This Monthly Payer Is Restarting Dividends And Paying A 5.5% Yield

The 2020 economic shutdown produced wildly different results for businesses, depending on their positions in the economy. Some sectors, such as technology, sailed through the shutdown without a scratch. Other economic sectors, such as travel and tourism, took a tremendous hit.

Is now the time to shift from the 2020 winners into stocks that most stand to benefit from a reopening economy? I want to discuss one stock that illustrates the extremes of the shutdown and recovery.

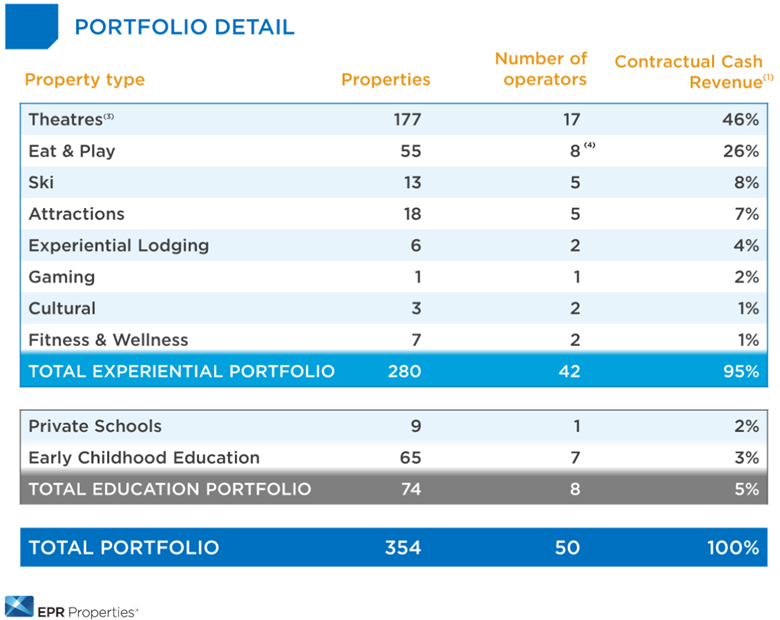

EPR Properties (PPR) is a REIT that owns “experiential” and education-focused properties. This table shows the portfolio breakdown.

Before the pandemic, EPR had a 20-plus year track record of steadily growing dividend payments. However, the pandemic-triggered economic shutdown forced an almost 100% closure of the operations of EPR’s tenant companies. The company suspended its monthly dividend in May 2020.

The pandemic turned EPR from a “buy and hold forever” dividend stock to one to sell because no one could predict the company’s future. I did recommend to my subscribers to pick up some EPR preferred shares, and we made some nice gains as the preferreds recovered from a post-crash low of $16 per share all the way back to par.

On July 13, I was happy to read that EPR will resume paying common stock dividends. Here are a couple of excerpts from the press release:

- “As of June 30, 2021, approximately 99% of the Company’s theatre and 98% of the Company’s non-theatre locations were open, excluding normal seasonal closings. Certain assets remain closed in Canada pursuant to local restrictions.”

- “For the second quarter of 2021 the Company collected approximately 82% of contractual cash revenue. This cash collection level is in excess of the high end of the previously announced guidance for the second quarter of 75%-80% and continues the favorable trajectory of cash collections the Company is experiencing.”

- “In addition to the collections above, collections of deferred rent and interest during the second quarter from accrual basis tenants totaled $16.3 million, bringing the total for such collections to $45.9 million for the six months ended June 30, 2021.”

Translation: EPR is now collecting more than 80% of regular rent, and payments that were missed due to the pandemic are starting to come in as well.

EPR’s initial dividend will be $0.25 per share, with the first payment on August 15. EPR pays monthly dividends, so the dividend rate gives a current yield of 5.5%.

Despite the short-term havoc from the pandemic shutdown, EPR business provides tremendous advantages. As far as I know, the company is unique for the types of properties it owns. That makes EPR a top choice to monetize properties in a market with $100 billion worth of a real estate. EPR to date has invested just over $6 billion.

Lease features allow EPR to exhibit stability and revenue growth. These features include:

- Long-term leases with a current weighted average term of 14.9 years

- Built-in 1.5% to 2% annual rent escalators

- Strong tenant credit with cross defaults, master leases, and corporate guarantees

As pandemic restrictions EASE, the properties owned by EPR offer drive-to locations and lower price points compared to pre-pandemic vacation or entertainment choices.

Before the pandemic shutdown, the EPR dividend was $0.38 per share. Over time, I expect the company will work the dividend back up to that level and start a new history of dividend growth.

Disclaimer: The information contained in this article is neither an offer nor a recommendation to buy or sell any security, options on equities, or cryptocurrency. Investors Alley Corp. and its ...

more