The Skyrocketing Unaffordability Of U.S. New Homes

One month after setting a record low level for affordability, the unaffordability of new homes in the U.S. has skyrocketed.

The mortgage payment for the median new home sold in the U.S. during October 2022 would now consume nearly half the monthly income of an American household earning the median income. The following chart illustrates that development.

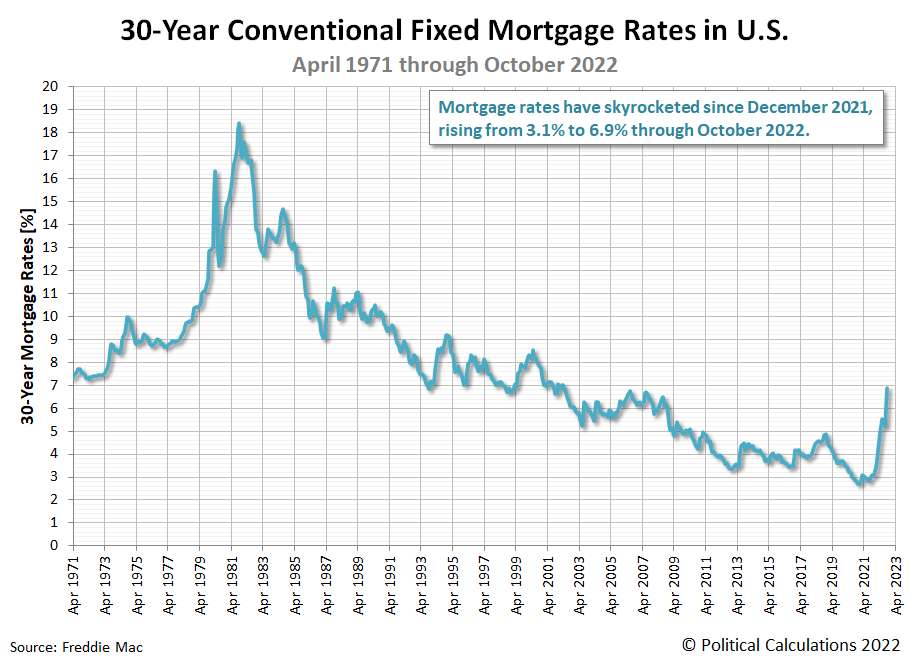

This negative change is primarily the consequence of rising mortgage rates, which have been pushed upward as the U.S. Federal Reserve has sought to make borrowing more expensive in its attempt to stall and reverse President Biden's inflation in the U.S. economy. The next chart shows how mortgage rates have exploded during 2022 in response.

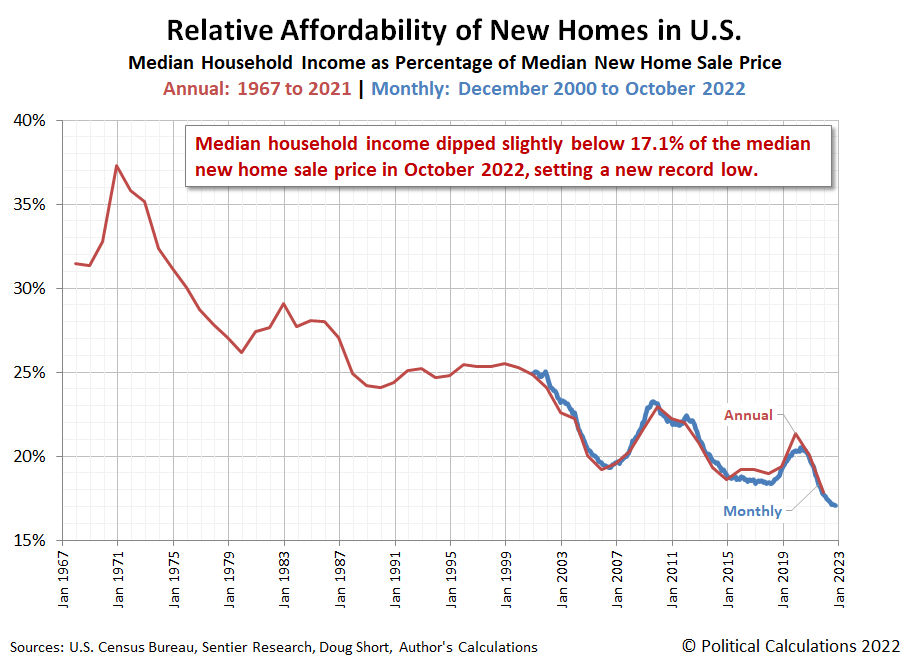

As mortgage rates have exploded, median new home prices have remained elevated, holding down their raw level of affordability with respect to median household income itself. The third chart confirms the raw affordability of new homes has hit a new low in that measure.

October 2022's estimated median household income of $78,595 would only cover 17.06% of the sale price of the median new home sold during the month. New homes have never been less affordable for the typical American household.

References

U.S. Census Bureau. New Residential Sales Historical Data. Houses Sold. [Excel Spreadsheet]. Accessed 23 November 2022.

U.S. Census Bureau. New Residential Sales Historical Data. Median and Average Sale Price of Houses Sold. [Excel Spreadsheet]. Accessed 23 November 2022.

Freddie Mac. 30-Year Fixed Rate Mortgages Since 1971. [Online Database]. Accessed 23 Novemmber 2022.

Political Calculations. Median Household Income in October 2022. [Online Article]. 1 December 2022.

More By This Author:

The S&P 500 Dances To The Fed's SongDividends By The Numbers In November 2022

Median Household Income In October 2022

Disclosure: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more