Unlocking REIT Returns: Real Estate Investment Factors

Image Source: Unsplash

As of 2024, real estate investment trusts (REITs) have cemented their role as a $1.5 trillion segment within global capital markets, offering investors a liquid and regulated gateway to commercial real estate. With robust dividend mandates, leverage restrictions, and transparent operations, REITs continue to attract both institutional and individual investors seeking diversification and steady income streams.

Groundbreaking Research

Mariya Letdin, Cayman Seagraves, and Stace Sirmans, authors of the May 2025 study “REIT Factors”, investigated the drivers of returns in REITs by developing and analyzing six specific return factors:

- Size (market capitalization)

- Value (relative cheapness)

- Momentum (recent performance persistence)

- Quality (profitability, earnings stability, strong fundamentals)

- Low Volatility (defensive)

- Short-Term Reversal (contrarian effects, mean reversion)

Using CRSP-Ziman data covering 364 REITs from 1987 to 2023, the authors aimed to determine whether these REIT-specific factors better explain returns than traditional equity models, and to test their robustness across economic cycles. Note that for their value factor they used three metrics: operating cash flow to market equity (OCF/ME); book equity to market equity (BE/ME); and revenues to market equity (REV/ME). They also used three metrics to construct their size factor: market capitalization (ME); free float market capitalization (FFME); and total enterprise value (TEV). The following is a summary of their key findings.

Key Findings

- Improved Explanatory Power: The six REIT-specific factors significantly outperform general equity models, achieving a 33% higher median firm-level R² and reducing average unexplained alphas by nearly 3% per year.

- Significant Factors: Short-term reversal, momentum, quality, and low volatility factors all generate significant risk-adjusted returns in REITs—highlighting their importance to investors.

- Size and Value Factors: The size factor underperformed, while the value factor only showed a robust premium after accounting for its negative exposures to momentum, quality, and low volatility—underscoring the need for a multi-factor approach to REIT investing.

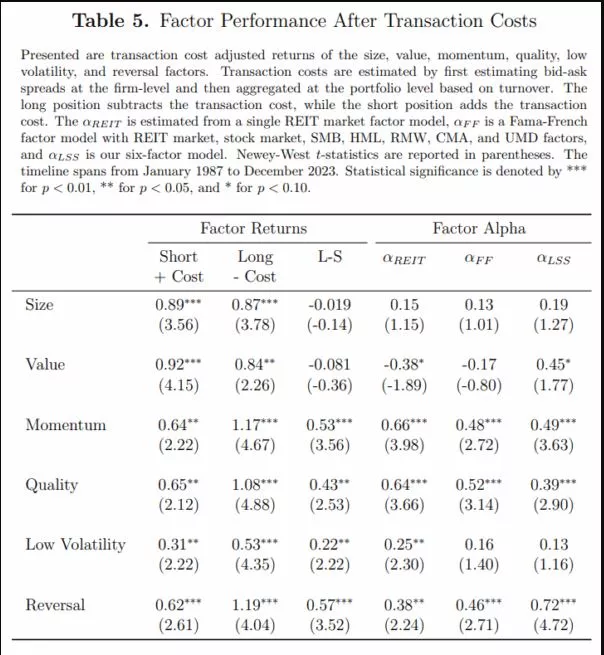

- Distinct Behavior Across Regimes: These factors behaved differently across various economic regimes and remain robust even after accounting for transaction costs.

- Unique REIT Anomalies: Compared to general equity factors, the momentum, quality, and reversal factors in REITs delivered unique alphas, suggesting that real estate markets have distinct return anomalies.

- Regime Dependent Returns: REIT factor returns can vary widely across economic regimes and crisis events. The 2008–2009 great financial crisis and 2020 Covid-19 shock showed particularly stark divergences: value suffered steep drawdowns amid financial turmoil, while quality and momentum remained comparatively resilient.

- Implementability: Transaction costs eroded the profitability of several REIT factor strategies, yet some remained robust even after accounting for higher bid-ask spreads and turnover.

Comprehensive Factor Coverage: After testing over 15,000 additional predictors, the authors found that nearly all were subsumed by their six-factor model, though some novel signals related to financial health may add incremental value.

| Factor | Performance in REITs | Practical Implications |

| Size | Underperformed | Not a reliable return driver |

| Value | Conditional premium | Only robust after adjusting for other exposures |

| Momentum | Significant alpha | Strong risk-adjusted returns |

| Quality | Significant alpha | Resilient in downturns |

| Low Volatility | Significant alpha | Enhances portfolio stability |

| Short-Term Reversal | Significant alpha | Exploits mean reversion |

Importantly, the authors provided their dataset for public download, supporting transparency and further research.

Practical Implications for Investors

- REIT-Specific Factors Matter: Traditional equity factors (like beta, size, and value) do not fully capture REIT return drivers. REIT-specific factors—especially momentum, quality, low volatility, and short-term reversal—offer superior explanatory power and should be prioritized in portfolio construction

- Factor Robustness: These factors are robust to transaction costs and remain significant across different economic environments, making them practical for real world investing.

- Size and Value Nuances: The size effect is weak in REITs, and value’s premium only emerges after adjusting for its overlap with other (often negatively rewarded) traits. Investors should use multifactor models to avoid unintended exposures.

- Diversification and Portfolio Construction: Integrating REIT factors with traditional stock factors can lower portfolio volatility and improve risk-adjusted returns. The study suggests that combining both sets of factors enhances diversification, even though individual size and value factors may not always deliver strong standalone performance.

Their findings led the authors to conclude that the REIT factors they identified “generate excess returns that are not fully explained by their stock market equivalents, pointing to unique return drivers within the REIT market.”

They added:

“Combining stock and REIT factors often lowers volatility and raises Sharpe ratios, evidencing meaningful diversification benefits, although in certain cases (e.g., size, value) neither factor alone delivers strong performance. These findings suggest that integrating REIT factors into multifactor portfolios can augment risk-adjusted returns beyond what is achievable using only broad equity factors.”

Summary

Letdin, Seagraves, and Sirmans advanced our understanding of REIT asset pricing by developing and rigorously testing six REIT-specific return factors—size, value, momentum, earnings quality, low volatility, and short-term reversal—using decades of data. They demonstrated that these factors—especially momentum, quality, low volatility, and short-term reversal—provided much better explanations for REIT returns than general equity models. Their findings revealed unique real estate-specific return patterns and offered a robust, practical framework for both researchers and practitioners in the field. The public release of their dataset further supports transparency and ongoing innovation in real estate investment research.

More By This Author:

Hindsight And Survivorship Biases In Managed FuturesVolatility Is A Reliable And Convenient Proxy For Downside Risk

Insider Trading Increases Market Efficiency