Monthly Dividend Stock In Focus: Ellington Financial Inc

Investors are often attracted to dividend-paying stocks because of the income they produce. Dividend-paying stocks provide income, even while the price of the stock can fluctuate.

There are some companies that even pay monthly dividends, which allow for consistent cash flows for investors. But there are less than 60 stocks that pay a monthly dividend.

Ellington Financial Inc (EFC) is a Real Estate Investment Trust, or REIT, that pays a monthly dividend. Even better, the stock has a very high dividend yield of nearly 11%.

Of course, high-yielding stocks can often be a warning sign that the underlying business has significant challenges. Stocks with extremely high yields above 10% can trap investors with dividend cuts later on. Those investments should be avoided by most investors.

This article will examine Ellington Financial’s business model, prospects for growth, and the safety of its dividend to determine if investors should consider buying the stock.

Business Overview

Ellington Financial only transitioned into a REIT at the beginning of 2019. Prior to this, the trust was taxed as a partnership. It is now classified as a mortgage REIT.

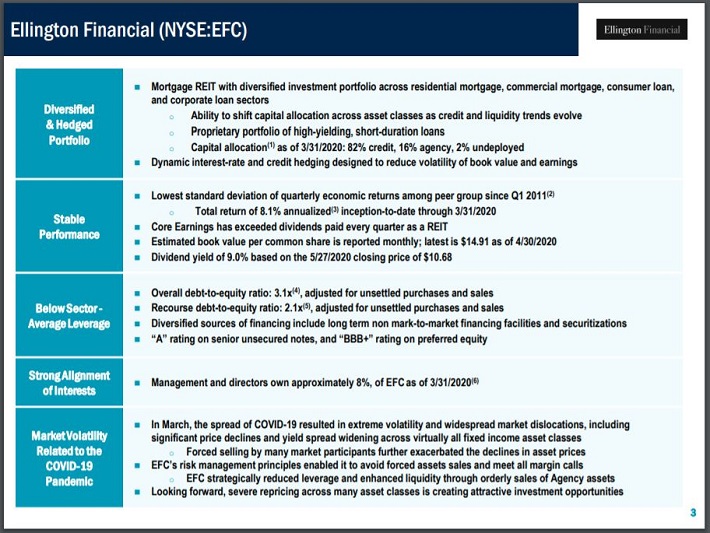

Source: Ellington Financial’s May Investor Presentation, slide 3.

Ellington Financial is a hybrid REIT, meaning that the trust is a combination of an equity REIT, which owns properties, and mortgage REITs, which invest in mortgage loans and mortgage-backed securities.

Ellington Financial has a market capitalization of $500 million and annual revenues of $115 million. The trust is a fairly diversified mortgage REIT.

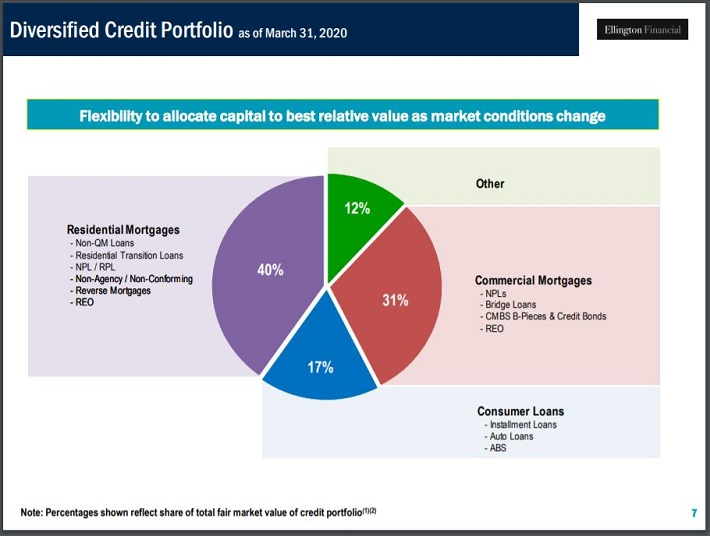

Source: Ellington Financial’s May Investor Presentation, slide 7.

Ellington Financial ended the first quarter with nearly $10 billion in assets under management. The trust’s loan portfolio consists of residential mortgages, commercial mortgages, consumer loans, and other types of loans. Within each subset exists multiple types of loans.

While most mortgage REITs would likely experience difficulty in its business during another mortgage crisis, Ellington Financial would likely fair better than its peers due to the diversity of its business model.

Growth Prospects

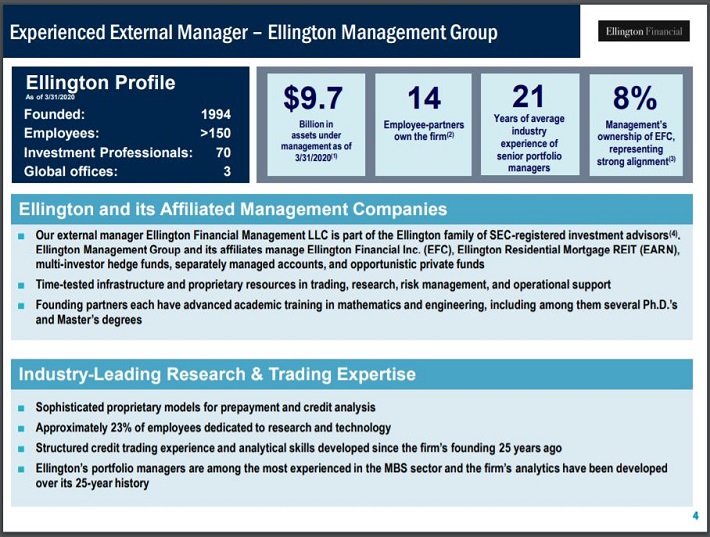

Ellington Financial has multiple levers that it can pull to generate future growth. First off, the trust has a very experienced leadership team that has been through the highs and lows of the economic cycle. This management team has established a track record of producing growth.

Source: Ellington Financial’s May Investor Presentation, slide 3.

The senior partners of the firm have more than two decades of experience in the industry, meaning that the trust’s leadership have seen multiple boom and bust cycles. This also gives Ellington Financial one of the most experienced management teams in the entire mortgage REIT industry. The management team owns 8% of Ellington Financial, which gives them incentive to see the company succeed.

Ellington Financial also has a solid credit rating of “A” on senior unsecured notes and a “BBB+” rating on preferred equity. This gives the trust an investment-grade rating, which is very important when it comes to raising capital, a common practice for REITs. This rating allows Ellington Financial access to capital at lower rates to invest in its business.

The trust has done so successfully in its short time as a REIT. Ellington Financial focuses on loans that are short-term but offer a high yield.

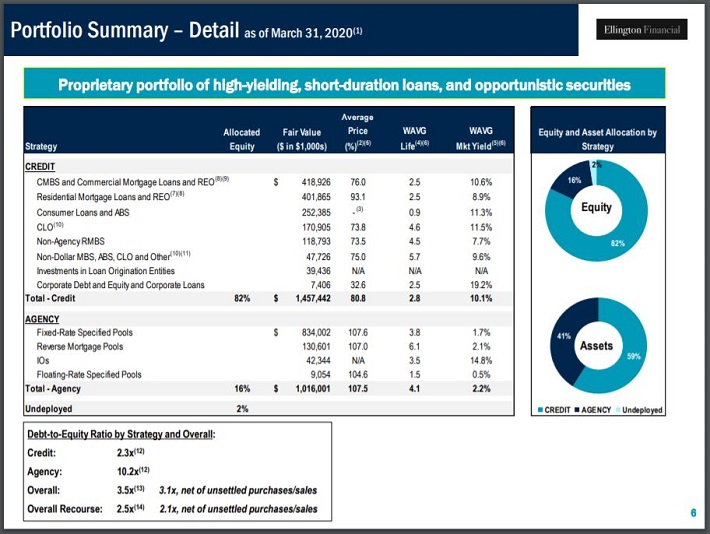

Source: Ellington Financial’s May Investor Presentation, slide 7.

The trust’s credit business, which accounts for 82% of allocated equity, has a weighted average life of loans less than three years but offers a weighted average market yield of more than 10%. The trust’s agency business has a weighted average life of just over four years but yields just 2.2%.

While shorter-term leases could be troublesome for the trust if yields were to dry up, Ellington Financial has performed quite well over long periods of time.

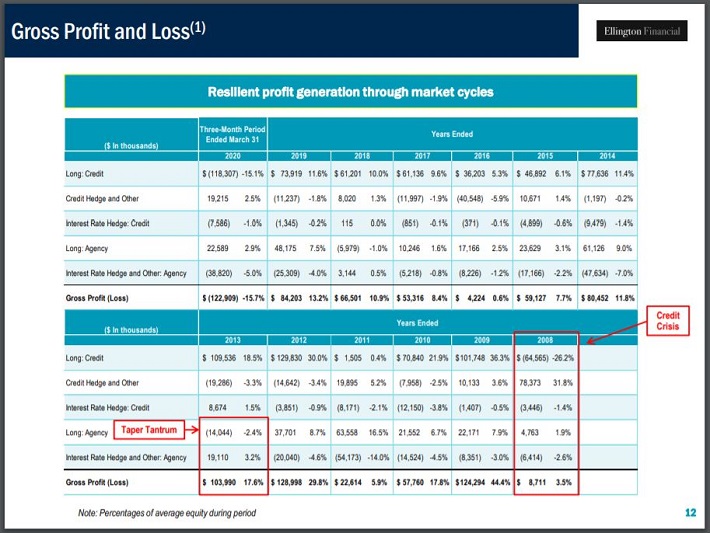

Source: Ellington Financial’s May Investor Presentation, slide 12.

Profit results for 2019 were down significantly from 2018. This was the only instance in the past decade when Ellington Financial suffered a year-over-year decline in profits. In fact, in 2008 and 2013, two very difficult periods for mortgage REITs, Ellington Financial actually increased its profits.

Its ability to withstand a challenging environment is impressive and should serve the company well in the next economic downturn. This gives it a rather consistent business model that helps protect it from severe downturns in the market.

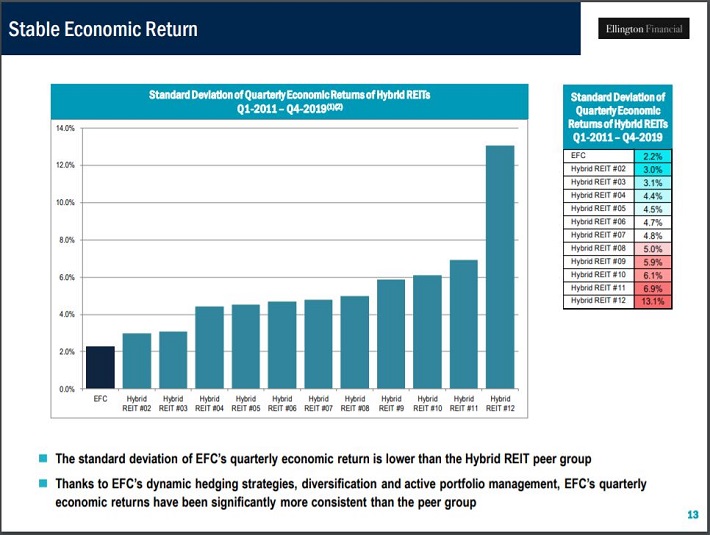

As such, Ellington Financial’s quarterly economic returns don’t vary too much from quarter to quarter or even year to year, especially when compared to its peers.

Source: Ellington Financial’s May Investor Presentation, slide 13.

Most of its peers have a wide variance in their economic returns over the last nine years. This factor should not be overlooked when considering purchase shares in a hybrid REIT.

Ellington Financial closed the first quarter with solid liquidity, including cash and equivalents of $136.7 million and unencumbered assets of $279.2 million. Combining Ellington Financial’s diversified loan portfolio and its ability to weather most economic environments, and the business seem like an attractive investment. However, the company’s dividend history leaves a little to be desired in terms of stability.

Dividend Analysis

Ellington Financial began paying a monthly dividend last year. Prior to that, shareholders received dividends on the more traditional quarterly schedule. There has been some variation in the amount paid monthly, but core earnings have exceeded dividends distributed every quarter that the trust has been a REIT.

The dividend has been cut twice over the last two years. Most recently, the dividend was reduced by 47% for the May 26th, 2020 payment. This was a steep cut, especially for investors relaying on income. On a positive note, Ellington Financial did raise its dividend by 12.5% for the upcoming July 27th payment.

Shareholders can expect to receive $1.24 in dividends per share in 2020 assuming that there is no further reduction in the trust’s dividend. Based on the current share price, this equates to a dividend yield of 10.9%. For context, the S&P 500 has an average yield of just 1.9%. Ellington Financial’s yield is nearly six times this amount, making it naturally appealing for income investors.

Analysts expect that Ellington Financial will produce earnings of $1.34, giving the stock an expected payout ratio of 93%. Considering that high payout ratios are very common for REITs, we are not as concerned about this as we would be for most other companies.

That said, the company’s recent dividend reductions are a bigger cause for concern. The dividend cut that was made in late May was likely done so to keep the payout ratio from ballooning even higher. After the cut, the yield is still very attractive.

We should note that dividend reductions have happened twice since Ellington Financial became a REIT. This was also a fairly common practice prior to transitioning to a REIT, so investors should be prepared for another cut in the future if the trust’s fundamentals were to deteriorate.

Final Thoughts

High-yielding investment options always need to be considered carefully as the elevated yield is often a warning sign of fundamental deterioration. In the case of Ellington Financial, however, the trust looks to be a possible exception to that rule.

The trust has a diversified loan portfolio and has proven successful at increasing its profitability through all phases of the economic cycle. Ellington Financial’s dividend yield also looks safe though another cut could be in the offering if the trust were to see a slowdown in its business.

Investors not looking to take elevated risks should probably avoid Ellington Financial stock. That said, Ellington Financial stock pays monthly dividends and has a very high yield, assuming the dividend remains intact. Investors with a higher tolerance for risk may find Ellington Financial an attractive investment option.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more