When Will Record Housing Units Under Construction Ease Rent Inflation?

Economists have incorrectly predicted falling rent inflation for two years. One of the reasons is housing units under construction. The other is new lease prices. Let’s discuss both.

Housing data from the Census Department, chart by Mish

Housing units under construction have topped 1.4 million for 25 straight months, 1.5 million for 21 months, and 1.6 million for 18 months.

And for 24 months or so, economists have been predicting an ease in rent inflations.

CPI Month-Over-Month

CPI data from BLS, chart by Mish

On September 13, I noted Consumer Price Inflation Jumps 0.6 Percent Led by Energy and Shelter

The price of gasoline rose 10.6 percent, rent another 0.5 percent, shelter, 0.3 percent, and new cars 0.3 percent leading the way for a 0.6 percent increase in the CPI in August.

The price of rent has gone up at least 0.4 percent for 25 straight months. Not to worry, Paul Krugman says this is lagging.

National Rent Price vs CPI Rent of Primary Residence

Data from Apartment List, chart by Mish

Ignore the Pundits, Don’t Expect Big Declines in the Price of Rent

Mish Flashback December 8: 2022: Ignore the Pundits, Don’t Expect Big Declines in the Price of Rent

From a CPI point of view, I don’t believe we will see rents decline even though the National Rent price from Apartment List shows that.

It’s not that their data is wrong. Rather, it has to do with what they measure.

The strong seasonal tendencies of Apartment List are smoothed over by the BLS every year. This year will be no different.

Three Key Difference to BLS

- Although Apartment List uses repeat rents of the same or similar unit and prices are are actual prices, not asking prices, it only shows new leases, not repeat leases.

- Because new leases on vacant units rise much more rapidly than existing leases, its year-over-year numbers rise or fall faster and in greater magnitude.

- The National Rent price reflects year-over-year changes, but in reality, people pay the same amount of rent for 12 months then there is one big price jump.

In addition to the cyclical nature of Apartment List, the vast majority of leases are renewals. Attempting to predict rents with these issues has been a continual mistake.

But what about housing units under construction? What happens to rent when these peaks turn down?

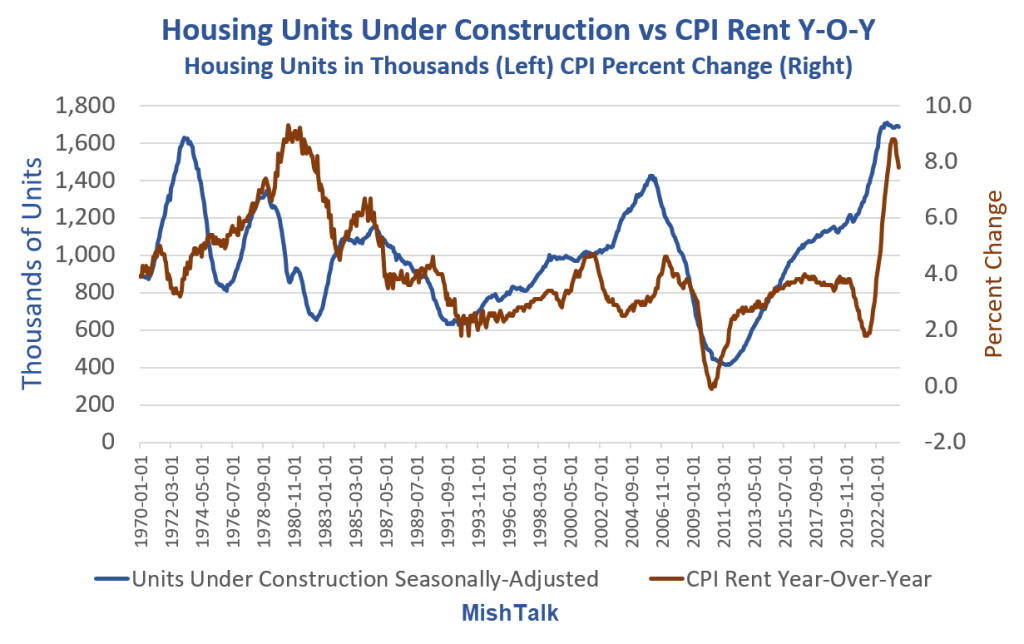

Housing Units Under Construction vs CPI Rent Year-Over-Year

Housing units from Census Department, Rent CPI from BLS, chart By Mish

I saw the theory that rent would collapse as soon as housing units get completed so many times that I almost started believing it myself.

The data shows no discernable correlation no matter how you shift the lead or lag times.

The chart looks totally random. So perhaps rent abate. Perhaps not. The data itself provides no reason to believe anything.

But please note the floor. Year-over-year rent has a floor of about 2 percent except in the Great Recession housing crash.

And these charts are not imputed Owner’s Equivalent Rent prices for which people pay no actual rent. These charts reflect rent of primary residence.

Well, don’t worry. That’s only 34 percent of the nation, and besides, rent is lagging.

Please note Fed Rate Interest Rate Hike Expectations Are Still Higher for Even Longer

The dot plot of FOMC participants is for tighter policy through all of next year.

Fed Rate Interest Rate Hike Expectations Are Still Higher for Even Longer

Looking to Buy a Home?

If you are looking to buy your first home and need to finance, good luck.

Please note Fed Rate Interest Rate Hike Expectations Are Still Higher for Even Longer

And Mortgage Rates Jump to the Highest Level in 23 Years

The longer the Fed holds rates high, the longer the housing transaction crash lasts. But cutting rates will further expand the housing bubble, asset bubbles in general. And bubbles are destabilizing.

That is the Fed’s tightrope dilemma, of its own making. The Fed is largely responsible for this housing mess.

More By This Author:

Small Business Bankruptcies Surge In 2023, Five Reasons WhyFord to Use China’s Battery Technology, GM Wants it Blocked

Personal Income Fails To Keep Up With Spending For Three Months

Disclaimer: The content on Mish's Global Economic Trend Analysis site is provided as general information only and should not be taken as investment advice. All site content, including ...

more