'Real' Retail Sales Tumbled For Second Straight Month In February

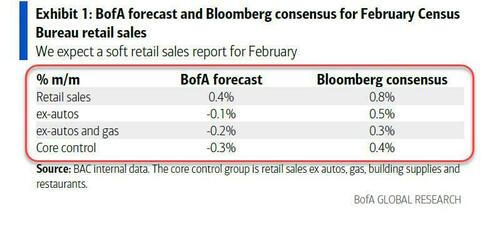

Following January's majorly disappointing decline in US retail sales, BofA's omniscient analysts forecast another disappointment in February, as we detailed last night...

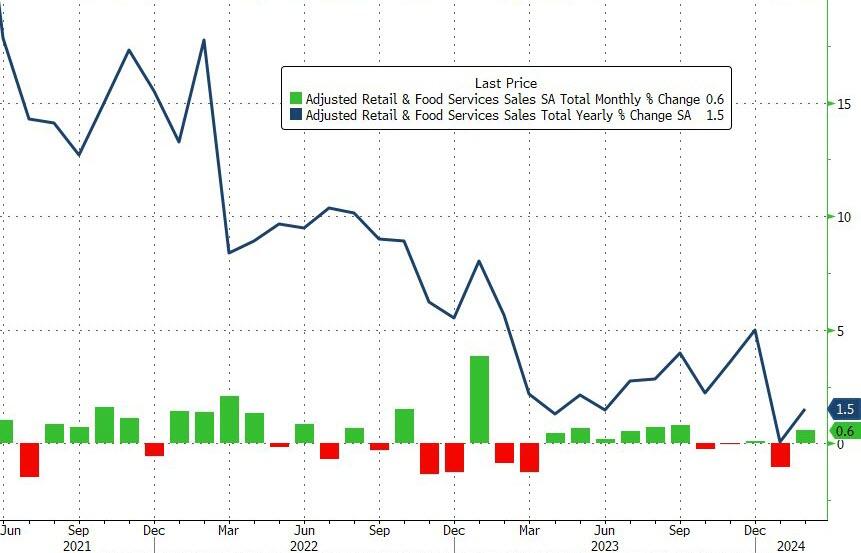

...and they were right... again (10th month in a row)... as headline retail sales rose 0.6% MoM (vs +0.8% exp) and January's 0.7% tumble was revised even lower to a 1.1% plunge...

Source: Bloomberg

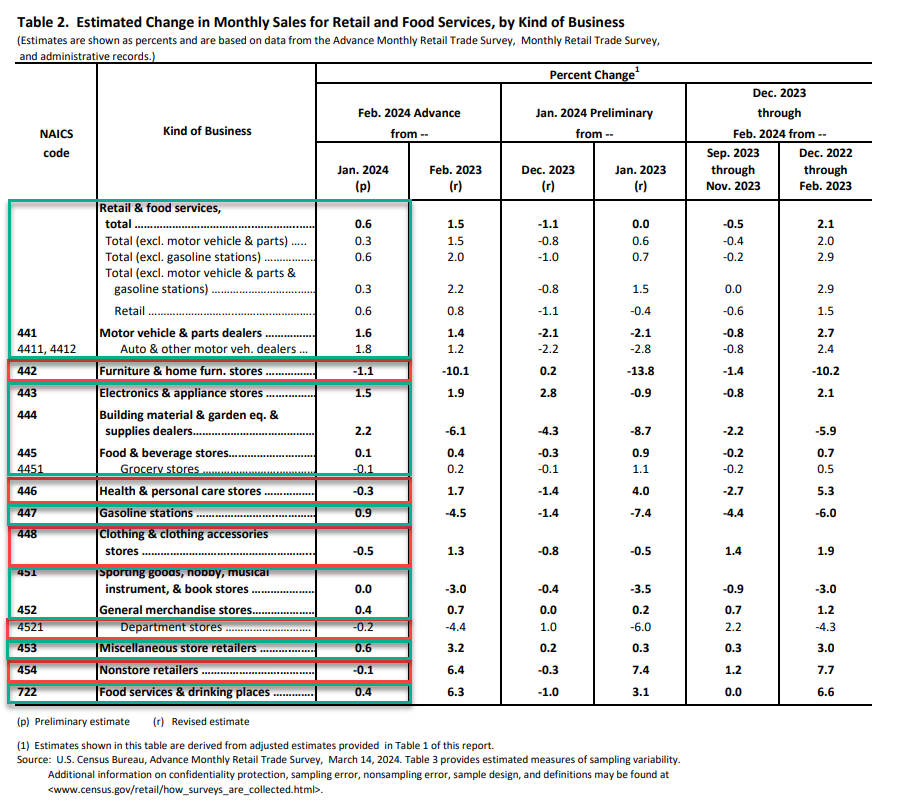

A mixed bag...

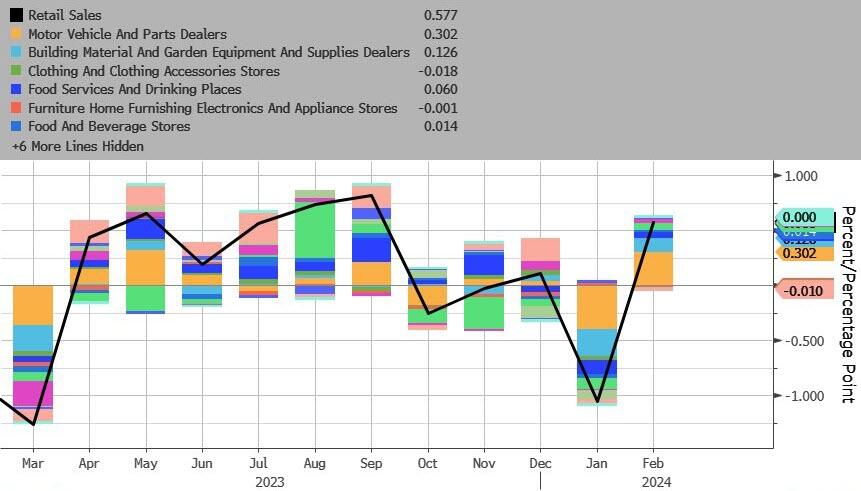

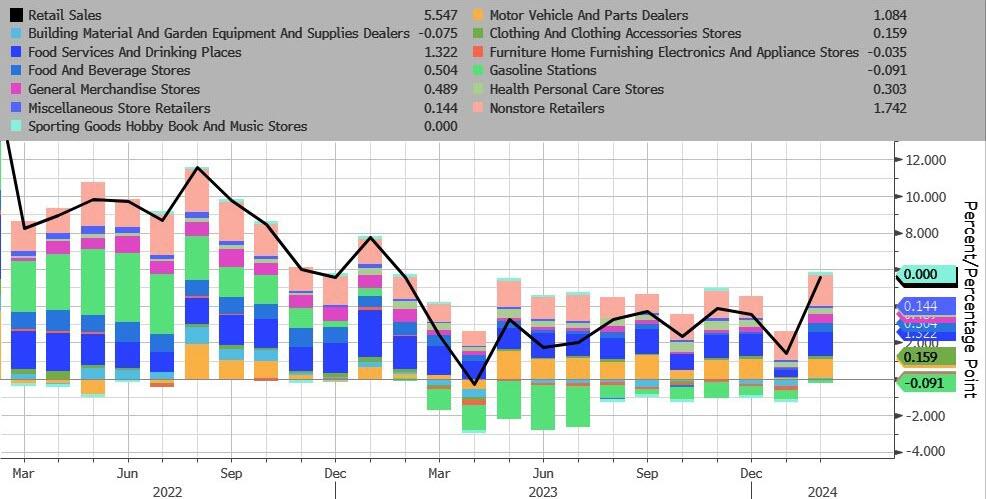

Motor Vehicle & Parts dealers were the biggest contributors to the MoM gains in retail sales while clothing and personal healthcare stores saw sales decline (and internet retailers saw sale decline too - very unusual)...

Source: Bloomberg

Core retail sales also disappointed (+0.3% MoM vs +0.5% exp), which heled the YoY levels down near their weakest since COVID lockdowns...

Source: Bloomberg

Gasoline stations sales were the biggest drag on a YoY basis (albeit small) while internet retailers and food services saw the largest YoY gains...

Source: Bloomberg

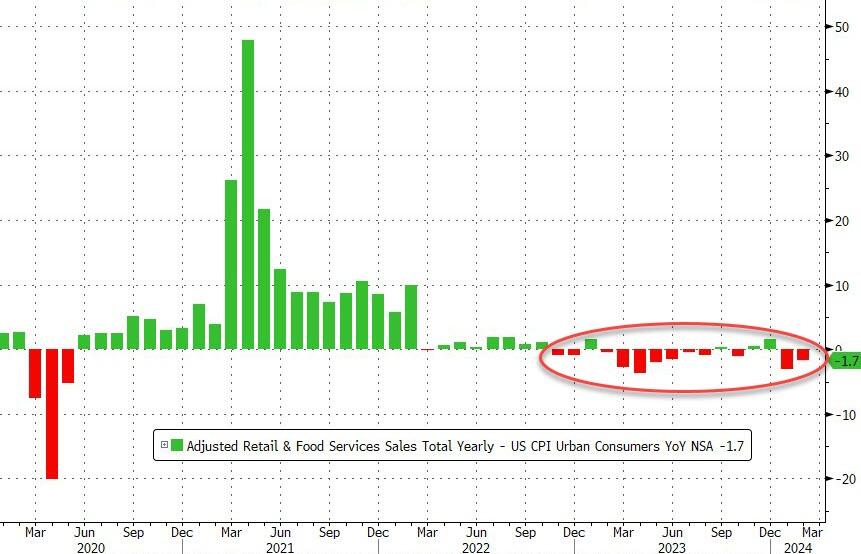

Adjusted (crudely) for inflation, this was a huge drop in 'real' retail sales. REAL retail sales have declined for 12 of the last 16 months - in other words, on a crude basis (Ret Sales - CPI), Americans aren't buying more shit.

Source: Bloomberg

Soft-landing morphing into a stagflationary crash-landing?

More By This Author:

Boeing "Overwrote" Camera Footage Of Work On MAX Jet Door That Blew Out, Can Not Identify Employee Who Worked On ItTime For A Backyard Chicken Coop? Supermarket Egg Prices Soaring Once-Again

WTI Dips After Smaller Crude Draw; Pump-Prices Set To Soar As Gasoline Stocks Plunge

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more