Review Of Risk Transfer Efforts By Freddie And Fannie, And A New Approach

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

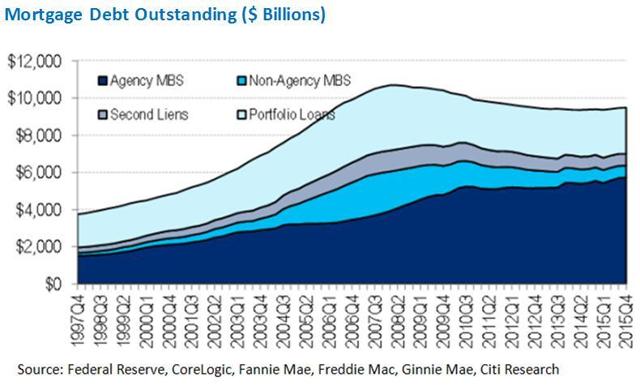

The role of Government Sponsored Enterprises (GSEs) in US housing finance is bigger now than it was in 2008, when the FHFA placed Fannie Mae (OTCQB:FNMA) and Freddie Mac (FHLMC) (OTCQB:FMCC) under conservatorship during the great crisis caused by the decline in U.S. house prices, as the chart below shows. Almost everyone agrees that the housing finance system needs to attract more private capital to protect taxpayers from being on the hook for most of the credit risk being taken in the mortgage market. However, private-label securities market for residential mortgages has not fully revived due to several reasons.

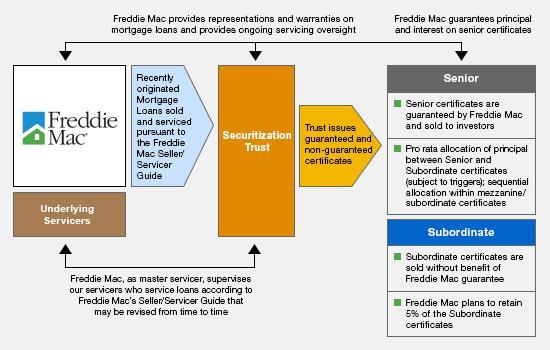

Freddie Mac's K-Deal program has shown a successful method of attracting significant amount of private capital to mortgage market for the multifamily sector. It uses a normal cash senior-subordinate securitization structure but with a unique twist - the K deals issue both guaranteed and unguaranteed bonds. Freddie Mac provides guarantee on the senior bonds only. The program has been very successful[1] in fully transferring the first loss risk of generally over 10% of the loans to private investors.

An ideal structure for the single-family mortgages will be something similar. However, one factor of critical importance in the residential mortgage finance system is the need to preserve the TBA market,[2] which is crucial to smooth functioning of the current housing finance system. TBAs and Pass-Through mortgage pools are fully guaranteed by one of the GSEs, which makes them highly liquid instruments attracting capital to the housing finance system. The GSE guarantee is what makes the residential TBA market work. Without the government guarantee, the TBA markets will not exist. These pools are often securitized by banks in Agency CMO (Collateralized Mortgage Obligation) deals, where all the bonds carry the guarantee provided by GSEs on the underlying pools. However, the need for fully guaranteed pools to allow TBA trading precludes K-deal type securitizations with a mix of guaranteed and non-guaranteed bonds for the single-family mortgages.

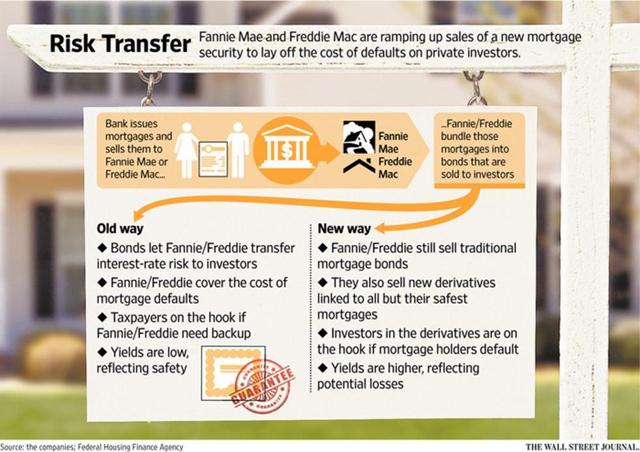

When the GSEs issue fully guaranteed single-family MBS, they retain all of the risk associated with losses if the underlying mortgage loans default. Wanting to reduce the credit risk they hold, and encouraged[3] to do so by the FHFA, their regulator, the GSEs have come up with new types of transactions to transfer some of the credit risk of the mortgage loans to private investors. These Credit Risk Transfer (CRT) deals have been very successful with GSEs having completed over $27 Billion of issuance since their introduction in 2013. However, these structures are derivatives and have characteristics that result in only partial transfer of risk and restrict participation from investors like REITs, which limits their growth potential and market size.

This article provides an overview of the CRT deal structures, and suggests a way to allow a K-Deal type structure with a mix of guaranteed and non-guaranteed bonds without disrupting the TBA market.

What are GSE Credit Risk Transfer Transactions?

Freddie Mac did the first risk-sharing transaction, named Structured Agency Credit Risk (STACR), in July 2013, which was followed by Fannie Mae's risk-sharing deal, named Connecticut Avenue Securities (CAS), in October, 2013.

Both of these programs transfer some of the mortgage default risk from GSEs to private investors without impacting the TBA or Agency CMO markets in any way. Mortgages are funded and traded as usual using TBA, Pool, and Agency CMO structures.

The risk sharing is achieved by doing new separate transactions (STACR and CAS), which transfer the risk of default to private investors synthetically by selling a new type of mortgage bonds whose payments are linked to performance of a reference pool of mortgages. The new bonds work just like synthetic CDOs. Investors buy the bonds by paying cash. As loans in the reference pool are paid, the principal balance of the securities is paid back, and if there are losses in the underlying reference pool in future, the principal balance on their bonds is reduced without making any principal payments. Thus they bear the losses as specified by the structure of the CRT deal.

Cash flows of CRT deals are entirely separate from those of the mortgages in the reference pool (which may have been sold as agency MBS securities - securitized as CMOs or as Pass-Through Pools) and mortgage payments are not used to pay holders of CRT debt.

The CRT bonds are not backed by the mortgages in the reference pool and are unguaranteed and unsecured obligations of the GSEs. The coupons on CRT bonds are theoretically paid out of the G-Fee that the GSEs receive for providing the guarantee on the reference pool.

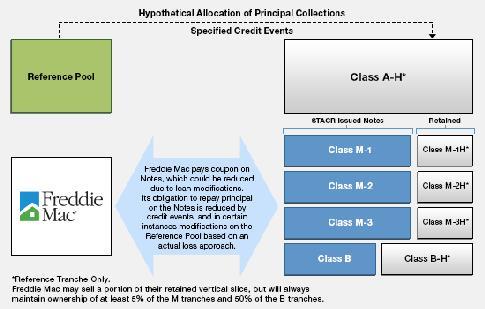

Freddie Mac: Structured Agency Credit Risk (STACR)[4]

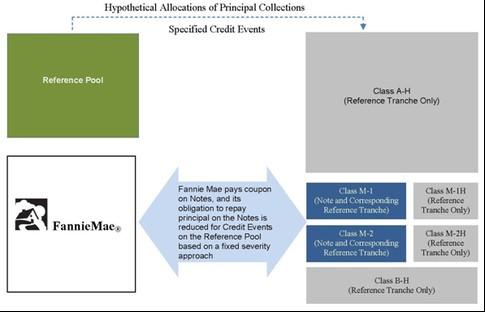

Connecticut Avenue Securities (CAS)[5]

Just like in Synthetic CDOs, the new securities allocate the risk of default to different tranches and losses are applied to the capital structure reverse sequentially upon certain credit events. The GSEs typically hold the safest tranche (class A-H) and the riskiest tranche (class B-H). Investors can buy those in the middle (classes M-1, M-2, and M-3) based on their risk and return appetites.

The STACR and CAS are generally similar in most respects though there are some differences in detail. For example, both use a pro-rata payment structure between the senior (A-H) and junior portions of the pool, and sequentially within the junior tranches. Both the Fannie and Freddie deals contain trigger language that dictate the allocation of unscheduled principal to the classes of the deal. Both the Fannie and the Freddie deals have a Hard Enhancement Trigger, e.g. part of unscheduled principal payments is only diverted to the M-1 and M-2 if the enhancement level on the senior is above 3%, which will lock out both STACR and CAS in higher loss scenarios. However, the Freddie deals also contain a Cumulative Loss Trigger, which if tripped, will stop diversion of principal to the M-1 and M-2 classes.

These transactions have been successful. As of March 2016, Fannie Mae has completed 10 CAS transactions issuing $12.9 Billion notes covering 2.5% of the $513.6 Billion reference pool, which represents 18.3% of its total outstanding single family guarantees, while Freddie has done 19 STACR transactions, issuing $14.2 Billion notes covering 3.0% of $468.2 Billion reference pool, which represents 27.54% of its outstanding single family guarantees.[6]

Hedge funds and money managers have made up the bulk of the earliest investors, with REITS, banks and insurance companies participating to a lesser extent.

Also, the deal structures have been evolving since their introduction in 2013. For example, while the early deals focused primarily on loans with very low loan-to-value (LTV) ratios, recently deals have also included mortgages with LTVs over 80%.

STACR and CAS deals have done a lot to transfer some of the risk to private investors. However, there are some things that they do not accomplish:

· These deals do not remove all the risk from GSEs. Generally, the GSEs have retained the first loss risk, although some recent deals have sold part of the first-loss risk also. This may be partly for economic reasons (first loss risk is expensive to transfer), and may be indicative of need for slightly higher g-fee that may be needed to sell a significant amount of this risk in this form to a limited set of investors.

· These deals may not be removing the right risks. Not transferring the first loss risk and covering losses above the first loss may not be adding value.[7] Using credit loss rate of 0.51% on 2000-2003 Fannie loans as a guide for 2014-2015 loans (similar credit quality with LTV and FICO of 73% and 714 for 2000-2003 FN loans vs. 76% and 746 for 2014-2015 FN loans) suggests there is more value in transferring the first loss risk. Retaining some risk signals alignment of interest with CRT investors, but transferring less risk also does the same.

· There is a basis risk that remains since the risk is not always tied to actual mortgage losses. For example, though some of the recent deals are based on the actual losses on the reference pool, the majority of deals were based on an assumed fixed loss severity. Also, some deals do not transfer specific risks, e.g. the Eminent Domain risk.

· The GSEs share the risk with STACR or CAS for a period of 10 years, after which the risk reverts to the GSEs. Theoretically, the risk could be sold again in a new CRT deal after the previous one matures. However, if the performance of mortgages deteriorates, the cost of new CRT deal may become prohibitive. The shorter maturity exposes GSEs to tail risk since the underlying mortgages have a maturity of 30 years.

· The risk-sharing transactions create an obligation to pay premiums for the next 10 years and responsibility for hedging and taking the remaining risk back after the 10 year maturity of the CRT notes. These entrench the GSEsin the housing system even more, moving further away from the goal of reducing their role in the housing finance system.

· Both STACR and CAS bonds are uncapped one-month LIBOR floaters with a 10-year final maturity. They are both senior unsecured general obligations of the respective GSE. Both deals are priced to a 10 CPR assumption. However, actual prepayment rate on mortgages can vary depending on interest rate movements. This introduces the risks related to negative convexity and hedging costs. Also, if the prepayments are slower than assumed due to interest rates going up, the risk will remain with GSEs for a longer period.

· CRTs are derivatives. They are not good assets for REITs. This restricts the ability of permanent capital from REITS to participate. So, there is a very limited and highly specialized investor base comprising primarily of hedge funds. This limits the volume of these transactions that can be done, and causes pricing to worsen as volume increases.

· CRTs are synthetic transactions. So, the mortgages being referenced generally are in separate securitizations or are held by investors. Unlike in a cash transaction, GSEs are not transferring the liquidity guarantee, and remain responsible for advancing when there are defaults. This increases the need for cash (and capital) during the life of transaction unlike cash transactions like K-deals where Freddie faces maturity default risk and not advancing obligation.

· CRT deals do not promote securitization by private issuers, and do not promote competition in the private market.

Credit Risk Insurance Deals

Given the limitation on the volume of CRTs the market can absorb, GSEs have employed other structures to transfer some of the credit risk. Another, less frequently used approach is Credit Risk insurance deals. Credit insurance risk sharing deals shift credit risk on a pool of loans to an insurance provider which may then transfer that risk to one or more reinsurers. Both companies have turned to separate insurance deals to satisfy some of their risk-sharing requirements.

As of March 2016, through 16 ACIS transactions (Agency Credit Insurance Structure)[8] since the program began in 2013, Freddie Mac has placed approximately $4.3 billion in insurance coverage.

As of March 2016, Fannie Mae has acquired nearly $1.7 billion of insurance coverage on over $66 billion of loans, provided by nine Credit Insurance Risk Transfer[9] (CIRT) transactions since the program's inception in 2014. In CIRT 2016-1 and CIRT 2016-2, which became effective February 1, 2016, Fannie Mae retains risk for the first 50 basis points of loss on the reference pool and an insurer covers the next 250 basis points of loss on the pool.

How do Multifamily K deals work?

The K-Deal program[10] is a securitization program in which Freddie Mac securitizes multifamily mortgages and creates bonds backed by the cash flows of those mortgages which are sold to private investors. K-Deal securities utilize a senior/subordinate bond structure with a mix of guaranteed and unguaranteed bonds. The unguaranteed bonds account for the overwhelming majority of the risk and are sold to private capital investors who assume the first-loss position in the event a loan goes into default or foreclosure. Freddie provides a guarantee for the senior-most bonds (which generally receive a AAA rating based solely on the quality of the underlying collateral, and not based on the Freddie Mac guarantee), but the riskier junior and first-loss bonds (generally totaling about 20% for fixed rate and 10% for floating rate deals) are purchased by private investors who take complete risk on those bonds. K-Deal bonds are REMICs (not derivatives) and are good REIT assets. They are liquid and have a broad base of investors. By transferring the risk of the bottom of the stack to private investors, K deals reduce taxpayer risk. The guarantee on senior bonds acts as catastrophic insurance and would be called on only in the most extreme cases where losses exceed the unguaranteed amounts of the securities.

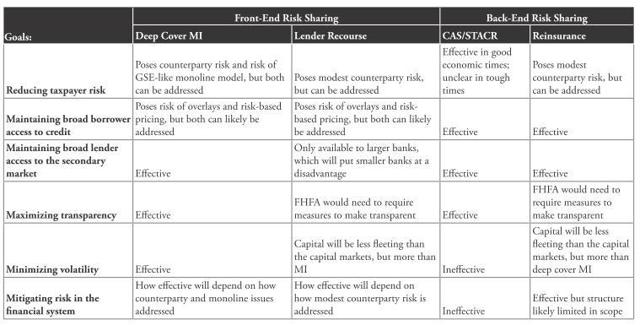

Front-End Risk Sharing

STACR, CAS, ACIS, and CIRT are ways to lay off the risk that the GSEs already have, i.e. the risk transfer happens on the back end after they've purchased the loan and put it into securitization. Another approach that has been proposed is sharing the risk on the front-end, i.e. when the GSEs initially assume the risk of the loans.

In a front-end transaction, a private mortgage insurer (MI) or lender takes some credit risk prior to the sale of the loan to the GSEs, with the GSEs lowering their guarantee fees to reflect the commensurate reduction in credit risk they assume when purchasing the loan.

A May 2013 concept paper Up-Front Risk Sharing: Ensuring Private Capital Delivers for Consumers released by the MBA urged the FHFA to require the GSEs to offer Upfront Risk-Sharing as an options to lenders at the "point of sale," in addition to laying off the risk at the back-end after loans have been delivered to the GSEs. The paper suggested that FHFA could require the GSEs to accept loans with deeper levels of private credit enhancement in exchange for reductions in guarantee fees and other loan level charges.

In the 2016 Scorecard, one of the directives for the agencies is to work with the FHFA to conduct an analysis and assessment of front-end credit risk transfer transactions.

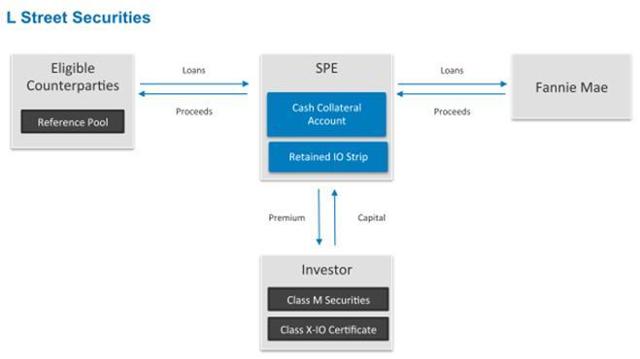

A Fannie Mae publication provides an example of such a front-end risk-sharing transaction described as Lender-facing Risk Transfer Transactions or L Street Securities.[11]

In this type of collateralized recourse structure, lenders who want to invest in the credit risk on loans they originate can retain a portion of the credit risk of the loans:

· The loan seller establishes Special Purpose Entities (SPE) to deliver a pool of mortgages to Fannie Mae. This pool of mortgages is then used as a reference pool for the lender collateralized recourse arrangement.

· The SPE issues securities where the performance of the securities is based on the reference pool. These securities are typically retained by the lender so that they can hold the credit risk on their loans in certificated form.

· Guaranty Fee on underlying loans are reduced, subsequently retained by the SPE issuer (retained IO strip), and is used to pay interest to class M securities (see figure above).

· The proceeds from sale of the securities are used to fund a Cash Collateral Account. The collateral account mitigates counterparty exposure and is used to reimburse Fannie Mae for any losses incurred, and then to make the principal and interest payments due on the securities.

In this structure, the credit risk is transferred at the time of delivery and typically covers initial/first loss through some projected loss level.

As of March 15, 2016, Fannie had completed transactions transferring approximately $350 million in credit risk covering $11 billion in mortgage loans.

These types of transactions are another useful tool for transferring risk. However, one disadvantage is that these are more likely to be used by larger originators, leaving the smaller originators at a disadvantage.

Senior Subordinate Securitization: Freddie Mac Whole Loan Securities[12]

Senior-subordinate structures with bottom tranches taking the credit risk and losses have been used in various asset classes for a long time including non-agency mortgage deals, commercial mortgage backed deals (CMBS), asset-backed securities (ABS), and Freddie's K-deals backed by multifamily loans.

Freddie Mac has used this structure in two transactions so far, offering a total of $934.5 million in securities ($300 million FWLS 2015-SC01 in July 2015 and $634.5 million FWLS 2015-SC02 in Nov 2015). Both were backed by newly-originated fixed-rate super conforming prime residential mortgage loans purchased by Freddie Mac that, while eligible, were not delivered into TBA loan pools.

In contrast to STACR deals, mortgage loans deposited in the trust are collateral for the bonds. Similar to K-deals, the securitization issues guaranteed senior and unguaranteed subordinate actual loss securities. Principal payments on the mortgage loans are generally allocated on a pro rata basis between the senior and subordinate certificates provided certain performance and collateral tests are met. Within the subordinate certificates, principal payments are allocated sequentially.

Investors in non-guaranteed, subordinate certificates may not receive full payments of either principal or interest on the certificates as a result of realized losses on the mortgage loans in the WLS trust.

This structure has not been applicable for the agency backed mortgage securitizations. Agency CMOs do use tranching, but since the underlying pools are guaranteed by one of the GSEs, there is no need for credit tranching, as there will be no credit losses.

However, Freddie can use this structure only for loans that it purchases (likely at the cash window which buys mortgages outright), which is a very small fraction of the overall credit risk of loans it guarantees.

Freddie Mac Whole Loan Securities Illustration

Summary of the Options being considered

A December 2015 paper Delivering on the Promise of Risk-Sharing[13] by Laurie Goodman, Jim Parrott and Mark Zandi summarized the various risk-sharing options being considered. The table below lists the various options in the Front-End and Back-End risk-transfer along with their pros and cons:

The New Approach

In addition to the above Front-End and Back-End Risk Sharing approaches, another approach is possible which falls somewhere between the front-end and back-end solutions. The approach allows a STACR/CAS type deal as a cash deal rather than synthetic and allows K-deal type securitizations with a mix of guaranteed and unguaranteed bonds.

The idea is to allow a holder of a fully guaranteed pool, after loans have been delivered and the pool is not a TBA anymore but before the pool has been securitized in an Agency CMO deal, to obtain a reduction in the total guarantee and loan level fees in exchange for assuming a certain amount of first loss risk. This option will be available to any holder of a mortgage pool, not just the originator of the loans.

In this approach, there will be absolutely no change to the process of financing using TBAs. Mortgage originators will still use the TBA market to sell their production in a forward market with full guarantees from the GSEs as they do now. Mortgage originators will sell TBAs and deliver loans after origination as they do now. It is only after the mortgages have been delivered into the pool that the holder of the pool will have the option (but not an obligation) to take some of the risk of mortgage defaults away from the GSEs in exchange for reduction in GSE guarantee and loan-level fees. This will ensure that the TBA market will continue to function as it does now with no impact.

Since the pool with the mortgages already delivered is likely to be held by a securitizer or an investor, this approach makes it possible for a wide set of market participants to take the default risk away from GSEs, unlike the Front-end risk sharing approaches which limit that to only the originator and may be of use only to larger originators, possibly putting smaller originators at a disadvantage. Also, having a larger group of market participants should bring more competition and demand from those with desire for the type of risk-reward profile offered by the new securities, which may not be available to them now.

In terms of mechanics, this could be achieved by allowing anyone who owns an entire fully-guaranteed pool (let's call it Pool A for this example) to give that Pool A to the GSE and in exchange receive two new sub-pools - a Senior portion and a Junior portion (let's call them Pool A Sr and Pool A Jr) and an IO. Pool A Sr will carry the GSE guarantee while Pool A Jr will be unguaranteed. The IO will simply be a strip from the entire pool and represent the reduction in fees for the reduction of risk to the GSE.

Similar to CRT deals, there will be a standardized waterfall governing allocation of payments between the Senior and Junior sub-pools. CRT deal waterfalls generally provide for scheduled principal payments to be paid to the senior first and then to the junior tranches. Principal amounts received from prepayments are split between the senior and junior based on a ratio. There may be a lockout period before any unscheduled principal payments are paid to the junior sub-pool. Also, the waterfall specifies some triggers, e.g. the Hard Enhancement and Cumulative Loss triggers. If the amount of default increases and a trigger threshold is reached, then some of the payments that may have gone to the junior otherwise will be paid to the senior instead. The structure could be somewhat similar to that used in the Freddie Mac's FWLS deals.

The new mechanism will open up several possibilities for securitizers and private investors. At present, banks purchase TBAs or pass-through pools which are fully guaranteed, and do Agency CMO deals creating bonds that carry the GSE guarantee. One option will be to place the non-guaranteed junior sub-pools with investors as high yield instruments and securitize the senior sub-pool in fully guaranteed Agency CMO transactions.

Another option will be to securitize both senior and junior sub-pools in the same CMO that, like K deals, issues both guaranteed and non-guaranteed bonds. This will allow tranching of the senior and junior portions to create bonds with different risk-return profiles that will appeal to a broader set of investors widening the investor base.

In 2007, the cash RMBS subordinate market was over $200 Billion. In the post-crisis era, there have been very few private-label RMBS deals resulting in little to no supply of subordinate RMBS bonds. The new structure will fulfill the need and bring in private capital to the housing finance system.

Since these securitizations will be cash transactions with the underlying mortgages providing all of the cash flows, and not derivative transactions linked to a reference pool synthetically, the CMO bonds will be good real-estate assets for REITs and other investors. A wider pool of potential investors will allow better pricing and enable higher volumes to be sold.

Since these will be cash deals, the actual risk of the pools will be transferred to private investors, and there will be no basis risk remaining with the GSEs. Also, unlike in CRTs, there will not be tail risk remaining with GSEs since there will be no need for the risk to come back to the GSEs after the maturity of the CRT transaction.

This approach not only puts private capital, not taxpayers, in the first-loss position, but also does not favor larger originators or puts smaller originators at a disadvantage.

The fact that the deals will be done by third parties, not the GSEs, just like Agency CMOs, this reduces the role of GSEs compared to CRT deals, and encourages competition in private market by leveraging market participants who are currently doing agency CMOs.

This proposed structure does not disrupt the TBA market. The additional functionality comes into play only after the loans have been delivered into pools. Also, unlike CRTs, the new structure does not require figuring out of the tax and accounting treatments for the new securities.

The new structure is economically similar to CRTs, other than the fact that it is a cash transaction as opposed to a synthetic one. Since the economics to the GSEs and investors are similar, we know the new structure will work in terms of economics, if GSEs sell the same amount of risk at similar pricing levels as in CRTs.

As with CRT deals, the new deals will start with a simpler structure, and evolve over time. The structure will allow more flexibility in managing how much of the exposure is transferred by managing the amount of reduction in fees for reduction in risk. Over time, greater amounts of risk could be transferred by slowly adjusting the total fees and reduction in fees.

The new structure has several advantages over CRTs. However, it is suggested as one more tool in GSE's toolbox, and not as a replacement for CRTs.

The proposal above describes the basic idea and a framework for implementing it. There are several variations possible on the basic idea. Details will need to be worked out to leverage the existing systems and processes as much as possible and minimize the requirements for systems and other changes. However, by bringing greater amounts of private capital into the mortgage market, the new deal structure will reduce taxpayers' exposure to mortgage credit risk, and will help the broader efforts to shrink the government's footprint in housing.

The K deal program was started in 2009 when the private label CMBS market was not functional. Just like K deals, the new structures will be hybrids between fully-guaranteed agency CMOs and non-guaranteed Private Label RMBS. A similar program for residential mortgages just might help restart the private label RMBS market.

Note: The views expressed are solely and strictly my own and not of any current or past employers, colleagues, or affiliated organizations. My writings are simply expressions of my intellectual thought process. The intent is not to promote any particular view point or agenda, and the writings are not influenced by any other groups or individual.

[1] As of December 2015, there has been approximately $128 billion of issuance in 103 K-deals since the start of the program in 2009.

[2] The To-Be-Announced (TBA) market allows for the sale of securities before they have been finalized-as in, before the mortgages that back the securities have been identified. The full GSE guarantee makes that possible.

[3] FHFA's 2015 Scorecard required $150 Bn and $120 Bn of risk transfer transactions from Fannie Mae and Freddie Mac respectively. The 2016 Scorecard requires transfer of credit risk on at least 90 percent of the balance of newly acquired single-family mortgages in targeted categories.

[4] http://www.freddiemac.com/creditriskofferings/stacr_debt.html

[5] http://fanniemae.com/portal/funding-the-market/credit-risk/conn-ave.html

[6] Source: Urban Institute's Monthly Chartbook for March 2016.

[7] Risk Sharing or Not, Timothy Howard,https://howardonmortgagefinance.com/2016/03/09/risk-sharing-or-not/

[8] http://www.freddiemac.com/creditriskofferings/creditrisk_insurance.html

[9] http://www.fanniemae.com/portal/funding-the-market/credit-risk/credit-insurance.html

[10] http://www.freddiemac.com/multifamily/investors/kcerts.html

[11]http://www.fanniemae.com/resources/file/mbs/pdf/mbsenger_031716a.pdf

[12]http://www.freddiemac.com/creditriskofferings/freddie_mac_whole_loan_securities.html

more