Hotel REITs Are Hot

As a group the REIT sector has been red hot. Since a moderate correction in September 2014, the major REIT ETFs are up about 20%. For many REITs, the prices have gotten too rich, making attractive investments more difficult to find. However, there is a subcategory in the sector that is loaded with great companies increasing their dividends rapidly that would be great additions to every income portfolio.

Comparing price gains, current yields and dividend growth rates, I see more potential for a correction in the REIT sector compared to continued share price growth which could lead to better entry prices in these four stocks. In the February issue of The Dividend Hunter newsletter, I recommended that subscribers sell a very high quality REIT. Even though the company is great, the yield had dropped to 3.8% compared 4.6% in mid-2014. That is too low a yield for an 8% dividend growth rate. Overall, it’s tough to find good value in the REIT sector, but these four stocks are great candidates for investors looking for dividend growth stocks.

The lodging sub-sector of commercial real estate where higher share prices are justified by excellent revenue and dividend growth. The lodging/hotel REITs are currently in a perfect financial storm to generate high levels of revenue and profit growth. Here is an outline of factors in play:

- While overall economic growth can be described as moderate, that growth is enough to generate significantly growing business on vacation travel. The result is increasing demand for hotel rooms.

- New hotel construction remains sluggish. The financial crisis aftermath continues to make companies leery of committing to new hotel construction.

- The combination of demand growth with lagging supply growth is allowing hotel operators to increase both occupancy and daily room rates.

- The low interest rate environment allows sharp hotel operators to invest capital and increase their internal growth rates through hotel renovations or the acquisition of less well-run properties.

Here are four lodging REITs that have started to rapidly grow their dividend rates, with momentum to continue the trend:

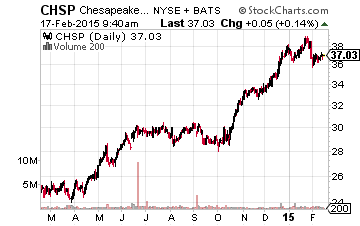

At the end of January, Chesapeake Lodging Trust (NYSE:CHSP) announced a 16.7% increase in its dividend rate. A year ago, the CHSP dividend was increased by 15.4%, so the rate of growth is acceleration. The stock yields 3.8%. Ex-dividend for the next, higher payout is March 27.

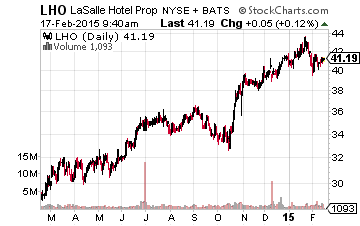

LaSalle Hotel Properties (NYSE:LHO) had paid five quarters of a level dividend before increasing its dividend rate by 40% in September 2013, then three quarters later the dividend was bumped up another 34%. LHO currently yields 3.65%. Last year LaSalle made a regular dividend announcement in March and then announced the increase in April.

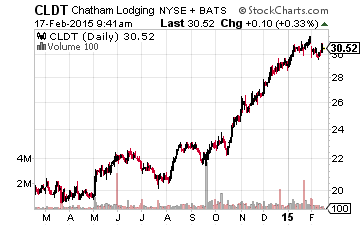

Chatham Lodging Trust (NYSE:CLDT) pays monthly dividends and currently yields 3.94%. The dividend has been increased twice over the last year by a total of 43%. Prior to April 2014, the dividend had been level for about two years, but now the growth in the lodging sector is producing regular dividend increases.

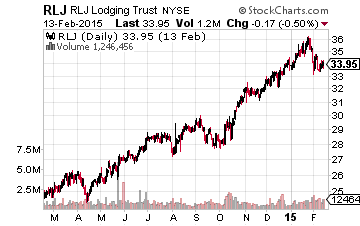

RLJ Lodging Trust (NYSE:RLJ) increased its dividend by 36% in August 2014. The RLJ dividend is now nearly double the rate investors were earning in 2012. The stock yields 3.5%. The last dividend increase came just two quarters after the previous bump, so expect the RLJ dividend to grow again sometime between now and September.

The hotel business is one of the more cyclical sectors of commercial real estate. The sector can go through a boom and bust cycle by building lots of hotels when times are good and then not having the ability to fill them when the economy hits a recession. Right now, lodging is on the upswing and there is money to be made by buying shares of the growth focused hotel REITs. Just be aware that these may not be buy-and-hold forever REITs. If the economy loses its growth track, be ready to take your lodging REIT profits and put that money to work in a less cyclical sector of commercial real estate.

The Monthly Dividend Paycheck Calendar is set up to make sure you’re getting ...

more

I would hardly call a sector with sluggish construction hot.