Stock Profile: PulteGroup, Inc.

Photo by Brad Weaver on Unsplash

PulteGroup, Inc. (PHM) is one of America’s largest homebuilding companies with operations in more than 40 markets throughout the country. Through its leading brand portfolio that includes Centex, Pulte Homes, Del Webb, DiVosta Homes, American West, and John Wieland Homes, the company is one of the industry’s most versatile homebuilders able to meet the needs of multiple buyer groups and respond to changing consumer demand.

Market Leader

PulteGroup started in 1950 when 18- year-old William “Bill” Pulte, with help from his high-school buddies, built a five-room bungalow near Detroit. In constructing his first home, Bill set the cornerstone of what would grow into one of the largest and most successful homebuilding companies in the country’s history. Today, PulteGroup is the nation’s third-largest builder. Pulte has delivered nearly 775,000 homes in the past 70+ years and serves homeowners as they move through all stages of their lives. Much has changed since Bill Pulte first picked up a hammer, but not the company’s commitment to delivering a superior quality home and customer experience.

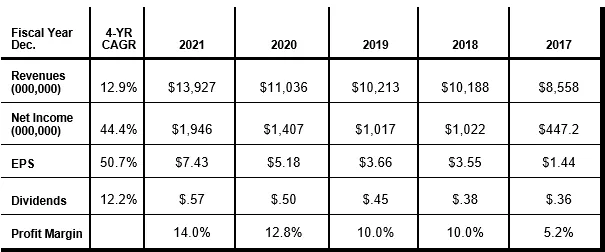

PulteGroup generated healthy growth during the past five years with revenues, net income, EPS, and dividends compounding at double-digit rates. During the past decade, Pulte has focused on delivering industry-leading returns on equity (ROE), launching a series of important changes including land acquisition criteria and new approaches to land development and home construction processes. Over the past five years, Pulte’s ROE has averaged a profitable 20%, rising to 26% in 2021.

Robust Cash Flows

In 2021, Pulte generated $1 billion in cash flow from operations, bringing the five-year total to $6 billion. The company’s priorities for allocating capital include investing in the business through land acquisition and development, funding its dividend, and using excess capital to repurchase common shares. In 2021, Pulte invested $4.2 billion in land acquisition and development with plans to invest $4.5-$5.0 billion in 2022. In addition, the company raised its dividend payout per share by 17% in 2021 and an additional 7% in 2022. Pulte returned over $1 billion to shareholders in 2021, including $897 million in share repurchases. In the first quarter, Pulte repurchased an additional $500 million of its stock, or 4% of outstanding shares, at an average price of $48.59 per share.

Strong Financial Results

Pulte reported strong first quarter results as robust demand continues to exceed a low housing supply, providing the company with pricing power. Housing demand has been strong across all markets and buyer groups the company serves due to a powerful demographic wave of more than 70 million millennials and increased interest in single-family living amid the pandemic. The home supply shortage has built up over 10 years and will need to sustain record new home starts for the next decade to bring the industry out of its current underbuilt situation.

During the quarter, Pulte’s revenues increased 13% to $3.2 billion, driven by an 18% increase in the average sales price to $508,000. Net income increased 50% to $454.7 million and EPS jumped over 60% to $1.83. Net new orders decreased 19%, mainly reflecting the company’s decision to restrict sales to better match the pace of production with ongoing supply chain disruptions and labor shortages. Benefiting from a significant increase in the average price of its new homes, the dollar value of net new orders increased 2% to $4.7 billion. The company’s backlog increased 31% to 19,935 homes valued at $11.5 billion. Pulte maintains one of the strongest balance sheets in the homebuilding industry. As of 3/31/22, the company had $1.1 billion in cash and equivalents, $2.4 billion in long-term debt, and $7.4 billion in shareholders’ equity.

Attractive Valuation

The Federal Reserve has been very clear in signaling that interest rates will rise as it seeks to control inflation. This has resulted in rising mortgage rates, which have pulled back homebuilder stock prices, resulting in very attractive valuations. Pulte is trading at about 1.4 times book value and just five times earnings with a dividend yield of 1.4%. Pulte is in a much better financial position to manage rising rates compared to a decade ago given the housing supply/demand imbalance and its focus on owning less land, maintaining prudent debt levels, and generating strong cash flows. Long-term investors should consider building a foundation in PulteGroup, a high-quality market leader with an attractive valuation, robust cash flows, a sturdy balance sheet, and strong financial results. Buy.

Disclaimer: Copying, reproduction or quotation is strictly prohibited without written permission. Information presented here was obtained from sources believed to be reliable but accuracy and ...

more