Real Income Higher

Image source: Pixabay

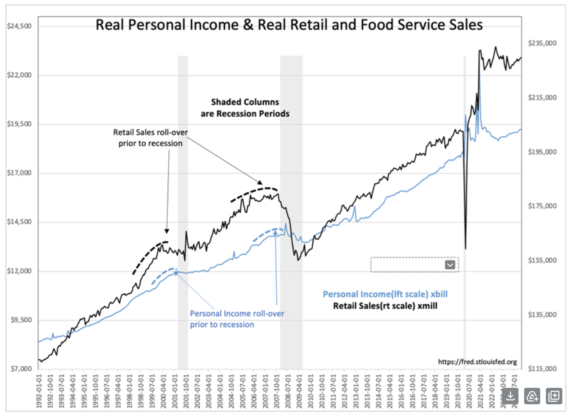

It’s hard to have a recession with this rising nationally.

“Davidson” submits:

The economic data continues to march higher with today’s Real Personal Income release. When matched against Real Retail Sales the correlation between these measures of consumer financial health and recessions should be obvious. There are no signs of recessionary threats in the current data. This has been so since Apr 2020 despite periods in which many feared we would tip into a dire economic collapse at any time. Some even claimed we were in recession even though none of the key hard data supported this thinking. I emphasize hard data to separate it from the myriad of indicators based on market psychology, soft data, which are utterly useless except for making decisions when the hard data and soft data are on the opposite poles of their respective signals. Somewhat like today, when investors are pessimistic as economic activity is clearly positive and has been so nearly 4yrs with few in agreement.

More By This Author:

Pessimism Has A Hair-Trigger, Optimism Not So MuchReal Personal Income Revised Higher

Pessimism Continues To Fall

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more