Real Personal Income Continues Uptrend

Image source: Pixabay

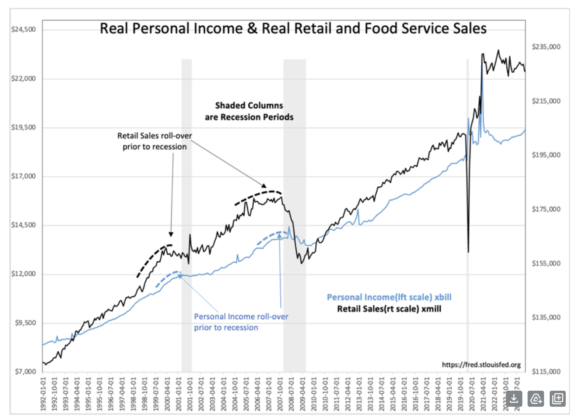

After the COVID payments caused the expected surge and an almost immediate decline after government payments and payment moratoriums ended, real personal income has returned to its historical trend. This is important because it does take into account inflation.

Perhaps this is why companies are not feeling much pricing backlash currently

“Davidson” submits:

Real Personal Income continues to rise. This correlates well with rising employment, rising retail sales, rising manufacturing, rising construction and other base “hard count” rising economic measures as opposed to the sentiment surveys such as Purchasing Managers Index(PMI), the Regional Fed Economic Activity Indices, the Leading Economic Index(LEI) and many others that reflect market psychology. The better investments are always made during periods of deep pessimism as base economic measures are in uptrends. It is the swing in sentiment from not believing there is economic growth to recognition that it is actually occurring that produces legendary investment returns. At some point, most investors make this adjustment and equities soar. Needless to say, the same is true about overly optimistic periods when base “hard count’ economic measures are weakening and investors do not believe it because the news is too positive. The worst investment returns follow for those who cannot differentiate between market psychology and economic activity.

More By This Author:

LEI Falls FurtherDurable Goods Orders Holding

Consumer Credit Defaults Remain Low

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more