Tanger Is A Textbook Strong Buy

Summary

- Tanger, in my view, is a cash cow, and that’s one of the primary reasons I have been so bullish with this pick.

- We maintain a Strong Buy on Tanger shares.

- “Buy not on optimism, but on arithmetic.” Benjamin Graham.

It appears that there's life left after all when it comes to Tanger Outlets (SKT). Despite being one of the most beaten-down REITs in our coverage spectrum, it’s not dead yet.

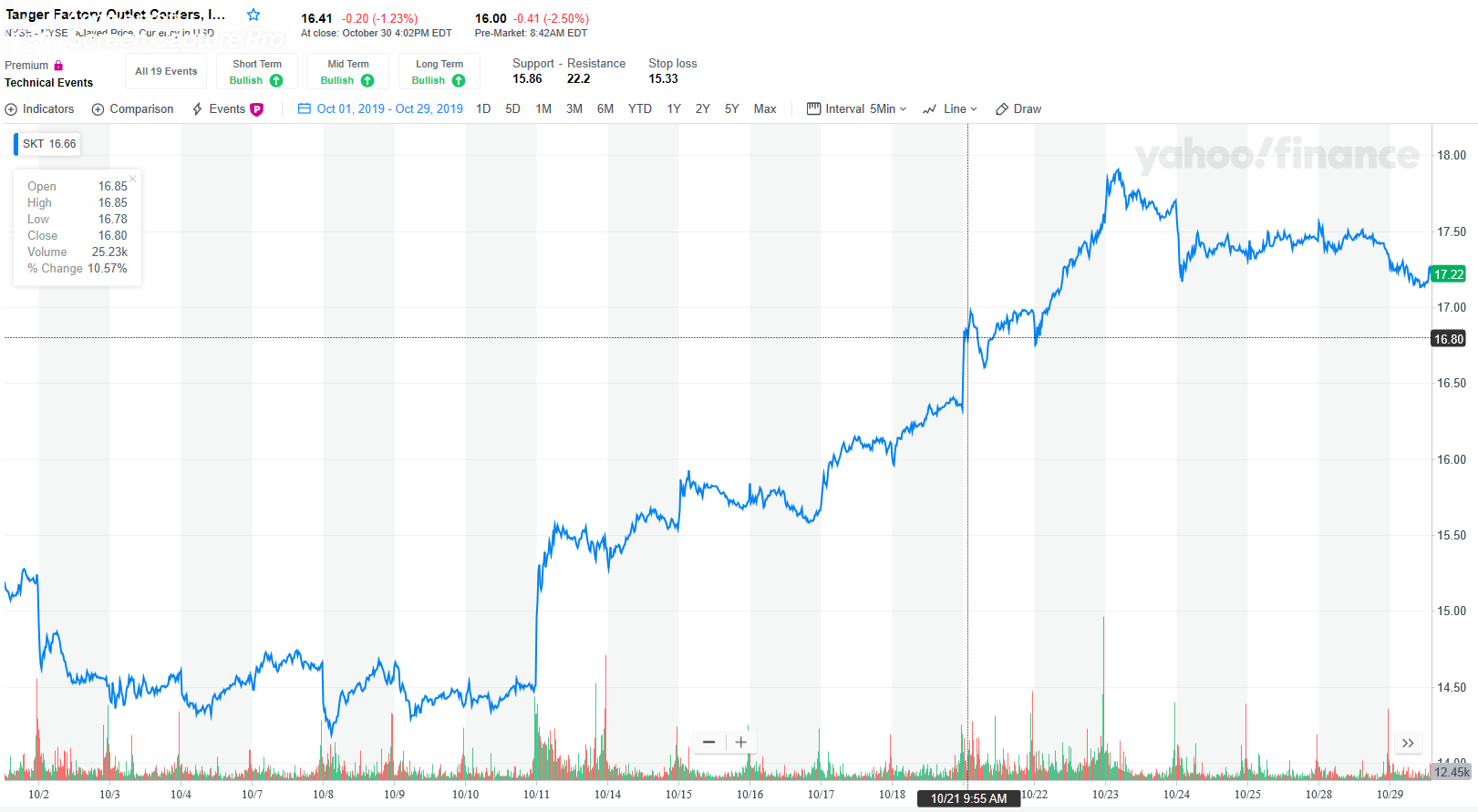

Nor do we expect it to be, and not because shares were up around 14% in the month of October. We’ll be the first to admit that – with the threat of continued store closures – there will be continued volatility in the months and quarters ahead.

Source: Yahoo Finance

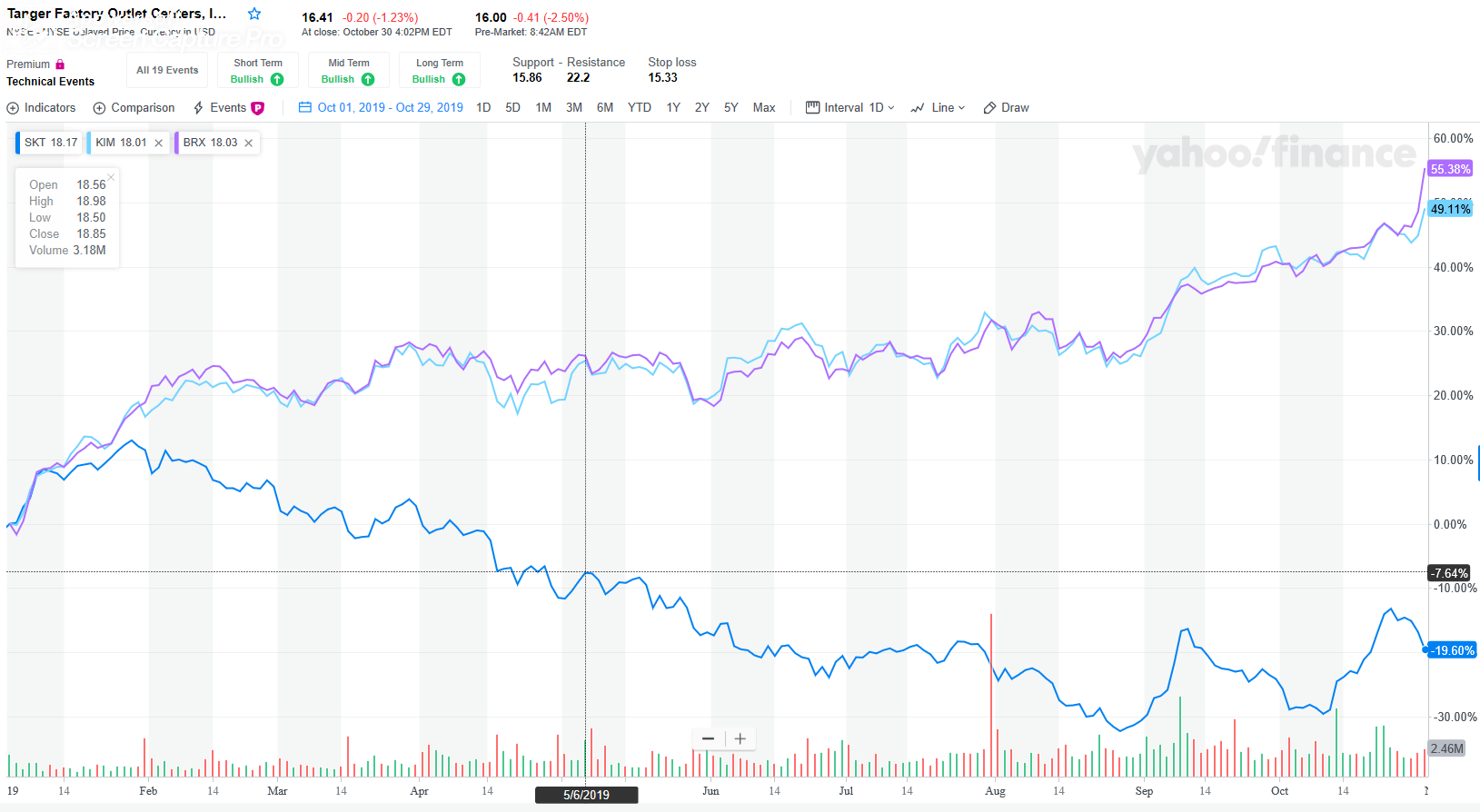

With that said, Tanger’s main problem is that it’s considered to be a mall REIT. Otherwise, I’m confident it would be trading more like Kimco (KIM) or Brixmor (BRX) – which means it would be up around 50% year-to-date.

Source: Yahoo Finance

For proof, consider how Tanger is the ONLY mall REIT that increased its dividend during the last recession. This means it’s the only “dividend aristocrat” (defined as having over 25 years of divided growth) in the mall sector.

A stock that reliable has no business trading at the valuation it is.

Read more at Seeking Alpha.

Brad Thomas is the Editor of the Forbes Real Estate Investor.

Disclaimer: This article is intended to provide information to interested parties. As ...

more