recessionary conditions affecting the economy began. Those already have. It's now a question of when those conditions will be determined to have met the NBER's scale, scope, and severity thresholds to qualify as an "official" national recession.

Previously in Political Calculations

We started this new recession watch series on 18 October 2022, coinciding with the inversion of the 10-Year and 3-Month constant maturity U.S. Treasuries. Here are all the posts-to-date on that topic in reverse chronological order, including this one...

- Recession Probability Nearing 50%

- Recession Probability Ratchets Up to Better Than 1-in-6

- U.S. Recession Odds Rise Above 1-in-10

- The Return of the Recession Probability Track

More By This Author:

The S&P 500 Rises As Index' Dividend Outlook ImprovesNew Home Market Capitalization Crash Continues

The Trillion Dollar Years Of The S&P 500

Disclosure: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more