Public Storage: Profiting From America's "Too Much Stuff" Problem

Image Source: Unsplash

Many Americans have too much stuff—one in five Americans already use a self-storage facility, and another 15% intend to rent space. Public Storage (PSA) is the current leader in both revenues and facilities, and the company is worth a look, writes Kelly Green, editor of Dividend Digest.

As I head to my home office, I look out the living room window to check the sky. More than once, I’ve been tricked into thinking we’re due for torrential rain when I spot the gray wall of the recently erected CubeSmart, a monstrosity that towers over my neighbors’ homes.

The explosion of these facilities isn’t unique to my neighborhood. Over the last five years alone, 252.3 million square feet of storage space has been built. That’s billions of dollars in construction.

There’s now over 2 billion square feet of storage space in the US. Of the estimated 51,206 storage facilities, 36.6% of those are owned by the top six operators -- all of which are publicly traded.

PSA opened its first facility in 1972 and has grown to become the largest owner and operator of self-storage facilities in the world. It has thousands of locations across the US and Europe, with more than 170 million rentable square feet. The company brought in $4.24 billion in revenues in 2022. That was a 21% growth over 2021.

Public Storage has paid a quarterly dividend to its shareholders since December 1995. And its current payment of $3 recently equaled an annual yield of 4%. Its trailing 12 months (TTM) yield is double that, as shareholders received a one-time special dividend last August related to the acquisition of PS Business Parks.

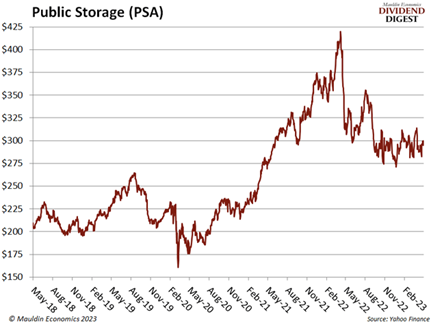

Investors have noticed the value here.

Despite dropping from 2021 record highs, shares are still up 40% over the past five years. But as PSA continues to grow, there will be capital gains to be made.

The self-storage business has a recession-proof nature. In fact, when things get rough, we see more people using the extra space. During the height of COVID-19, demand spiked. Consumers experienced displacement, downsizing, relocation, home remodels, and divorce, just to name a few. Still, hundreds of thousands of Americans experience these things every year, so the demand for storage remains strong even without a pandemic.

That said, I anticipate some volatility in public storage over the next few years. As you can see by the stock chart above, the industry saw record highs in 2021-2022. And 2023 is going to be a normalization year across the board.

About the Author

Kelly Green, senior editor at Mauldin Economics, has been a researcher for as long as she can remember. She was always fascinated with taking things apart and asking hundreds of questions, whether it was a car or a complex math equation.

Ms. Green graduated at just 20 years old with a bachelor's degree in mathematical economics. A short time later, she passed her Series 7 and 66 exams, sponsored by one of the largest financial services companies in the world. Within months of starting her promising career, however, Kelly realized she wasn't suited to preparing information packets. She longed for analysis work.

Kelly turned to a career researching the lucrative field of high-yielding equities. The numbers and the research didn't lie. She fell in love with exploring the ins and outs of income-investing opportunities and sell-side options trades. Over the next few years, Kelly would work as co-editor of several income-focused newsletters, chief researcher, and portfolio analyst. She even wrote an educational series for investors covering topics ranging from making first trades to how to trade options.

More By This Author:

Alliant Energy: A Midwest Utility Offering Solid Value And Yield"Revenge Travel" - A New Wave For Royal Caribbean

Cogent Communications: A High-Speed Internet Provider Worth Tapping Into

Disclaimer: © 2023 MoneyShow.com, LLC. All Rights Reserved.