High Dividend 50: M.D.C. Holdings

Inflation has surged to a 40-year high this year due to the immense fiscal stimulus packages offered by the government in response to the pandemic and the invasion of Russia in Ukraine, which has led commodity prices to skyrocket.

High inflation exerts great pressure on income-oriented investors, as it erodes the real value of their portfolios. As a result, many income-oriented investors will choose to resort to high-yield stocks, in order to maintain positive actual returns.

In this article, we will analyze the prospects of M.D.C. Holdings (MDC), which is offering a 4.9% dividend yield with a payout ratio of only 21%.

Business Overview

M.D.C. Holdings has two primary operations, home building and financial services. Its home building operation purchases finished lots or develops lots to the extent necessary for the construction and sale of single-family detached homes to home buyers under the name “Richmond American Homes.” Its financial services operation issues mortgage loans primarily for the home buyers of the company while it also sells insurance coverage.

Due to the nature of its business, M.D.C. Holdings has always been highly vulnerable to recessions, as demand for new homes plunges during rough economic periods. In the Great Recession, the quarterly sales of M.D.C. Holdings plunged 99% within just a few quarters and the company incurred hefty losses.

However, M.D.C. Holdings has proved markedly resilient throughout the coronavirus crisis. Despite the fierce recession caused by the unprecedented lockdowns imposed in 2020, the home builder grew its earnings per share 50% in that year, from $3.56 to $5.33.

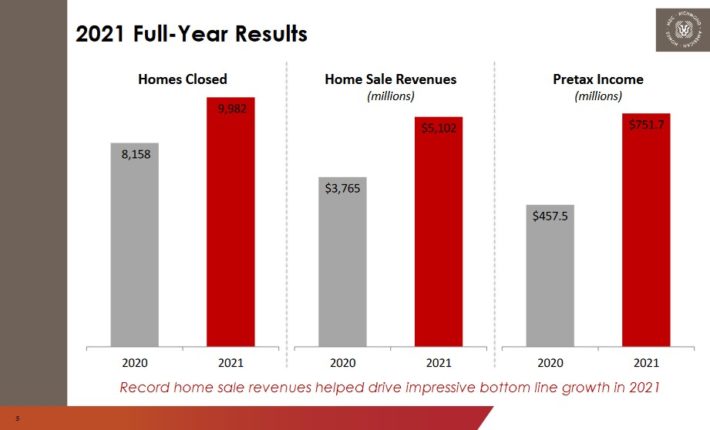

Even better, thanks to the excessive fiscal stimulus packages offered by the government and strong pent-up demand, M.D.C. Holdings posted blowout results in 2021.

Source: Investor Presentation

The company grew its home sale units by 22%, from 8,158 to a record 9,982, and its earnings per share by 53%, from $5.33 to a new all-time high of $8.13.

Even better, the business momentum remains strong. In the fourth quarter, the company grew its home sale revenues 22% over the prior year’s quarter thanks to a 4% increase in new units and a 17% increase in average selling prices. As a result, it grew its earnings per share 10%.

Thanks to lack of existing home supply and pent-up demand, M.D.C. Holdings is likely to continue to enjoy strong pricing power for the foreseeable future. It also has a record backlog of $4.3 billion.

Management expects 10,500-11,000 home deliveries in 2022, which correspond to 5%-10% growth vs. 2021, and a gross margin around 25%, a significant improvement from 20.8% in 2020 and 23.1% in 2021.

Given the impressive business momentum of M.D.C. Holdings and its bright outlook, we expect it to grow its earnings per share at a double-digit rate this year, to a new record level.

Growth Prospects

Due to the nature of its business, M.D.C. Holdings has exhibited a volatile performance record, with dramatic swings. However, the company has grown its earnings per share for seven consecutive years, at a 35.3% average annual rate.

Of course, investors should not expect M.D.C. Holdings to maintain such a high growth rate in the upcoming years. The tailwinds from the strong recovery from the pandemic and the huge fiscal stimulus packages, which have greatly increased the discretionary income of consumers, are likely to fade going forward.

In addition, the Fed has just begun to raise interest rates aggressively in an effort to put inflation under control. Higher rates are likely to take their toll on the demand for new homes at some point in the future.

On the other hand, the ideal business conditions prevailing right now should not be underestimated. In the most recent quarter, M.D.C. Holdings enjoyed 9% growth in new orders and thus its backlog rose to a record level of $4.3 billion. This bodes well for the future growth prospects of the company.

Overall, we expect M.D.C. Holdings to grow its earnings per share at an 8.0% average annual rate over the next five years.

Competitive Advantages

M.D.C. Holdings offers affordable prices and a built-to-order model, which resonates well with the desire of consumers for new home customization. This is a significant competitive advantage. In addition, the company has proved extremely resilient throughout the coronavirus crisis.

However, investors should not jump to the conclusion that M.D.C. Holdings is immune to recessions. As evidenced by the Great Recession, the home builder is highly vulnerable to recessions. It proved resilient during the pandemic thanks to the short duration of the recession and the unprecedented fiscal stimulus packages, which led to a sharp recovery of the economy.

On the contrary, the Great Recession was the worst financial crisis of the last 80 years and included a collapse of the home market as well. In other words, it was the worst possible business environment for M.D.C. Holdings.

As long as the economy remains healthy, M.D.C. Holdings is likely to keep thriving, but the company will be affected whenever the next recession shows up.

Dividend Analysis

Due to its cyclical business performance, M.D.C. Holdings has a poor dividend record. The company has grown its dividend for only seven consecutive years and thus it passes under the radar of most income-oriented investors.

However, M.D.C. Holdings is currently offering an attractive 4.9% dividend yield. Even better, thanks to its blowout earnings, the stock has a payout ratio of only 21%. We also praise management for maintaining a healthy balance sheet, which is paramount in this highly cyclical business.

The company pays negligible interest expense and its net debt of $1.8 billion is only 60% of the market capitalization of the stock and only 3 times the annual earnings of the company. Therefore, although M.D.C. Holdings is vulnerable to economic downturns, its 4.9% dividend has a wide margin of safety.

Final Thoughts

M.D.C. Holdings is on track to post record earnings for a third consecutive year in 2022 thanks to favorable business conditions, including pent-up demand and tight home supply. It is also offering a 4.9% dividend, which has a wide margin of safety. On the other hand, this business is notorious for its cyclicality and the benefit from the accommodative fiscal policy will fade at some point in the future.

This is the reason behind the extremely low forward price-to-earnings ratio of 4.1 of the stock. Overall, the stock is attractively valued from a long-term perspective right now but it is suitable only for the investors who can stomach high stock price volatility and extended periods of potential paper losses.

We have created a spreadsheet of stocks (and closely related REITs and MLPs, etc.) with dividend yields of 5% or more…

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

Click here to download your free spreadsheet of all high dividend stocks now.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more