Industrial REIT Search: Prologis Inc. Is Fairly Valued, But Waiting For A Dip

Introduction

Recently I have decided I would like to diversify by investing a small portion of my retirement funds into a real estate investment trust (REIT). This then yielded the question of what type of REIT to invest in. What I wanted was an area of real estate that could grow in demand but also currently provides solid income. This led me to industrial REITs, in particular ones focused on logistics. The largest of such a trust is Prologis Inc. (PLD) which this article will analyze to see if the strong underlying operations are worth the premium valuation.

Overview

Company

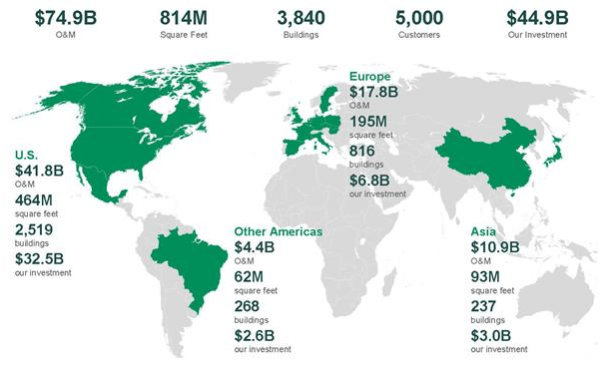

Source: SEC 2019 10-K

Prologis Inc. is a global leader in logistics real estate with a presence in 19 countries. The trust owns and manages high quality logistics facilities with a focus on consumption side supply chain. What this means is the trust want to own or manage facilities were there is strong demand to be close to the end consumer. This trust owns and manages many "Last Touch" facilities which are classified as any facility in the largest global markets urban area with immediate access to the consumer population. As can be seen above Prologis has 814 million square feet or 3,840 facilities available to rent. Most of the trust's property is in the United States which consists of 66% of buildings owned and managed. Prologis operates under two segment breakdowns, real estate operations and strategic capital. The real estate operations segment is obviously the bulk of revenue generation and consists of rental and developmental property. The strategic capital segment contributes around 10-15% of revenue per year primarily from asset/property management.

Industry Trends

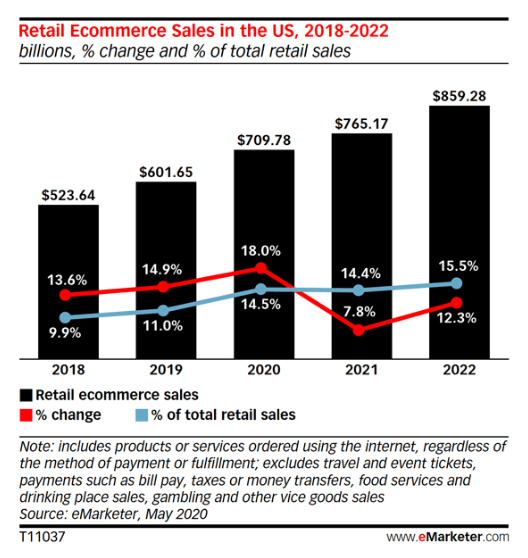

Source: eMarketer

Source: Business Wire

Logistics services and business have seen a solid growth trend in recent years due to increased e-commerce. As can be seen above a recent report for the United States projects that high growth rates will persist, and a greater percent of retail sales will be from e-commerce. E-commerce growth has increased the need for transportation to ship and facilities to hold goods. Again, looking at the second graphic shows projected global e-commerce logistics growth of 11% per year. More and more products and services are being provided right to the consumers door at faster and faster speeds and with warehouses and distribution centers a key part of any e-commerce logistics strategy Prologis' facilities will be in demand.

Prologis Growth

| Customer | % of Net Effective Rent |

| Amazon | 5.8% |

| Home Depot | 1.9% |

| FedEx | 1.7% |

| UPS | 1.3% |

| Geodis | 0.9% |

Source: SEC 2019 10-K

Prologis' top five customers can be seen above which shows that 8.8% of net effective rent in 2019 was from major logistic companies. More demand in these customers services means more demand in the facilities Prologis has. The fact the Prologis focuses on the end consumer and being located near them is key to future rental income performance. On top of organic growth form more demand the trust is always looking to make strategic acquisitions. In 2018 Prologis purchased DCT Industrial Trust and in February 2020 purchased Liberty Property Trust thus adding around 958 properties to the trust. Prologis also projects a 4.86% increase in rentable square feet from developmental project completions. Overall, the general demand for logistics facilities close to the end customer will be in high demand and along with this demand the trust is increasing the amount of rentable property owned/managed.

Past Financial Performance

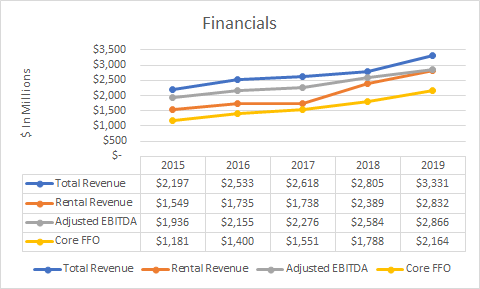

Source: SEC 10-K's & Prologis Press Releases

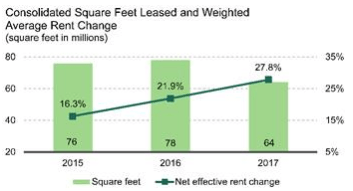

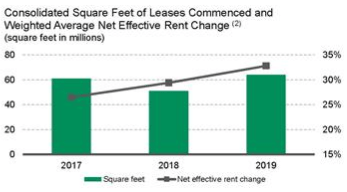

Source: SEC 10-K's

As can be seen above total revenue has grown each year over the past five with a CAGR of 2.89%. The main source of revenue, rent, has increase at a 12.83% clip. A good portion of this revenue increase has been due to acquisitions, but weighted net effective rent has grown year over year as can be seen above. Important to any investor in Prologis is the increases in funds from operations which has grown at a rate of 12.88%. I used the core FFO provided by the trust in year reports rather the conventional NAREIT FFO as it has been adjusted down for items from non-controlling interests making it a more conservative metric. In the end Prologis has seen some very solid operations over the past five years but I also need to check the financial health. In 2019 Prologis had a debt to adjusted EBITDA of 4.87x and a current credit rating from S&P Global of A-. This is not incredible but not bad either. With a rosy outlook on growth for Prologis it's manageable. With the largest acquisition of Liberty Property Trust it will be interesting to see these metrics in FY 2020.

Valuation

| Core FFO | NAREIT FFO | AFFO |

| $2,164 | $2,517 | $2,276 |

| $2.83 | $3.29 | $2.97 |

Source: Press Releases

Above is the core FFO, NAREIT FFO, and AFFO for Prologis in 2019 with diluted per share data is below. With the price at around $101 Prologis is trading at 35.69x, 30.70x, and 34.00x, respectively. With a 2019 dividend per year of $2.12 the AFFO payout ratio is at 71.38%, so there is some room for growth in the dividend. The REIT is also offering a forward yield of 2.26%. Estimates of cap rate for Prologis to acquire Liberty Property Trust and DCT are 4.4-4.6%, therefore paying 21.74x for net operating income. With all of these metrics taken together it seem the market has priced in future growth and is fairly valued.

Conclusion

Taking all the data together Prologis has a solid operational side. There could be much upside in the future with such strong industry trends backing demands for warehousing/distribution facilities near the end customer. Prologis has seen strong net effective rent growth and has made large acquisitions to bolster growth too.

With all that being said, the valuation is just too high for me to purchase this REIT. It makes little sense to me to purchase Prologis when there are common stocks trading at lower valuations, lower leverage, and equal or higher yields. If the price per share of Prologis were to drop closer to 30x AFFO or $90 per share I would rethink making an investment as I am always looking for a margin of safety.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am ...

more

Good article, thanks. I've followed you.