The Safety Net: Are We Starting To See Cracks In This 13.7% Yield?

Whenever I see a double-digit yield, it reminds me of a gorgeous woman whom you just know you shouldn’t get involved with – kind of like Sharon Stone in Basic Instinct. Sure, she (that yield) is incredibly attractive. But there’s going to be a whole lot of drama to go along with all that beauty.

So when PennyMac Mortgage Investment Trust (NYSE: PMT) and its voluptuous 13.7% yield walks into the bar, everyone turns to look. But I’ve been burned by high yields (and a few gorgeous women) before, so when I look at a stock with a 10% yield or more, my guard is up. Is PennyMac Mortgage going to be more trouble than it’s worth?

PennyMac Mortgage invests in residential and commercial mortgages. It is set up as a real estate investment trust (REIT), which means it must pay 90% of its earnings in the form of dividends.

But when it comes to REITs, earnings are pretty meaningless. There are other measures of a company’s performance that are more important. For mortgage REITs like PennyMac Mortgage, one of the most important is net investment income. That takes into account the interest received on the mortgages it owns, the interest expense on its borrowings, and gains and losses on mortgages that it has bought or sold.

That’s the number we want to make sure covers the dividend, not earnings.

In 2014, PennyMac Mortgage earned $356.7 million in net investment income – far eclipsing the $174.4 million it paid in dividends. The two prior years had a similar look, with net investment income double or triple the amount paid in dividends.

But the first quarter wasn’t nearly as strong. Net investment income totaled only $37.7 million while it paid out $45.9 million in dividends. In the first quarter of 2014, it wasn’t an issue. Net investment income was $76.6 million and dividends paid were $41.6 million.

The poor performance in the first quarter was due to a number of factors, according to management. Weaker-than-expected results from its distressed assets portfolio, higher prepayments of mortgages and hedge losses were some of the chief reasons for the subpar quarter.

I typically don’t react to one quarter’s results when they are far better or worse than usual. But with such a high yield, the fact that dividends paid was higher than net investment income caught my attention, and I would closely watch the next quarter’s results.

Short but Strong Track Record

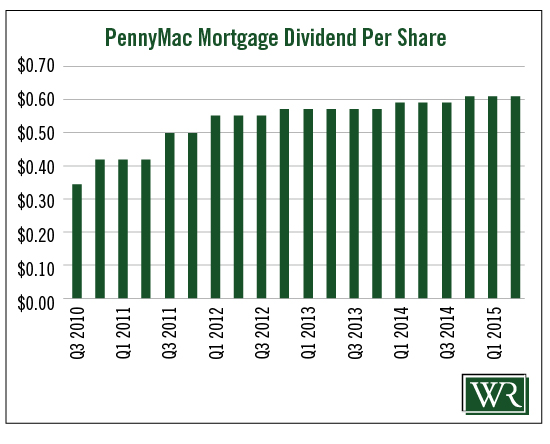

Besides PennyMac Mortgage’s double-digit yield, a dividend investor also has to love its track record of dividend raises (kind of like combining beauty and brains). The company has raised the dividend six times in the past five years – at an impressive 12% compound annual growth rate. Though the last raise was a less exciting 3.3% hike.

Nevertheless, any company that raises the dividend consistently grabs my attention. But when it comes to mortgage REITs, I’d like to see how they performed during the financial crisis. Anyone can look like a genius when times are good.

Unfortunately, PennyMac Mortgage didn’t go public until 2009, when the crisis was ending. It started paying a dividend in 2010 and has raised it nearly every year since.

I can’t penalize a company for not being around during the financial crisis, but I may put a little less weight on its track record because it is so short and because mortgage REITs can have big fluctuations in their financial performance when times get tough.

Because of the weak first quarter and the track record that includes only the good times, I can’t give PennyMac Mortgage my highest rating. As of today, I don’t see anything to worry about. But if the next quarter’s net investment income also comes in below its dividend payments, I’ll be more concerned.

For now, PennyMac Mortgage doesn’t appear to be a drama queen. But my guard is still up.

Dividend Safety Rating: B

Good investing,

Marc

The single greatest threat to a lengthy retirement is inflation. Learn how to outperform the market and get on the path to easy living with these income producing assets. Get our free ...

more