LAMR: An Outdoor Ad REIT Spinning Off Attractive Income, Returns

Image Source: Pixabay

Lamar Advertising Co. (LAMR) is one of the largest outdoor advertising Real Estate Investing Trusts (REITs) worldwide, with more than 363,000 displays across 45 US states and Canada. LAMR offers its customers a broad range of advertising mediums, including billboards, digital billboards, interstate logo, transit systems, and airport advertising formats.

The company’s business risk and competitive position are solid, while country risk is very low. However, financial risk and cash flow leverage remain somewhat aggressive. Increased leverage was brought on by the pandemic and the decline in travel, but has since been reduced. Deleveraging is likely to continue.

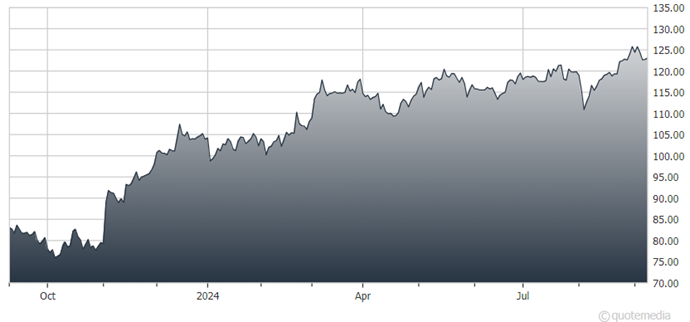

Lamar Advertising Co. (LAMR)

LAMR generates more than 90% of its revenues from billboards in small and midsize US markets. The company reported solid 2Q 2024 revenue growth and adjusted funds from operations (AFFO) of $213.5 million, up almost 10% year-over-year. AFFO per share for the quarterly period was $2.08, topping analysts’ estimates by a penny, while net revenue of $565.3 million grew 4.5%, also ahead of estimates.

Free cash flow to debt coverage should increase this year due to the reduction in capital expenditures. As of June 30, LAMR’s liquidity position was solid, with $744.3 million in total liquidity.

Dividend growth from this common stock investment has been solid, with distributions taxed as ordinary income. LAMR common stock is suitable for medium- to high-risk tax-deferred portfolios.

Recommended Action: Buy LAMR.

More By This Author:

Amid Fed Cut Chatter, Investors Should Stay Focused On The Long TermADX: A High-Yielding, Diversified CEF Worth Looking Into

ORCL: Another Great Quarter With Strong Datacenter Business Growth

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more