The World’s Largest Real Estate Investment Trusts (REITs)

(Click on image to enlarge)

Real estate is widely regarded as an attractive asset class for investors.

This is because it offers several benefits like diversification (due to less correlation with stocks), monthly income, and protection from inflation. The latter is known as “inflation hedging”, and stems from real estate’s tendency to appreciate during periods of rising prices.

Affordability, of course, is a major barrier to investing in most real estate. Property markets around the world have reached bubble territory, making it incredibly difficult for people to get their foot in the door.

Thankfully, there are easier ways of gaining exposure. One of these is purchasing shares in a real estate investment trust (REIT), a type of company that owns and operates income-producing real estate, and is most often publicly traded.

What Qualifies as REIT?

To qualify as a REIT in the U.S., a company must meet several criteria:

- Invest at least 75% of assets in real estate, cash , or U.S. Treasuries

- Derive at least 75% of gross income from rents, interest on mortgages, or real estate sales

- Pay at least 90% of taxable income in the form of shareholder dividends

- Be a taxable corporation

- Be managed by a board of directors or trustees

- Have at least 100 shareholders after one year of operations

- Have no more than half its shares held by five or fewer people

Investing in a REIT is similar to purchasing shares of any other publicly-traded company. There are also exchange-traded funds (ETFs) and mutual funds which may hold a basket of REITs. Lastly, note that some REITs are private, meaning they aren’t traded on stock exchanges.

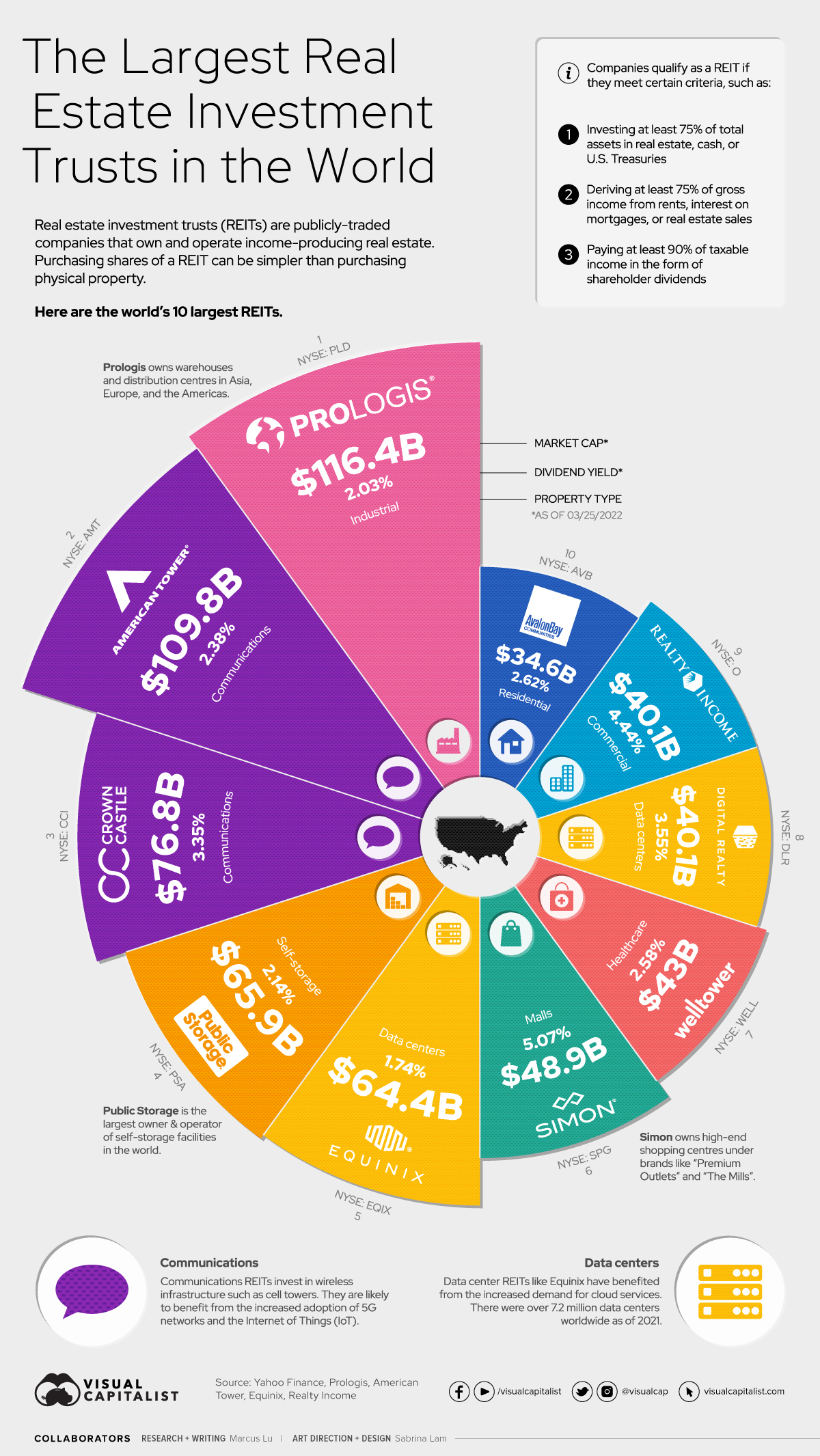

The Top 10 by Market Cap

Here are the world’s 10 largest publicly-traded REITs, as of March 25, 2022.

| REIT | Market Cap | Dividend Yield | Property Type |

|---|---|---|---|

| Prologis (NYSE: PLD) | $116.4B | 2.03% | Industrial |

| American Tower (NYSE: AMT) | $109.8B | 2.38% | Communications |

| Crown Castle (NYSE: CCI) | $76.8B | 3.35% | Communications |

| Public Storage (NYSE: PSA) | $65.9B | 2.14% | Self-storage |

| Equinix (NYSE: EQIX) | $64.4B | 1.74% | Data centers |

| Simon Property Group (NYSE: SPG) | $48.9B | 5.07% | Malls |

| Welltower (NYSE: WELL) | $43.0B | 2.58% | Healthcare |

| Digital Realty (NYSE: DLR) | $40.1B | 3.55% | Data centers |

| Realty Income (NYSE: O) | $40.1B | 4.44% | Commercial |

| AvalonBay Communities (NYSE: AVB) | $34.6B | 2.62% | Residential |

As shown above, REITs focus on different sectors of the market. Understanding their differences is an important step to consider before making an investment.

For example, Prologis manages the world’s largest portfolio of logistics real estate. This includes warehouses, distribution centers, and other supply chain facilities around the globe. It’s reasonable to assume that this REIT would benefit from further growth in e-commerce—more on this near the end.

Realty Income, on the other hand, owns a portfolio of over 11,100 commercial real estate properties in the U.S. and Europe. It rents these properties out to major brands like Walgreens and 7-Eleven, which together account for 8.1% of the REIT’s annual income.

More Than Just Buildings

Cell towers and data centers may not seem like “real estate”, but they are both critical pieces of modern infrastructure that take up land.

REITs that focus on these sectors include American Tower and Crown Castle, which own wireless communications assets in the U.S. and abroad. They are likely to benefit from the increased adoption of 5G networks and the Internet of Things (IoT).

On the other hand, Equinix and Digital Realty are focused on data centers, a fast-growing industry that is benefitting from digitalization. Both of these REITs work with major tech firms such as Amazon and Google.

Trends to Watch

The demand for real estate can be heavily influenced by overarching trends found around the world. One of these is population growth and urbanization, which has drastically pushed up the cost of housing in many cities around the world.

There’s also the rising prevalence of e-commerce, which has triggered a boom in demand for warehouse space. This is best captured by Amazon’s massive growth during the COVID-19 pandemic, during which the company doubled the number of its warehouse facilities.

Globally, e-commerce accounts for just 19.6% of total retail sales. Should that figure continue to rise, industrial real estate prices could be in store for robust, long-term growth.

Disclosure: None.