These Housing Stocks Are Going Higher

One of the core investment themes I had entering 2015 was that this would be the year that the housing market finally started to take off. Driven by historically low mortgage rates, improving consumer sentiment and the fastest job growth in over a decade housing starts would start to accelerate in 2015.

This is especially true because the economy has produced more than 500,000 fewer annual housing starts over the past seven years than the 1.5 million annual rate it has averaged over the past three decades. In addition, the country has some twenty million more people than it did before the financial crisis. It is fairly easy to see some long term pent up demand would be unleashed once confidence returned to the housing market and credit conditions started to loosen.

I stocked up the Small Cap Gems portfolio with several homebuilding plays in anticipation of this increased activity. It looks like I was about six months early in this call but those plays are starting to move up in a big way as there are more and more indicators the housing market is recovering at a marked clip. Last Tuesday it was reported that new home sales just posted its strongest month in seven years.

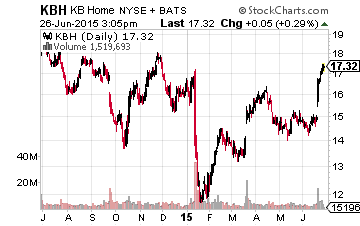

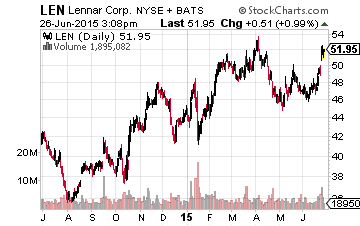

KB Home (NYSE: KBH) shot up after reporting better than expected results on June 19th. Large homebuilder Lennar (NYSE:LEN) took the whole sector up with it when it delivered stellar numbers and reported strong demand this Wednesday. In addition, the fragmented industry could be at the start of a consolidation wave, something my colleague Marshall Hargrave covered recently. Last week Standard Pacific (NYSE:SPF) bought Ryland (NYSE: RYL) in a $5 billion plus transaction. Given the robust level of M&A activity across the market in 2015, I would not be surprised if several mergers within this industry take place over the next six to 12 months with several small and medium sized builders making logical targets.

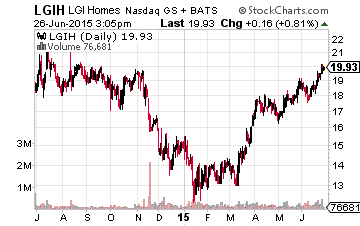

LGI Homes (NASDAQ: LGIH) has done well since I talked about it to begin the month. This Texas heavy homebuilder does not seem to have been impacted by the job losses across the energy sector in the state. This makes sense, as it has little exposure to Houston which is the hub of the energy industry in Texas and the rest of the state is doing quite nicely.

The fast growing builder is diversifying rapidly out of the state into high growth markets like Denver and parts of Florida. This will mitigate geographical risk and spur growth as well. Earnings are projected to be up 40% year-over-year this fiscal year to almost $2.00 a share. Next year the consensus has LGI Homes earning approximately $2.70 a share. The stock goes for under 7.5 times next year’s profit projections.

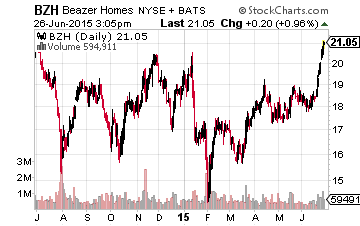

Beazer Homes (NYSE: BZH) is a homebuilder with active operations in 16 states within three geographic regions in the United States: West, East, and Southeast. The company has a market capitalization just north of $500 million and has been a solid performer for the Small Cap Gems. I am starting to see some major investors start to disclose new stakes in this homebuilder, including Paul Tudor Jones.

Stern Agee made a good call when it stated to buy a half dozen homebuilders in late May including Beazer as it saw an improving housing market on the horizon and still has a Buy rating on the stock. If we do get a sustained housing recovery, Beazer could be a major beneficiary and I could easily see it becoming acquired given its small size and geographical diversity.

Things are already looking up for the homebuilder. Revenue growth should be in the mid-teens over the next few years. After posting a small loss in FY2014, the homebuilder is on track to make approximately $1.40 a share in profit this fiscal year and the consensus has it earning nearly $1.90 a share in FY2016. The shares go for just 11 times next year’s earnings despite this projected growth. S&P just raised its credit rating on the firm and I expect its credit profile to continue to improve on increasing earnings and cash flow.

Investors looking for less volatile plays in the space should consider the aforementioned Lennar which just reported very strong results. The company has a market capitalization of over $10 billion and is a good proxy for the space. Investors are paying up for that privilege a bit as Lennar is going for approximately 13.5 times next year earnings projections. However, that is a discount to the overall market multiple and Lennar should see revenue growth in the high teens over the next few years with slightly higher earnings growth rates.

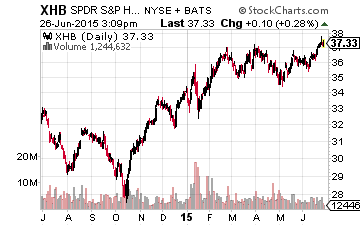

I rarely recommend ETFs, but in this article I will make an exception. Investors who want broad exposure to the improving domestic housing market on a macro basis should consider the SPDR Series Trust – SPDR S&P Homebuilders ETF (NYSE: XHB) which not only has a slew of homebuilders but also building supply companies and other parts of the economy that will ride higher housing activity levels to faster earnings growth.

Disclosure: Positions: Long ...

more

Next earnings over 20.

RANDOM NOTES...not sure I am as bullish as you..LEN did well because they built more multi family than singles. housing is at 63% vs 69% since 2004 peak.and that number is going to fall even more. Boomers are renting more than any other demo, so they are giving up their houses. rents are so high millenials can't save enough for a downpayment- they may never buy. rents are rising at twice the rAte of inflation but that is not stopping demand. the housing starts rose because the few fence sitters jumped off in re fear of raising rates. but clearly the housing sector is going thru a rough patch and will continue to rough it out for a long time. It's bettertahn it was but it's no snorting bull. I am long LEN KBH Pulte SPF XHB HD WHR AMWD CSTE and a few other related stocks. Cheers and good luck to us. I thought you were just a biotech guy..guess not.