Monthly Dividend Stock In Focus: Apple Hospitality REIT

Real Estate Investment Trusts, or REITs, are a core holding for many income investors due to their high dividend yields. The coronavirus pandemic was devastating for many REITs. It especially hit the hospitality industry hard, including REITs in that industry.

Apple Hospitality REIT Inc. (APLE) is a REIT that pays a monthly dividend. Monthly dividend stocks pay shareholders 12 dividends per year instead of the more typical quarterly payments.

Apple Hospitality has a 3.4% dividend yield, which is lower than many other REITs. But extreme high-yielders should generally be avoided because such high-yielding stocks often have unsustainable dividends.

Business Overview

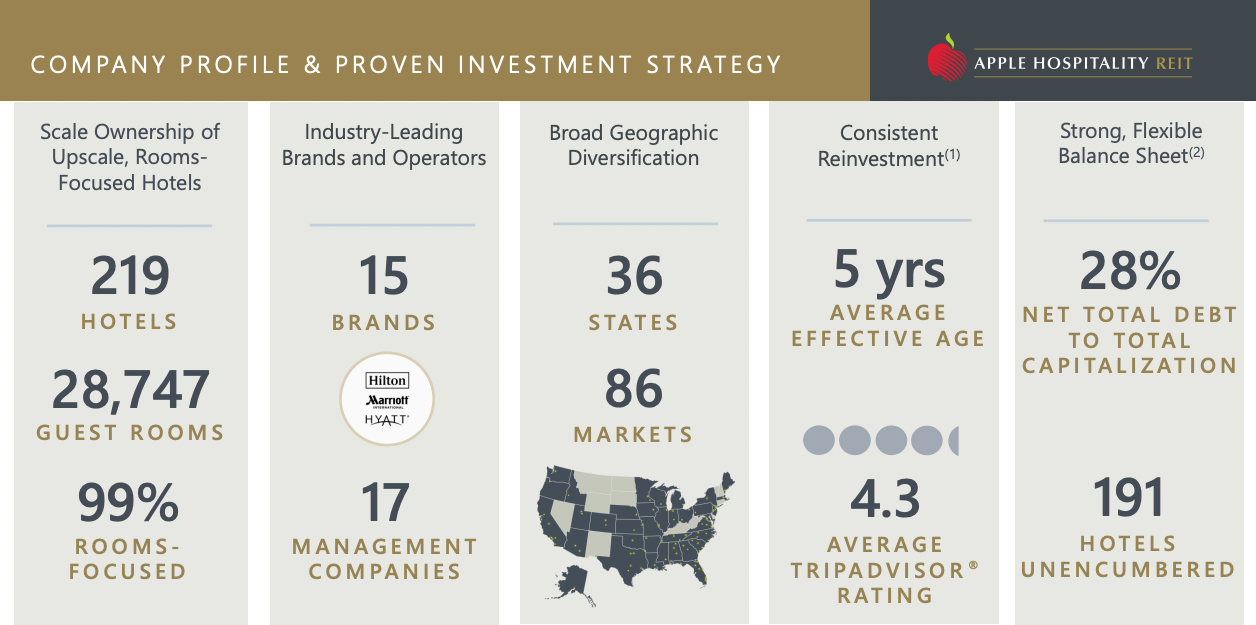

Apple Hospitality is a company that owns one of the largest and most diverse portfolios of upscale, rooms-focused hotels in the United States. Apple Hospitality’s portfolio consists of 219 hotels with more than 28,700 guest rooms located in 86 markets throughout 36 states. Concentrated with industry-leading brands, the company’s portfolio consists of 94 Marriott-branded hotels, 119 Hilton-branded hotels, 4 Hyatt-branded hotels, and two independent hotels.

(Click on image to enlarge)

Source: Investor Presentation

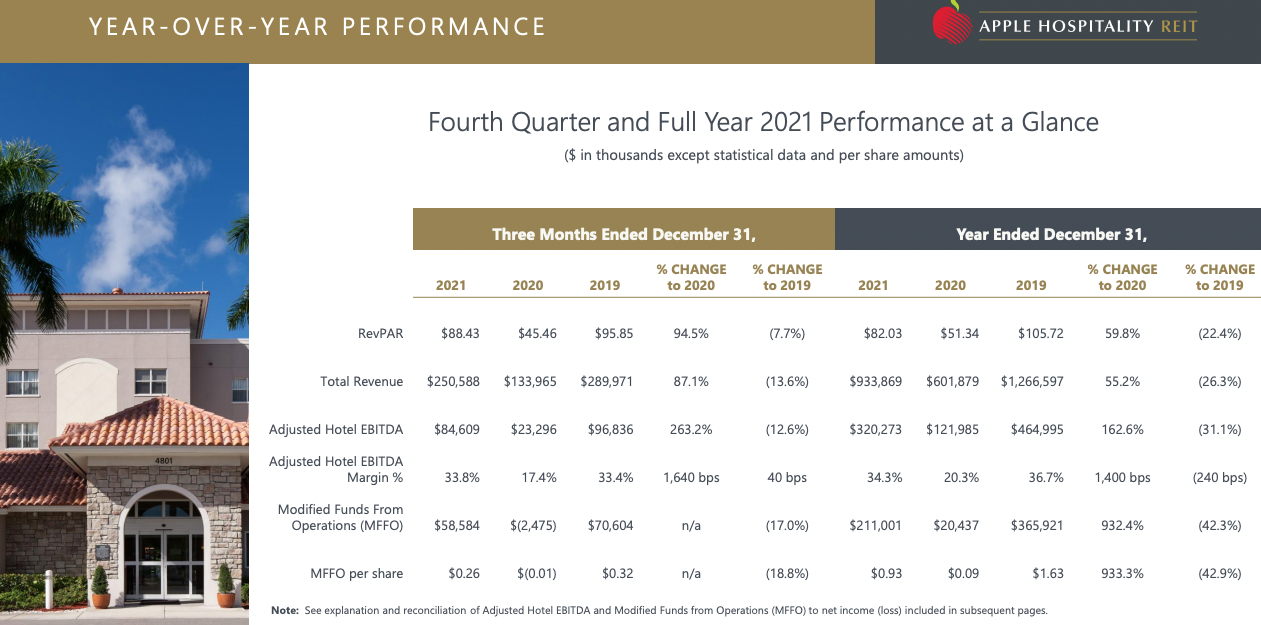

On February 22, 2022, the company reported fourth-quarter and full-year results for the Fiscal Year (FY)2021. Total revenue for the quarter was $250.6 million compared to $133.9 million in 4Q2020, or 87.1%. For the quarter, the company reported a net income of $13.2 million compared to a loss of $51.2 million in the fourth quarter of 2020. This was driven by a mix of leisure and business demands, both transient and minor group bookings. Adjusted Hotel EBITDA margin was 34% for the quarter, increasing 40 basis points over the fourth quarter of 2019.

Total expenses were up 31.8%. The increase in operating expenses was driven by operations, hotel administration, and marketing which all three segments saw almost double the spending. However, operating income was positive $28 million compared to a loss of $32.8 million in 4Q2020.

Adjusted EBITDA stood at $73.38 million, up significantly from $16.19 million in the year-ago period. The average daily rate rose to $131.04 from $97.87 year-over-year, and occupancy stood at 67.5%, up from 46.5% in the year-ago period. That said, revenue per available room surged considerably to $88.43 from $45.46 in the year-ago period.

(Click on image to enlarge)

Source: Investor Presentation

For the year, the company increased revenue from $601.9 million in 2020 to $933.9 million last year, or 55.2%. Operating expenses increased by 18.9% year over year. Since the company had a much better year for 2021 than in 2020, operating income was positive $87 million for the year compared to a loss of $102 million.

Overall, net income for the year was a profit of $18.8 million compared to a loss of $173 million in 2020. Thus, the company made Funds From Operation (FFO) of $0.93 per share for the year, a huge increase compared to what the company made in Fy2020. In 2020, the company made an FFO of $0.09 per share. However, last year’s FFO is still lower than what the company earned in FY2019 when it did $1.63 per share in FFO.

The company also reinstated its monthly dividends for its shareholders, with a March payment of $0.05 per share. The company remains intently concentrated on maximizing long-term value for its shareholders and is confident it is well-positioned for additional upside as leisure travel continues to show strength and business travel steadily recovers.

Thus, we expect the company to make an FFO of $1.38 per share for FY2022. This will represent an increase of 48.4% compared to 2021.

Growth Prospects

Apple Hospitality’s growth prospects will mostly come from an increase in rents. They were also, selling not-so-profitable properties to acquire more beneficial properties. For example, in 2021, the company sold 23 hotels for approximately $235 million and acquired eight hotels for roughly $361 million.

Other growth drivers will come from long-term cost savings. The company has an expense reduction ratio target of 0.80 – 0.90. In FY2021, the company achieved 0.89. This is accomplished by an ability to increase the cross-utilization of managers and associates. Also, scaling to renegotiate vendor contracts and optimize labor management software already in place can help reduce overall costs.

If the company can concentrate on upscale, room-focused hotels, this will allow the company to increase it’s per night room rate. If this is done correctly, more location and market diversification should help the company continue to grow its FFO for years to come. This will also allow the company to start increasing its dividend.

Dividend Analysis

The company does not have a long dividend history as it became public in 2015. As mentioned above, the company pays its dividend monthly, which is attractive to many income-looking investors. In 2016, the company did increase its dividend substantially by 50%, from a $0.80 rate to a $1.20 rate. However, in the following years, the dividend stayed at that same rate until 2020, when the COVID-19 pandemic forced the company to cut its dividend and freeze it to a $0.20 rate for the year.

In 2021, the company reinitiated the dividend by paying it every quarter instead of every month as it did before. However, starting March 2022, the company is now paying its dividend monthly at $0.05 per share.

Regarding dividend safety, let’s look at FFO and the Free Cash Flow payout ratio. In 2021, the company’s FFO was $0.93 per share. The total dividend for the year was $0.04. Thus, the dividend was very well coved for 2021 with a payout ratio of 4.3%. For the entire year of 2022, we expect the company to make an FFO of $1.38 per share. The company will pay out $0.50 per share in dividends for the year, giving us a dividend payout ratio of 33.9%. So the company has plenty of room to increase its dividend and provide a safe paying dividend.

If we look at FCF, the dividend payout ratio for 2021 was 5.3%. We anticipate that the company will earn an FCF of $1.26 per share for FY2022. This will give us a payout ratio of 39.7%. Overall, the dividend is safe based on the company’s FFO and FCF.

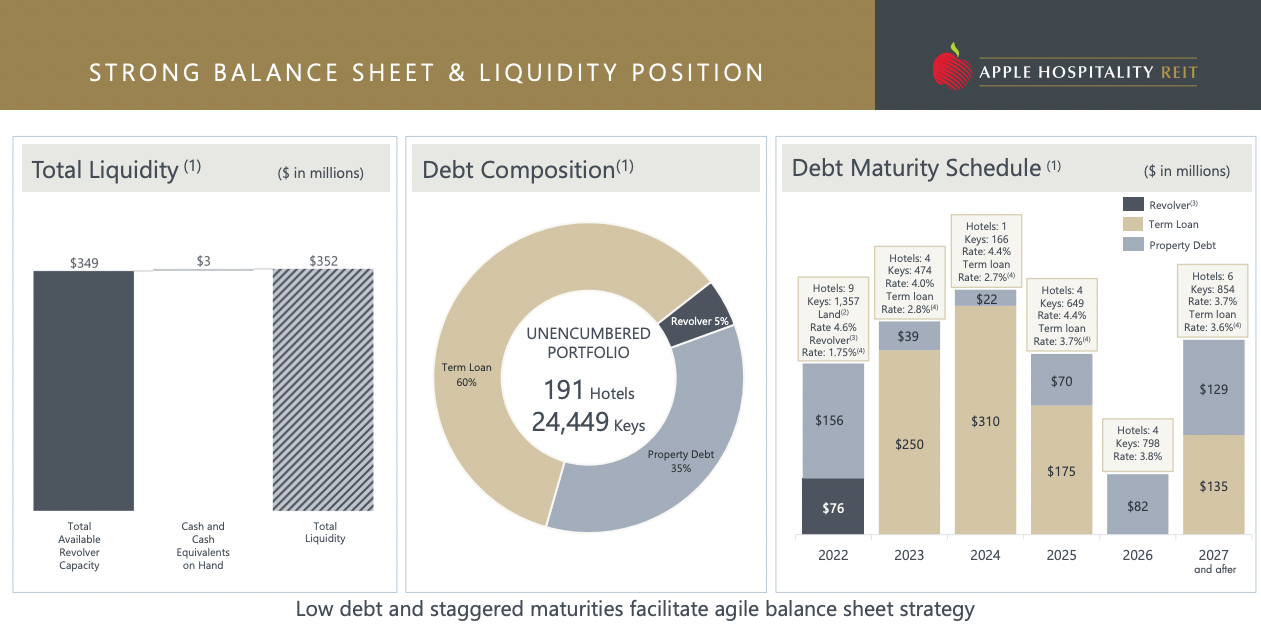

The company has a strong balance sheet. Apple Hospitality has a debt to equity ratio of 0.5, which is good for a REIT. Interest coverage of 1.3 is a little low but at a respectable level. The financial leverage level is 1.5, in line with the company’s past five years. Thus, overall the balance sheet is strong and should give the company flexibility to continue to pay its dividend if a recession hits.

(Click on image to enlarge)

Source: Investor Presentation

Final Thoughts

Apple Hospitality is one of the strongest players in the hotel sector due to its strong brand power, conservative balance sheet, and high-quality assets. The company has the potential to start increasing its dividend for years to come as the world is getting over the COVID-19 pandemic. The dividend payout ratios are low, and earnings are expected to grow 1.6% over the next five years.

Right now, the stock is overvalued. We want a decent pullback where we will see the dividend yield around 5%. At that point, the company would be very attractive to income-seeking investors. Until then, the stock earns a hold at today’s prices.